The new year hasn’t brought stability to Bitcoin’s price, with BTC experiencing significant volatility this week. The volatility peaked on Jan. 9, with the price opening at $95,057 and reaching a high of $95,346 before dropping sharply to $90,707. This $4,640 trading range represented a drop of around 4.9%.

Intense volatility like that tends to significantly increase spot trading on exchanges, with retail traders adding to the selling pressure.

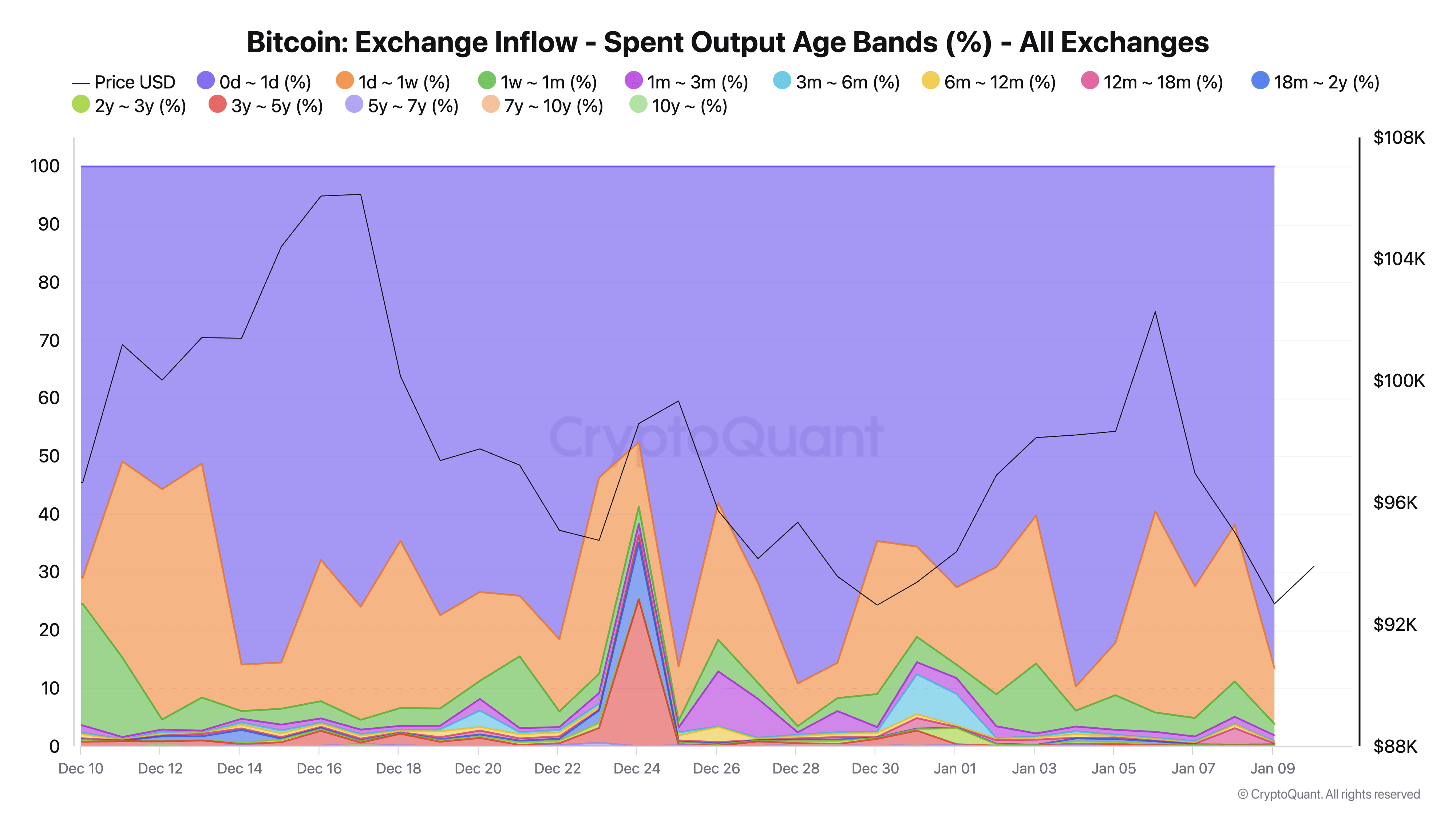

Exchange inflow data shows that 86.53% of all coins moving to exchanges during this period came from the 0-1 day band, indicating an unusually high level of short-term trading activity. For context, this percentage significantly exceeds typical daily patterns we’ve seen in the past month, where 0-1 day old UTXOs often account for 50-70% of exchange inflows.

The dominance of short-term coin movements was further emphasized by the distribution across other time bands, with 9.62% of inflows coming from coins held for 1-7 days and only 1.97% from coins held for 1 week to 1 month. Coins held for longer than one month accounted for less than 2% of total exchange inflows, suggesting minimal participation from long-term holders during this market movement. This distribution pattern is particularly relevant as it shows that the day’s price volatility was primarily driven by short-term trading activity rather than a shift in long-term holder sentiment.

The fact that long-term holders remained largely inactive during this price movement indicates they viewed the volatility as a temporary market phenomenon rather than a fundamental shift that requires portfolio adjustment. This behavior pattern often emerges during corrections, where short-term price movements are absorbed without triggering broader market participation.

From a market structure perspective, the concentration of activity in the 0-1 day band, despite the substantial price decline, suggests strong market depth and resilience. While the influx of short-term coins to exchanges created immediate selling pressure, the lack of long-term holder participation helped contain the price decline. This is important for creating market stability, as increased activity from longer-term holders during price declines often indicates deeper market stress and can lead to more sustained downward pressure.

The trading volume during this period further supports this analysis, showing elevated activity consistent with the high percentage of short-term coin movements. The volume, price action, and exchange inflow patterns showed that the broader market maintained its position.

CryptoQuant’s data showing short-term and long-term holder activity during price volatility helps us distinguish between temporary market adjustments and more significant shifts in market structure. When combined with price and volume data, exchange inflow patterns by coin age provide much-needed context for market movements.

The post 86% of Bitcoin’s sell-off driven by short-term retail traders appeared first on CryptoSlate.