Follow Nikolaus On 𝕏 Here For Daily Posts

One year ago today, Gary Gensler and the Securities and Exchange Commission (SEC) finally capitulated and approved the trading of spot bitcoin exchange traded funds (ETF) to go live the next day. These ETFs would go on to be the best performing ETFs in history, with BlackRock’s ETF $IBIT leading the charge, taking in over $52 billion inflows alone.

I feel like a lot of people are afraid to admit this, or just don’t want to, but the ETFs were the most significant moment in Bitcoin over the course of 2024. Looking back on the year, it feels like everything that went in Bitcoin’s favor was downstream from these approvals. Let me explain.

The six big events that happened in 2024 were as followed:

- Spot Bitcoin ETF approval by the SEC

- Donald Trump pledging the USA to embrace Bitcoin

- MicroStrategy and other corporate adoption of Bitcoin

- $100,000 price milestone

- Gary Gensler resigning from the SEC

- The halving

When BlackRock filed for its ETF towards the tail end of the bear market in 2023, that marked the beginning of the new bull market for me. We immediately saw a stampede of other large asset managers rush to also apply for an ETF and the price of Bitcoin has risen ever since — the price of bitcoin was $24,900 when BlackRock filed its ETF, then it was $46,000 when it was approved, and today we’re sitting at just under $100,000.

The number one driver of interest and more adoption of Bitcoin is its price, not its utility. Large price increases bring in the most eye balls, new pools of capital, and generate more interest in the asset overall. When bitcoin is going down in price, all the tourists leave and only the HODLers remain.

Bitcoin ETFs driving up the price in historic fashion helped set the stage for Donald Trump to embrace it. No longer was Bitcoin just mere magic internet money for a small crowd of people on the internet, it was now backed by the world’s largest asset managers in BlackRock and Fidelity. The massive amounts of inflows into these products was like a tsunami, showcasing how much demand there really was for bitcoin and the new direction our country was going in financially. It showed that this is an industry that is set to grow exponentially, and I believe Trump, like many of the other politicians including senators and congressmen, realized they are better off fighting with us than against us.

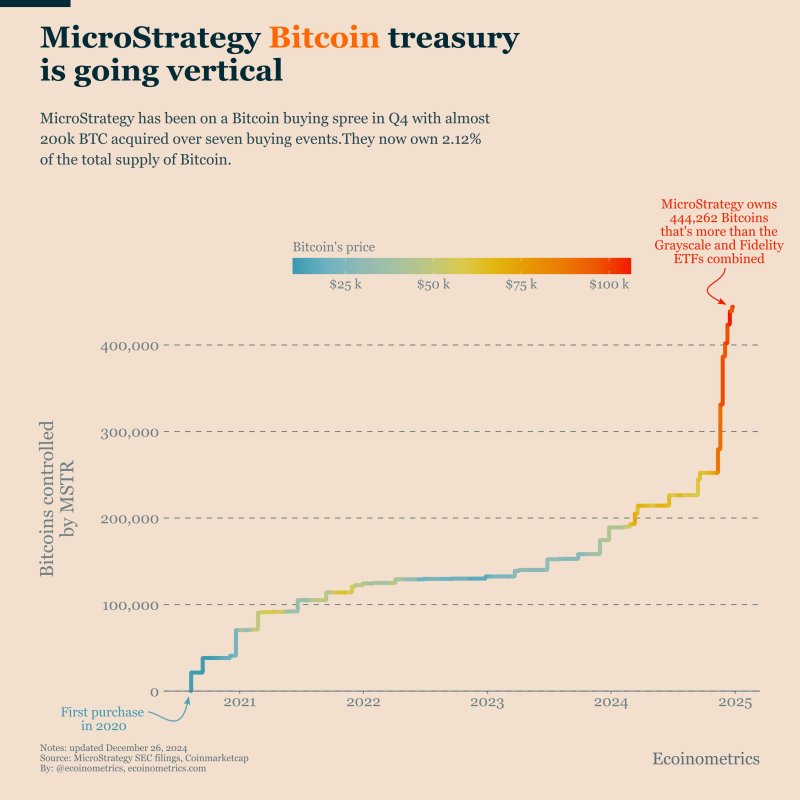

Now with the price getting driven up with the backing of the largest asset managers, and a new pro-Bitcoin administration coming into the White House, this gave the green light for MicroStrategy and other corporations to dive deeper into the asset. And that’s exactly what happened.

Michael Saylor ramped up MicroStrategy’s bitcoin purchases like never before, and has no signs of slowing down in 2025. Their stock outperforming bitcoin had caught the attention of countless other publicly traded companies who copied the ‘Bitcoin For Corporations’ strategy, all adding more buying pressure to bitcoin, further driving up the asset. MicroStrategy is raising over $42 billion to buy more bitcoin to front-run everyone who doesn’t own any yet — this large increase in demand and regulatory certainty is sending bitcoin accumulators into a FOMO frenzy.

All of this combined, including the halving event where the production of new bitcoin created was cut in half to only 3.125 BTC per block, sent us to a new all time high over $108,000. The sheer buying demand on most days completely off sets the amount of new coins mined, further driving up the price. Just the other day, BlackRock’s ETF alone bought over 6,078 bitcoin while miners only made 450 new bitcoin. There is not enough bitcoin to go around for everyone, and they are not making any more than 21 million coins.

NEW: 🇺🇸 BlackRock's spot #Bitcoin ETF bought 6,078 bitcoin today, while miners only mined 450 new bitcoin.

Absolute. Scarcity. pic.twitter.com/KkHGpP2WAL

— Nikolaus Hoffman (@NikolausHoff) January 8, 2025

The success of these ETFs and change in presidential administration spelt bad news for the SEC and other anti-Bitcoin regulators and politicians. Gary Gensler, who helped hold up the approval of the spot ETFs for years, is officially leaving the SEC. Both of the democrat commissioners on the SEC who voted against the approval are also leaving the commission. And it appears that Bitcoin is now being set up to thrive in the United States over the next four without being attacked by the regulators and politicians who have held back this industry for so long.

The ETFs were a massive moment for this industry, and things would most likely have turned out very differently if they had not been approved. The price of bitcoin would likely be much lower than it is today, and we might have even had a different winner in the US presidential election if they had not been approved. So many great things went in Bitcoin’s favor this past year, and it was all downstream from the ETF approvals.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.