Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

Higher Inflation causes headwinds for stocks and bonds

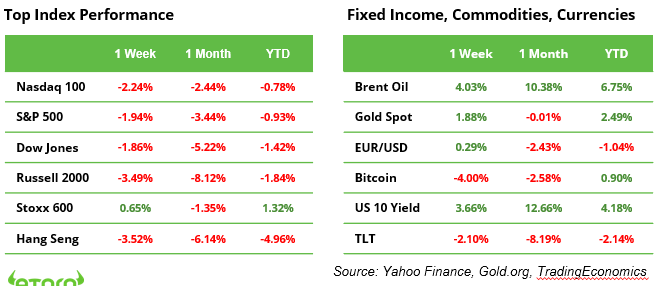

A stronger-than-expected jobs report and renewed concerns about inflation led major US equity indices to decline by nearly 2% last week. The 10-year Treasury yield surged to 4.75%, driven by fears that the US economy may be too robust for the Federal Reserve to continue reducing its funding rate toward the targeted 3%. In contrast, European stocks showed resilience, with the STOXX 600 index rising by 0.7%. Oil prices rose by 4% following increased US sanctions on Russia.

This week promises to be eventful, featuring a series of macroeconomic data releases (see next page), the kickoff of the Q4 earnings season (details below), and the release of OPEC’s monthly oil market report. Additionally, any unexpected political developments are likely to capture attention ahead of Donald Trump’s inauguration next Monday.

Q4 US earnings season: financial sector likely to drive earnings growth

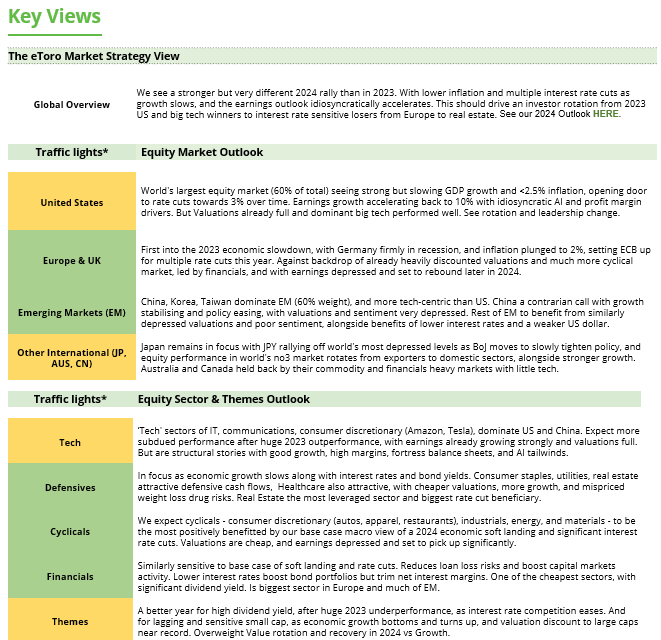

The US earnings season unofficially kicks off next week, with particular attention on the big banks. This focus arises not only because financial institutions typically report first but also because the financial sector has performed exceptionally well since Donald Trump’s election, buoyed by expectations of reduced regulation. The sector is projected to deliver the strongest earnings growth in the S&P 500, an impressive 39.5% year-on-year.

On Wednesday, major players like JP Morgan, Wells Fargo, Goldman Sachs and Citigroup are set to release their results, followed by Bank of America and Morgan Stanley on Thursday.

During the earnings season, results from 11 sectors are analysed and compared. While the financial sector is expected to lead, the technology sector is projected to achieve earnings growth of 14.0%, securing third place (see graph). This figure remains above the S&P 500’s overall anticipated growth of 11.9%, which would mark the strongest earnings growth since Q4 2021 and significantly exceed the 10-year average of 8.5%. Sales growth for the index is estimated at 5.1%.

The political landscape continues to introduce uncertainty. Donald Trump’s inauguration on Monday, January 20, could prompt a cautious, wait-and-see approach from investors. However, significant deviations from earnings expectations or major announcements from the banks could disrupt market stability and drive volatility.

Inflation is a key focus in this week’s global macroeconomic data releases

On the macro front, it will be a busy week of key data releases from the US, the UK, and China. For the US and the UK, CPI data will be important to gauge whether core CPI and services inflation, key metrics from a policy perspective, are showing any signs of acceleration. Given last week’s hawkish US labor market data, investors are not seeing any rate cuts until June. CPI data will be another cue to gauge the pace of the rate cutting cycle ahead. Retail sales from the US, the UK, and China will also be monitored closely to gauge overall consumer spending health and whether inflationary pressures are inherent on a micro level. Finally, China will release its GDP numbers while, in Japan, Deputy Governor Himino’s remarks will be closely watched for signs of the BoJ’s thinking about hotter inflation.

Quantum computing ctocks see wild swings

Google made headlines a month ago with the breakthrough announcement of Willow, its advanced quantum computing chip. The news initially sparked excitement across the market, leading to a sharp rally in quantum computing stocks like Rigetti, D-Wave, and IonQ. However, optimism was short-lived. NVIDIA CEO Jensen Huang tempered expectations last week with a sobering comment, stating that useful quantum computing is still 15 to 30 years away. Following Huang’s remarks, stocks in the sector experienced a dramatic reversal, plummeting as investor sentiment shifted.

Meanwhile, attention in the semiconductor sector is turning to Taiwan Semiconductor Manufacturing Company (TSMC), which is set to report its earnings this Thursday. The results are expected to provide critical insights into the health of the broader semiconductor industry, especially as demand faces uncertainty in the current economic environment.

Macro and earnings data releases

Macro

US PPI (14/1), US CPI, UK CPI & PPI (15/1), US retail sales (16/1), China data package (17/1, including GDP, industrial production and retail sales). OPEC monthly oil report (15/1)

Earnings

15 Jan. JP Morgan, Wells Fargo, Goldman Sachs, Citibank, Blackrock

16 Jan. TSMC, Infosys, UnitedHealth, Bank of America, Morgan Stanley

17 Jan. Schlumberger

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

![Best Altcoins Under $1 in 2025 [September] – Top Crypto Picks for High Growth Best Altcoins Under $1 in 2025 [September] – Top Crypto Picks for High Growth](https://changelly.com/blog/wp-content/uploads/2025/02/best-altcoins-under-1.png)