Diversification could have saved investors a lot of pain amid this week’s AI-fueled selloff. The Daily Breakdown explains.

Friday’s TLDR

- AI stocks took a beating, but…

- Diversification could have helped

- Charting earnings estimates

The Bottom Line + Daily Breakdown

This week was supposed to be busy, chaotic, noisy and overwhelming — but it wasn’t supposed to start before the sun rose on Monday morning.

We went over some of the AI-fueled carnage on Tuesday — like how Nvidia lost almost $600 billion in market cap that day — but we also went over some other positive observations.

Those “positives” highlight how diversification can keep a portfolio upright during an unexpected storm.

Diversifying can shield the pain

Nvidia fell 17% on Monday, while the Semiconductor ETF (SMH) fell “just” 9.8%. I’m not trying to make a one-day loss of nearly 10% sound pretty — it wasn’t — but investors gaining exposure to AI via the ETF rather than Nvidia were able to shield their portfolio from some of Monday’s wrath.

Same for investors who used technology ETFs like the QQQ or XLK vs. direct exposure to stocks like Broadcom, Oracle, or Dell. Those in the Utilities ETF (XLU) sidestepped a bulk of the brutal selloffs we saw in Constellation Energy and Vistra.

That all said, there’s no reward without some level of risk.

Investors who have been able to capture a large portion of Nvidia’s rally may not regret getting caught up in yesterday’s selloff — it’s just part of a ride that can be bumpy at times. For others though, Monday’s selloff was a wake up call that having too many eggs in one basket can result in a painful outcome.

How to Diversify

Investors outside of AI may not have even noticed the market action earlier this week.

That’s as the Dow finished higher on the day, along with 7 of the 11 sectors in the S&P 500. Heck, four of those sectors were up 1% or more on the day and financials closed at record highs.

That’s not a cheap shot at investors who were over-exposed to AI stocks, it’s a reminder that having exposure to a wider basket of assets can help mitigate some of the big losses we sometimes see on Wall Street.

One concept I like to talk about is “anchor tenants.”

While a common phrase in real estate, this is a concept that I like to impart on portfolios by using a well-known, diversified fund (or funds) as my “anchor” tenant(s), then building individual ETFs and stocks around them. This allows me to stay invested in the market, while gaining exposure to individual themes I feel more strongly about.

For instance, consider how much better a portfolio would have fared on Monday if, say, 60% of it was allocated to an S&P 500 ETF like VOO, SPY or IVV vs. being all-in on semiconductor stocks. If that portfolio also had some exposure to the Dow — the DIA ETF — it would have sheltered Monday’s losses even more.

The Bottom Line

Investors should always do what works best for them and should know their risk appetite before filling their plate with a bunch of potentially volatile assets.

If investors were caught off-guard by Monday’s rapid selloff, they should consider if a little diversification would do them some good. Same goes for a portfolio that wasn’t caught up in Monday’s dip but is over-concentrated in other assets.

Want to receive these insights straight to your inbox?

Sign up here

The setup — Uber

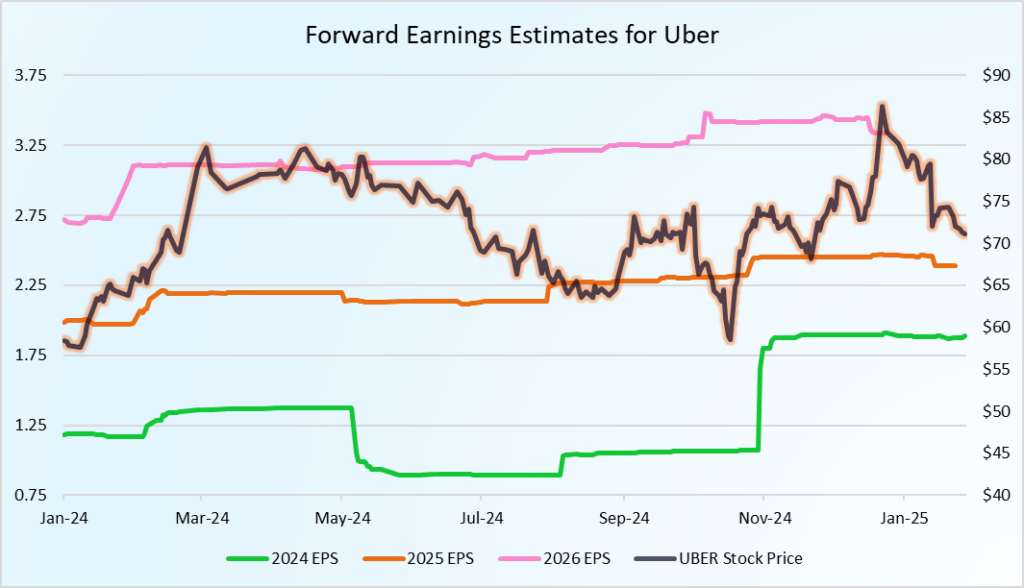

I want to present a different type of chart than what we usually see. This chart is for Uber. While shares are only down about 2% over the past year, that badly lags the S&P 500, which is up about 23% in the same span.

Worries about Tesla’s Robotaxi and Alphabet’s Waymo service have weighed on Uber, even as earnings estimates for 2024, 2025, and 2026 continue to climb. That’s exactly what the chart below shows, with the left axis showing earnings estimates and the right axis representing Uber’s share price.

Notice how multi-year earnings estimates have mostly drifted higher since about July. Also notice how each year of earnings estimates are higher than the other, showing an expected increase each year. Despite that, shares of Uber have struggled.

Does this present an opportunity for investors?

It’s one of many things to consider, but looking at earnings estimates — particularly for the current year and the following year — is a good starting point for fundamental investors. Remember, on Wall Street it’s not about what you did, it’s about what you are doing now and will do in the future.

No one has a crystal ball, so there’s no guarantee that future estimates — for Uber or otherwise — will pan out to be too optimistic or if analysts are underestimating the business. But for investors, earnings are a good starting point when trying to build a case for or against a company based on fundamentals.

For Uber specifically, I’ll just say this: Rising earnings expectations do not guarantee the stock will rise too, but increasing profits certainly isn’t a bad thing.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.