Aedifica ($AED.BR) is a lesser known Belgian healthcare REIT. It operates across Europe and boasts attractive fundamentals such as an 100% occupancy, ~19 year WAULT and even a high EPRA yield at 8%. Yet the stock has been under pressure since 2021, is this deserved given the changes in interest rates or does Aedifica currently present investors with an attractive investment case?

Business Profile

Aedifica is a Belgian regulated real estate company (REIT) specializing in the investment and development of healthcare real estate across Europe. The company focuses on senior housing and care facilities, addressing the increasing demand driven by demographic shifts.

Aedifica’s has long-term lease agreements, typically with established operators from a mix of for profit and non profits. The company’s portfolio spans Belgium, Germany, the Netherlands, the UK, Finland, Ireland and Spain.

Investment case

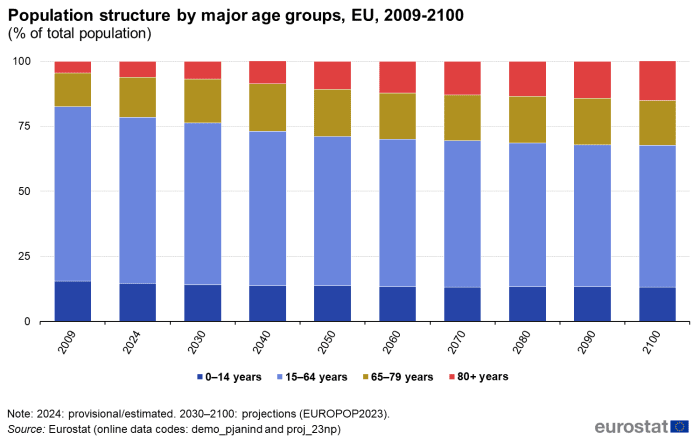

The investment case is quite simple for Aedifica, long term tailwinds from an increasingly ageing population across Europe supported by an attractive valuation. Let’s break these down:

Demand drivers

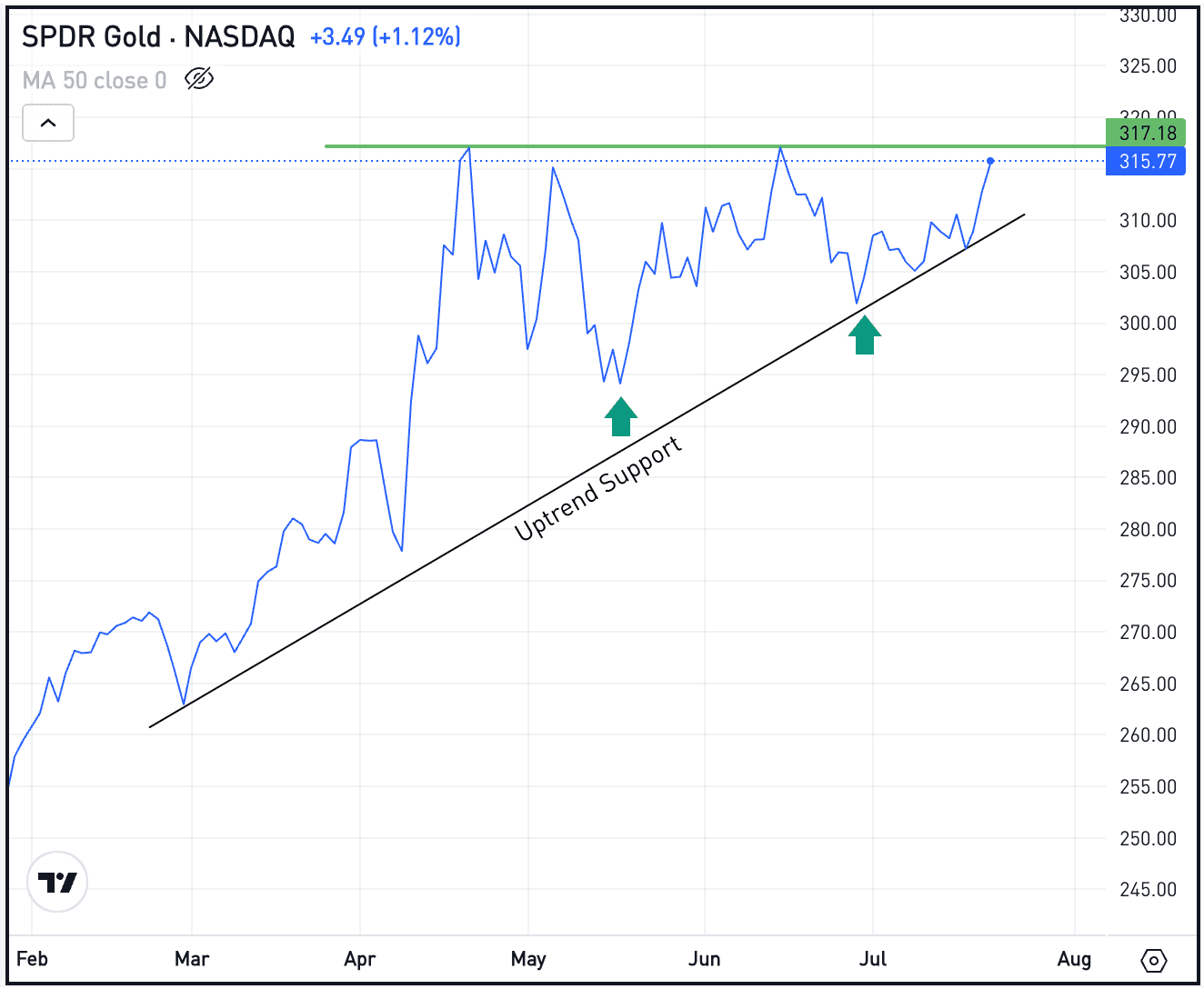

The population in Europe is ageing, the share of those aged 80 years or above in the EU’s population is projected to have a 2.5 fold increase between 2024 and 2100, from 6.1% to 15.3%. This will require more adequate housing and care facilities which already are not keeping up in many countries.

Figure 1: 21st century development of population across the EU

Tenants

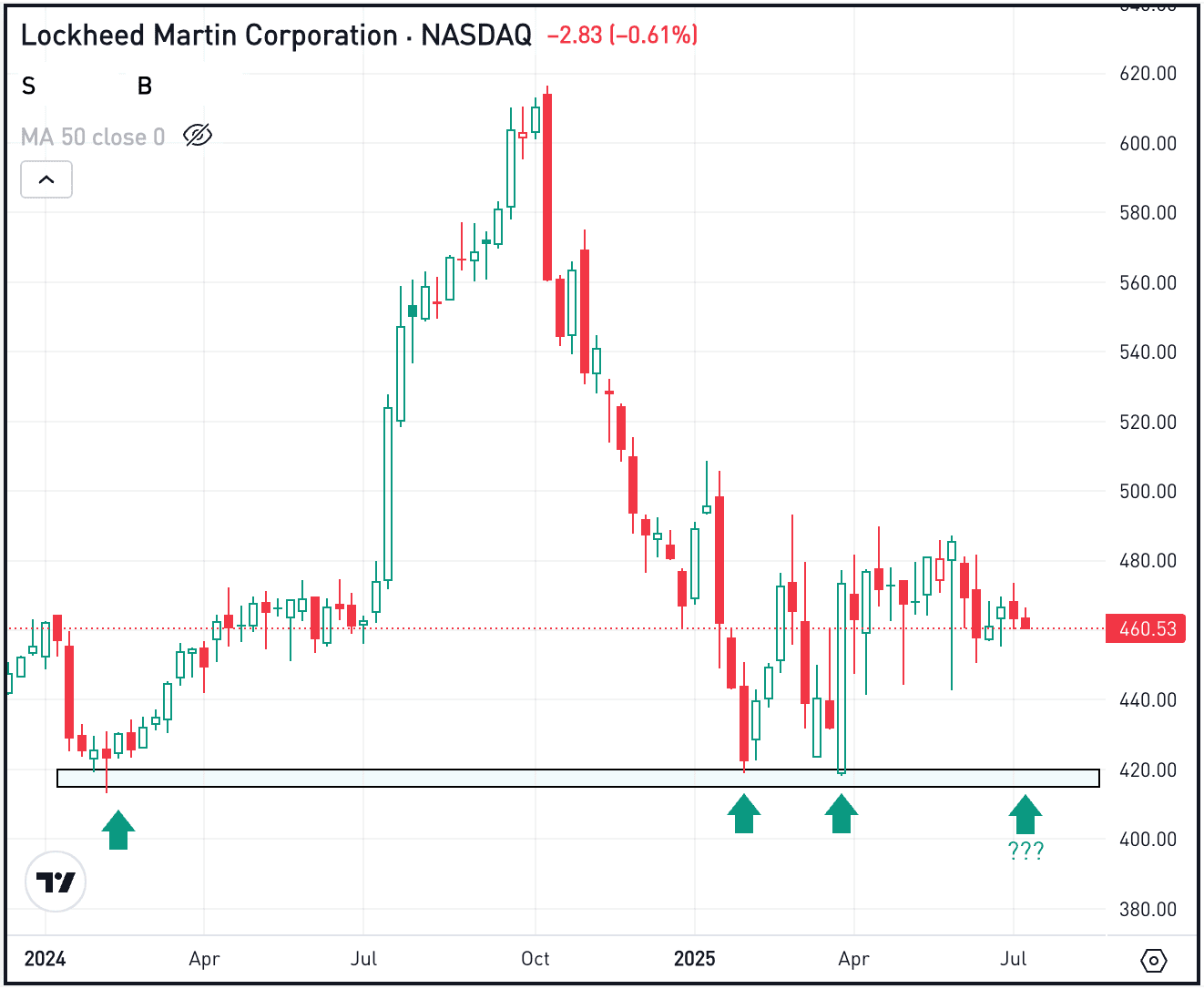

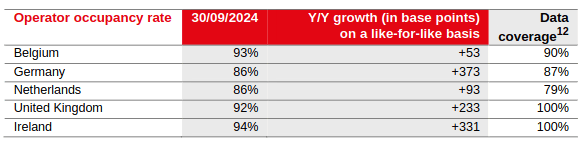

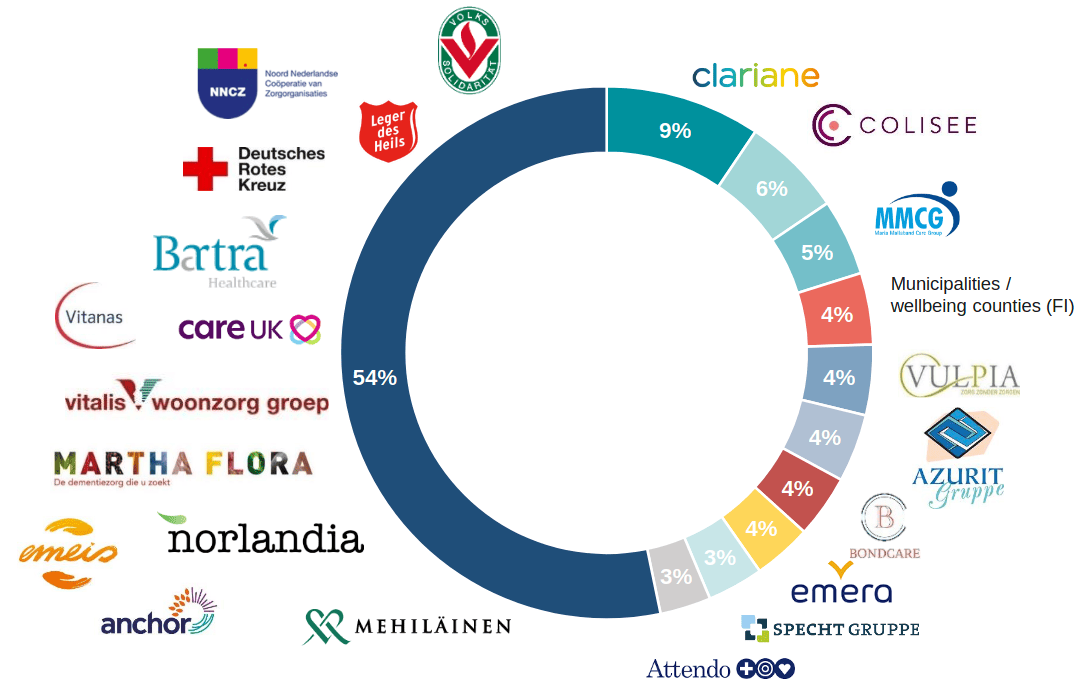

The ones directly profiting from the aforementioned trends are the operators of these care facilities. Think of companies such as Korian or non profits such as Leger des Heils. They have had some after effects from covid through lower occupancy, increased labor costs and higher rates. The situation for Aedifica´s tennants is improving though.

Figure 2: Tenant occupancy rates

Yields

As a REIT Aedifica of course is very dependent on interest rate changes, these affect their interest rate costs and property values and potentially the spread between borrowing and rental yields. In lower yield environments Aedifica traded at more than €120 a share however as rates increased the share got cut in half.

Valuation

As I do not have a crystal ball which includes the ECBs rates at the end of the decade I valued Aedifica from a scenario based approach.

| High RFR | Base case (current yield) | Low RFR | |

|---|---|---|---|

| LTM EPRA yield | 10% | 7.98% | 4% |

| Current share price | 61.90 | 61.90 | 61.90 |

| Ending share price | 57.43 | 71.98 | 143.58 |

| Accumulated EPRA per share | 24.39 | 27.10 | 29.81 |

| Total | 81.83 | 99.08 | 173.40 |

| ARR | 6.44% | 12.01% | 36.03% |

Table 1: Very simple valuation based on 5 years of forecasting, RFR = risk free rate

The 4% EPRA yield observed during the post covid low yield environment could be repeated again which in my opinion is not unlikely given the current political situation in Europe. Even if rates stay the same to now a very attractive double digit annual return can be observed. This is based in Aedifica adjusting to higher rates, 2025 and 2026 will be transitional years in this case. If rates were to start increasing again (I have doubts the ECB would increase it much more from recent highs) a positive return remains due to the high EPRA generation potential of Aedifica.

Risks

Rates

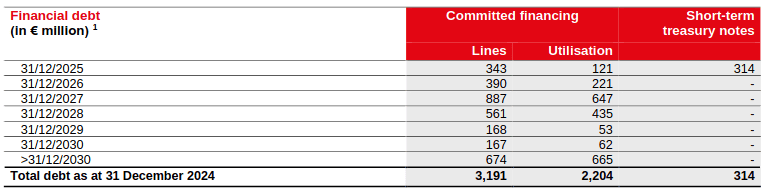

Aedifica ($AED.BR) is rated BBB but significantly higher rates could put pressure on them from three sides: lower asset values, increased financial expenses and tenant credit deterioration. Refinancing is spread out relatively evenly as debt gets rolled over, short term most debt is fixed anyways so most interest rate changes would go into refinanced debt cost and hamper growth.

Figure 4: Debt types

Demand changes

If Europeans manage to live longer at home at a rate which compensates for the absolute number growth in elderly this could have effects on the occupancy levels of Aedifica´s tenants.

Large tenants

Aedifica does have some tenant concentration with Clariane which is publicly traded and has not performed well, however their portfolio expansions are also diversifying away from large single tenants and improve geographical diversification as well reducing regulatory risk from certain countries.

Conclusion

Aedifica presents a compelling investment case with strong fundamentals, including 100% occupancy (tenant occupancy ~90%), long-term leases (~19-year WAULT), and an 8% EPRA yield. Driven by Europe’s aging population, demand for healthcare real estate is expected to grow. Despite this, the stock has been under pressure due to rising interest rates post covid, impacting valuation. A simple scenario-based valuation implies attractive potential returns even if rates remain steady, with significant upside if rates decline and limited downside in a slightly higher rate environment. Risks include refinancing challenges, tenant concentration, and potential demand shifts. Overall, Aedifica appears undervalued, offering a solid long-term opportunity for investors willing to make a directional bet on interest rates with a high quality company.

The author of this analysis does hold shares in Aedifica at the time of writing, which may influence the perspective provided.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

Sources:

https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Population_structure_and_ageing

Aedifica annual results 2021, 2022, 2023 & 2024