Introduction

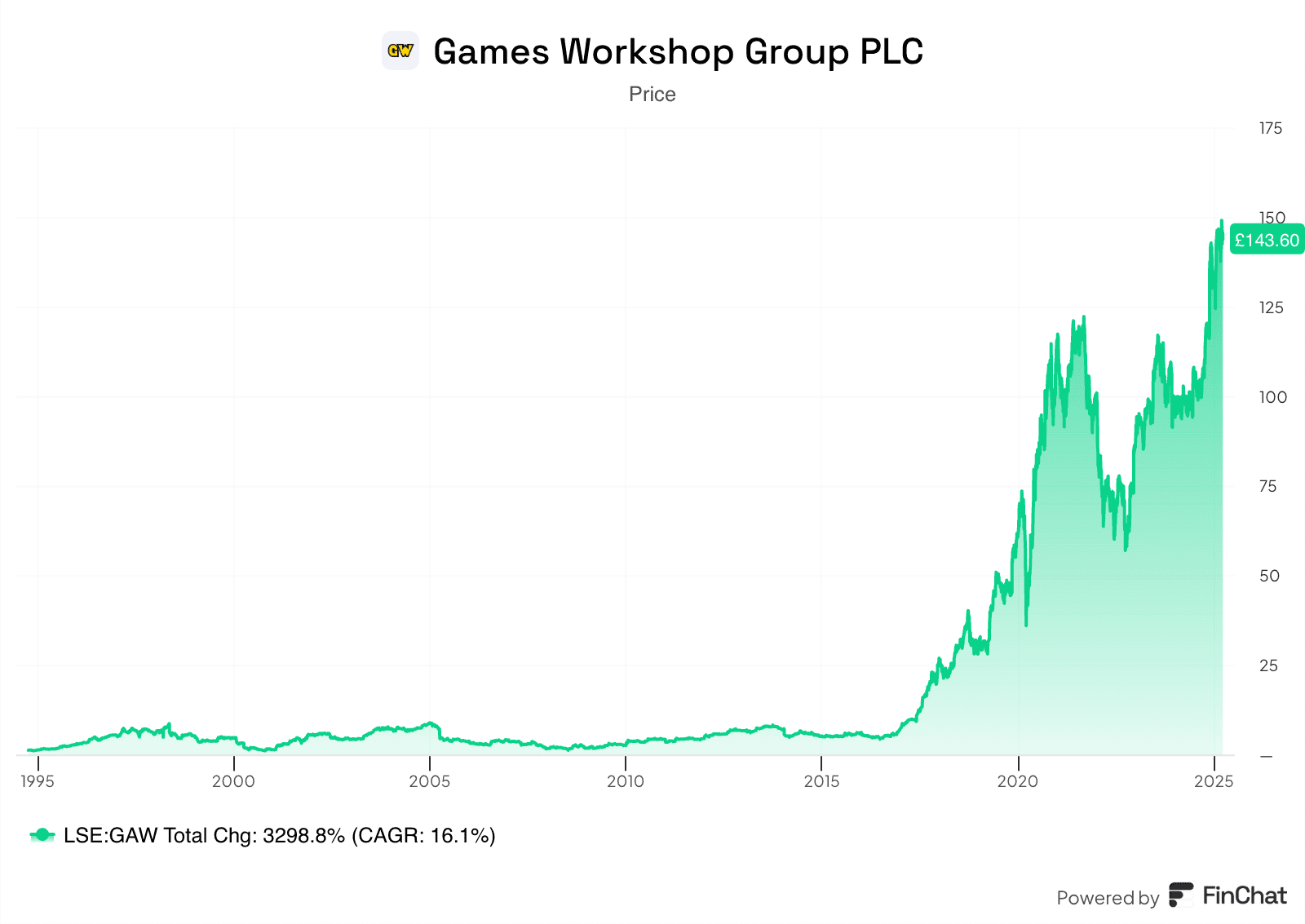

Games Workshop ($GAW.L) is a British company that has returned 16.1% per year since it started trading on the stock market in 1994, for a total return of over 3.000%. This is a great compounder that the market has overlooked because people miss the strength of a loyal fan base.

Source: Finchat

Key highlights

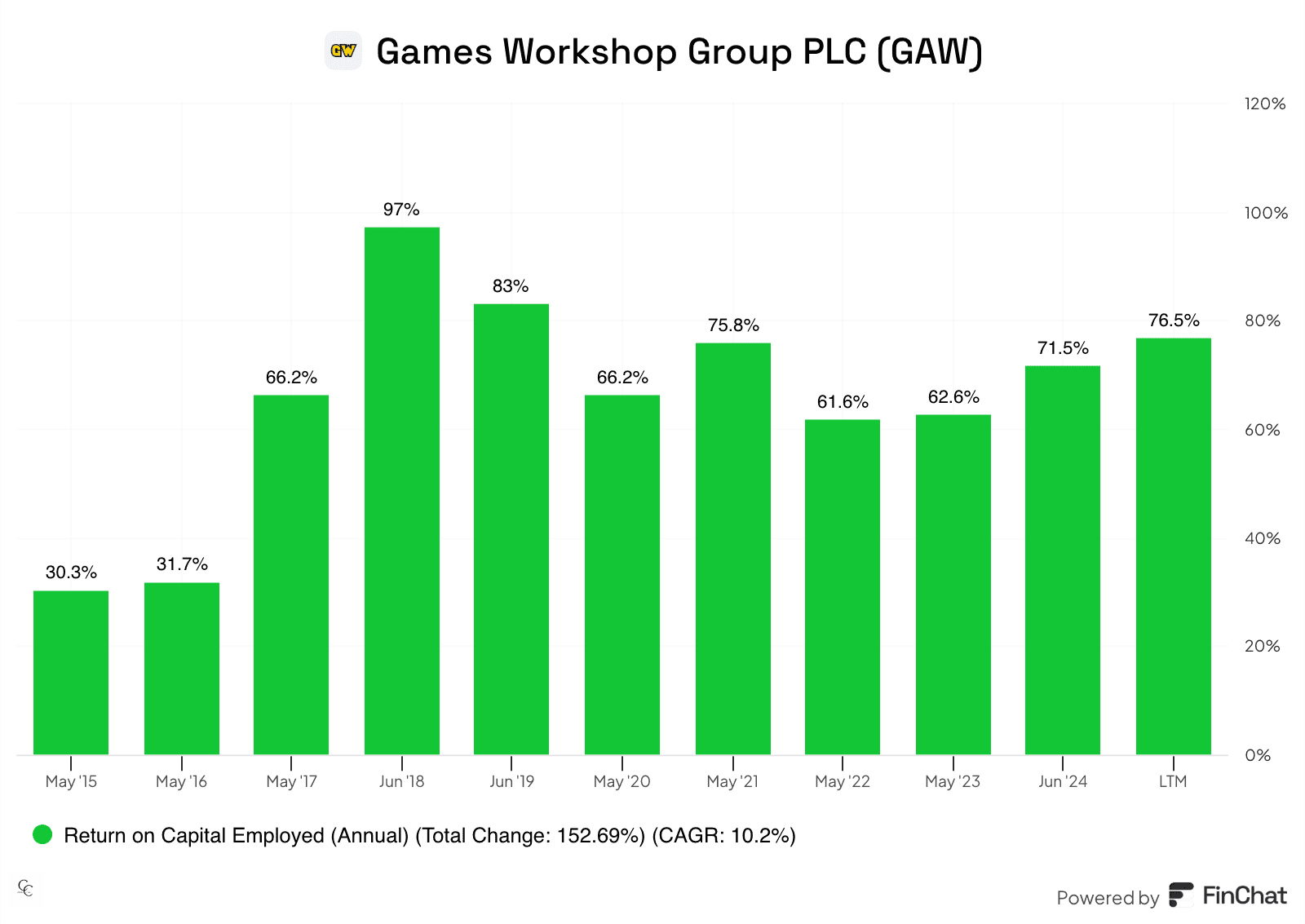

- Games Workshop is one of the companies with the highest Return on Invested Capital in the stock market.

- The company distributes to shareholders all its excess capital

- Revenue without cost? Yes, Games Workshop has a hidden gem.

Business Model Overview

Games Workshop has a very boring business that won’t make it to the news. Its business consists of selling boxed games, painting and modeling figures, and books, among many other physical products designed and manufactured within the company. These products can only be developed by Games Workshop because they own the rights to the Brand they sell (Warhammer). To sell these products, the company has its own stores, generally managed by one person. They also collaborate with third-party stores to which they provide their products. Both sales channels have grown over the last years.

The company has an outstanding track record of being profitable, growing, and distributing to shareholders the excess capital that it generates. In the past five years, the company has grown by over 15% per year and delivers today a dividend yield of over 4%.

Detailed Investment Thesis

Despite growing consistently and delivering one of the highest ROICs in the capital markets, Games Workshop keeps being an ignored company. One of the “secrets” of the company’s success is its Intellectual Property. They own all the rights to the Warhammer franchise. This way, they are the only company allowed to sell miniatures of the franchise, which is very profitable since it’s a very extensive Hobby.

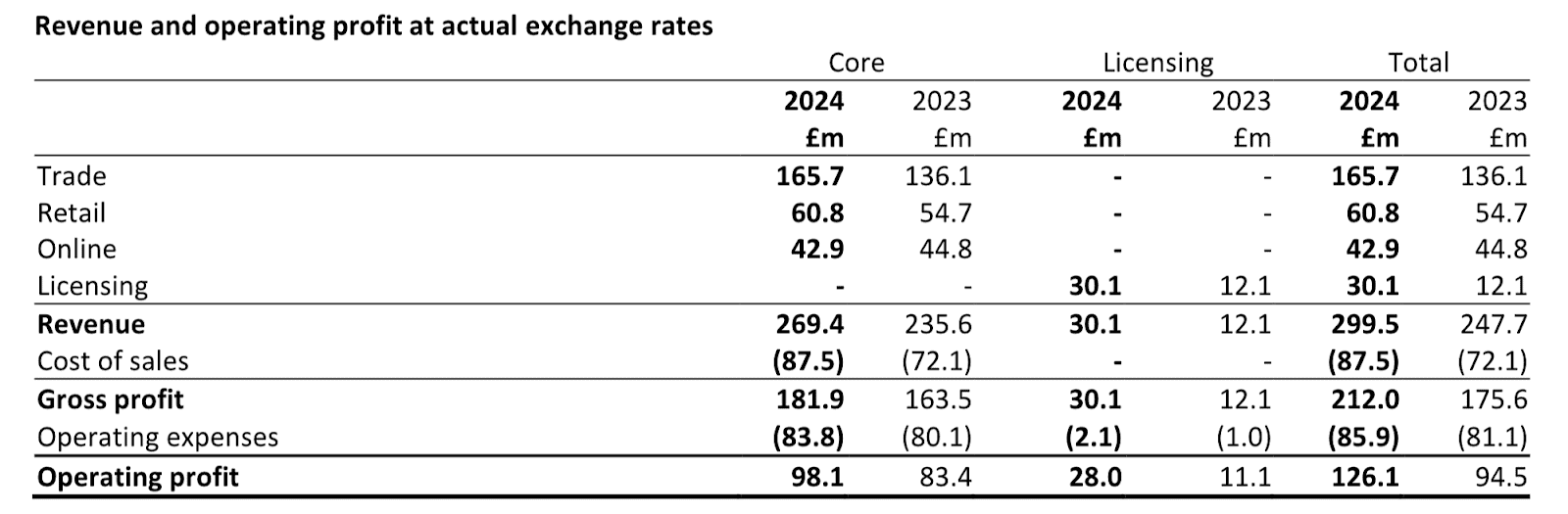

But beyond this, the company also licenses third parties to, mainly, develop games using the brand’s name. These deals are usually done in two different stages. In the first stage, the company collects and recognizes revenue for a fixed part of the development of the game. The second part, which offers upside, is recognized yearly depending on the sales of the game. Basically, the contracts have a fixed part, which doesn’t have cost at all for the company, and a variable part depending on the success of the game that comes, again, without a cost associated.

With this structure, the gross margin of the company’s physical products in the first half of their 2025 fiscal year is over 67%, and the gross margin of the licenses is 100%. How can a company be unsuccessful with these margins?

Source: Games Workshop H1 2025 earnings release

For a good reason, the company’s Return On Invested Capital is quite high consistently:

Source: Finchat

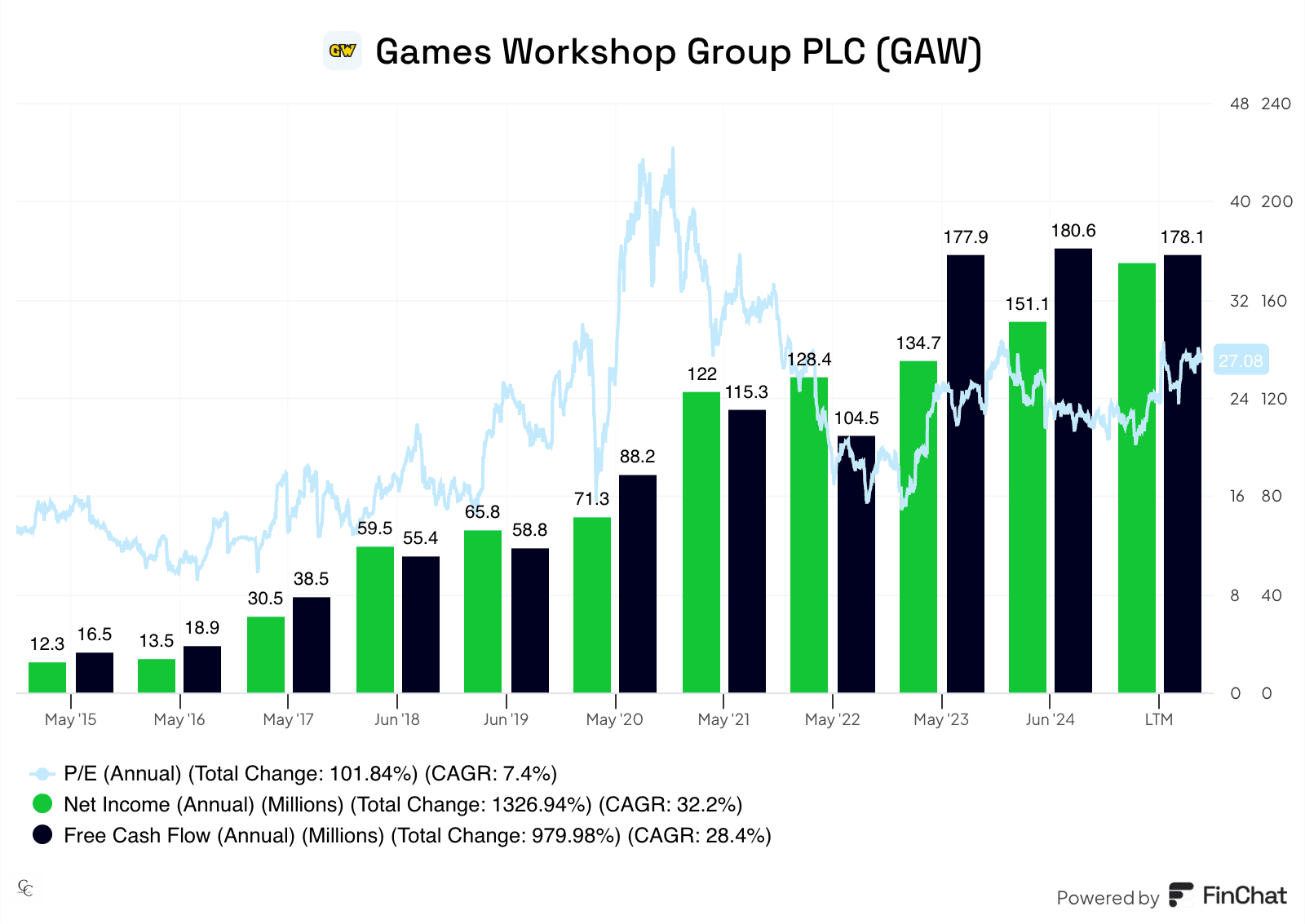

I wouldn’t say that the multiple that the market is currently paying for the company is low. And it isn’t, historically speaking. However, the company has no debt, and the total cash of the company is higher than its liabilities, showing an enormous strength in its balance sheet. We should only be worried, then, about how much this company is able to generate in the future, at outstanding profitability rates.

Source: Finchat

In my opinion, the company has the ability, IP, pricing power, and enough demand for their products to keep increasing revenue double-digit in the mid-teens for many years. Thus, even with no multiple expansion, the company can comfortably deliver 15% per year in the coming 5 to 10 years, which is an above average return.

Of course, if the price fell, to about 15 times earnings, the potential would be greater. But I’m comfortably holding this outstanding business at 27 times earnings. Also, if the company keeps delivering, which it has done for many years, growth and profit growth can surpass my expectations. In that sense, the company’s management has stated in their latest trading update that this year’s results are ahead of the board expectations. In that case, we could also see multiple expansion from this point, adding to the potential return of the stock.

Catalyst

- Higher growth in Licencse revenue, which adds directly to the bottom line.

- Market’s recognition of the higher quality of the business

- Ultimately, time to let this wonderful business compound our money over time.

Conclusion

Games Workshop is one of the best companies in the world, from a return on investment capital point of view. Companies of similar quality are often traded in the stock market at above 40 times earnings, so the market is not fully recognizing the exceptional quality of this business. Paying what is now an average price we are buying a way above average business, with potential to grow.

We’re also protected on the downside, since the company has one of the strongest balance sheets I’ve ever analyzed. Besides this, the management pays out the excess cash that the company generates, so we are sitting at a 4% dividend yield for a company growing double-digit for years, and for many years to come.

Risk Factors

Games Workshop is not a retailer, but in the end, the sell products to retail customers. Hence, a change in consumer’s preferences may hurt the company. Also, a slowdown of the business could cause multiple contraction. So in case these two things happen at the same time, we could experience a sudden drop in the company’s price.

I hold a position in GAW.L at the time of writing.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of or solicitation to buy or sell any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.