Nikkei, Sensex, Taiwan crash, Bitcoin gets crushed, Bill Ackman wants a timeout and Jim Cramer’s “not going to panic”. Welcome to

tariff tantrum week. Are we looking at another Black Monday?

If you logged into your brokerage app today and screamed, you weren’t

alone. Global markets were sucker-punched overnight as Donald Trump’s latest

round of tariffs sent a shockwave across Asia and beyond. The Sensex? Smashed.

The Nikkei? Nuked. The China stock market? Coughing up red candles like it

swallowed a firecracker.

The Nikkei is down -8% right now.

-8%. pic.twitter.com/rSQsema3Yq

— Spencer Hakimian (@SpencerHakimian) April 7, 2025

Let’s start with the Sensex, India’s benchmark index, which

tanked 2,500 points in a single session—its biggest drop in over a year.

Traders are calling it the “Modi Meltdown,” but the real blame lies elsewhere.

Across the East China Sea, the Nikkei 225 collapsed by around

8%, its worst daily loss since the early days of COVID. And in China,

investors braced for what some financial pundits are already dubbing “Black

Monday 2.0.”

Bloodbath in #StockMarketIndia #stockmarketcrash #Nifty #Sensex pic.twitter.com/pJ0bhHnRcb

— Dinesh Balasundaram (@dineshbala89) April 7, 2025

It’s not just equities . Taiwanese authorities scrambled to stabilize

their bourse, promising more support if the bloodbath continues. Spoiler alert:

it will. According

to Reuters, Taiwan’s financial regulators announced it would impose

temporary curbs lasting all this week on short-selling to help deal

with the tariff-induced market. Panic, but quiet panic.

China’s Ugly Monday: It’s All About Confidence (Or Lack Thereof)

Let’s zero in on China for a second, because if there’s one country

that hates losing face, it’s the one that just got hit with another round of

U.S. tariffs. Beijing announced 34% tariffs on all imports from the US and

stocks of Chinese companies listed in the US fell by 8.9% on Friday. The China

stock market opened to what local analysts are calling an “ugly

Monday,” with sectors like tech and exports taking the brunt of the damage.

When Donald Trump intentionally crashes the stock market, you don’t call it Black Monday. It’s Orange Monday. pic.twitter.com/LHCzYq7FN3

— Piyush Mittal 🇺🇸🇺🇦🇬🇪🇨🇦🟧🌊🌈 (@piyushmittal) April 7, 2025

Investors in Shenzhen and Shanghai are pricing in a prolonged trade

war, and the sentiment is grim. Traders are selling first, asking questions

never. Domestic confidence in the government’s ability to retaliate without

blowing up the economy is dwindling fast.

And while Beijing hasn’t fired back just yet, make no mistake: a

response is coming. Whether it’s through counter-tariffs, currency devaluation,

or a strongly worded memo (written in bold font), China’s not going to sit this

one out.

And there ends our global tour, but if you’d like to Google, you’ll

find it’s happening everywhere.

Brokers Get Hit, Too

The shares of publicly traded online brokers are also taking a hit

due to the newly imposed tariffs. Taking a quick look at the numbers at the time of writing, it’s not

great reading for the likes of Robinhood (down 9.80%), NAGA (down 2.75%), XTB

(down 2.55%) and Plus 500 (down 1.14%) to name just a few.

If your business is involved in international trade, no matter the

type, it seems that Trump’s tariffs are causing absolute chaos.

Bill Ackman Calls for a Pause

Enter Bill Ackman, billionaire investor and part-time economic

lifeguard. He’s been sounding the alarm about the tariffs and is calling for a 90-day

pause to reassess the situation before the global economy gets tossed into a

blender.

Ackman warned that Trump’s tariff

policy is alienating business leaders and destabilizing markets. He didn’t

mince words either, saying the current approach will lead to “an economic

nuclear winter” and calling for a strategic timeout before this turns into a

self-inflicted recession.

The country is 100% behind the president on fixing a global system of tariffs that has disadvantaged the country. But, business is a confidence game and confidence depends on trust.

President @realDonaldTrump has elevated the tariff issue to the most important geopolitical…

— Bill Ackman (@BillAckman) April 6, 2025

Ackman’s not alone. According

to CNBC, other business leaders are quietly losing confidence in Trump’s

economic leadership. Publicly, they’re toeing the line. Privately? They’re

dusting off their crash helmets and updating their résumés for a move to

Zurich.

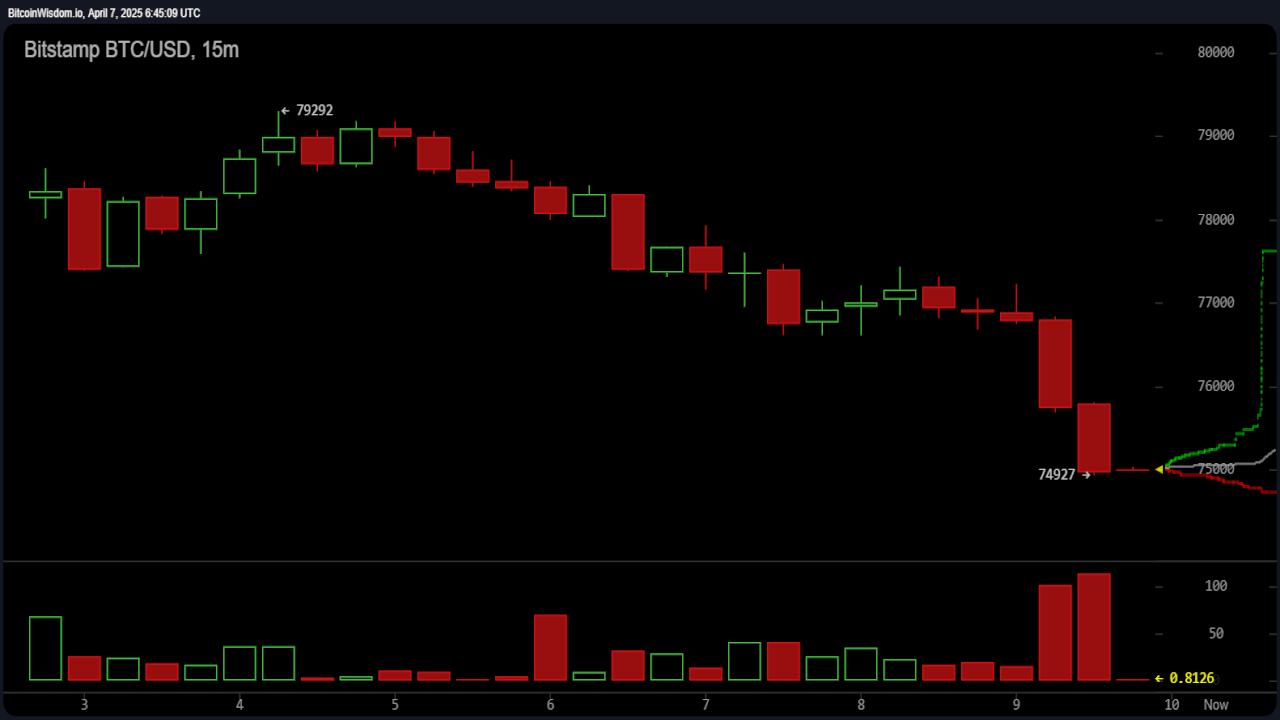

Bitcoin is No Safe Haven—It’s a Punching Bag

You’d think crypto would thrive in chaos, right? Wrong. Instead of

rising from the ashes like a digital phoenix, Bitcoin belly-flopped into the

trading week, plummeting

nearly 7% as Asian markets opened. According

to Bloomberg, BTC got caught in the “risk-off” firestorm and sold off with

everything else.

It gets worse. XRP shed 10% in just 24 hours, according to Investing.com,

while Binance users reported heavy liquidations and margin calls galore. Crypto

bros Tweeting “buy the dip” are now just waving a white flag.

The theory that crypto is a hedge against geopolitical instability

is—let’s face it—looking shaky. When panic hits, people don’t turn to Bitcoin .

They turn off their phones and Google “how to file for bankruptcy.”

Jim Cramer Isn’t Panicking—But Everyone Else Is

Jim Cramer, Investment Pro and Media Personality (LinkedIn).

In the midst of the madness, everyone’s favorite Cassandra, Jim Cramer –

he of “I

feel like a sucker” fame – went on CNBC to say he’s “not

going to panic.” Which is exactly what someone says right before they

panic. While that might sound comforting, it’s like saying you’re not afraid of

sharks while your foot is bleeding in the water.

According to Cramer, the fundamentals are still intact, and he’s

looking for buying opportunities. Meanwhile, the rest of Wall Street is

frantically rebalancing their portfolios and adding canned food stocks to their

watchlists.

Buckle Up, It’s Going to Get Bumpy

So here we are—smack in the middle of another Trump-induced market

tantrum. Tariffs are back on the menu, crypto is crying in a corner, and even

the big-money guys like Bill Ackman are begging for a timeout. If this is a

taste of what a second Trump term looks like, investors might want to start

practicing their deep breathing exercises—or learning how to trade from a cabin

in the woods.

Nikkei, Sensex, Taiwan crash, Bitcoin gets crushed, Bill Ackman wants a timeout and Jim Cramer’s “not going to panic”. Welcome to

tariff tantrum week. Are we looking at another Black Monday?

If you logged into your brokerage app today and screamed, you weren’t

alone. Global markets were sucker-punched overnight as Donald Trump’s latest

round of tariffs sent a shockwave across Asia and beyond. The Sensex? Smashed.

The Nikkei? Nuked. The China stock market? Coughing up red candles like it

swallowed a firecracker.

The Nikkei is down -8% right now.

-8%. pic.twitter.com/rSQsema3Yq

— Spencer Hakimian (@SpencerHakimian) April 7, 2025

Let’s start with the Sensex, India’s benchmark index, which

tanked 2,500 points in a single session—its biggest drop in over a year.

Traders are calling it the “Modi Meltdown,” but the real blame lies elsewhere.

Across the East China Sea, the Nikkei 225 collapsed by around

8%, its worst daily loss since the early days of COVID. And in China,

investors braced for what some financial pundits are already dubbing “Black

Monday 2.0.”

Bloodbath in #StockMarketIndia #stockmarketcrash #Nifty #Sensex pic.twitter.com/pJ0bhHnRcb

— Dinesh Balasundaram (@dineshbala89) April 7, 2025

It’s not just equities . Taiwanese authorities scrambled to stabilize

their bourse, promising more support if the bloodbath continues. Spoiler alert:

it will. According

to Reuters, Taiwan’s financial regulators announced it would impose

temporary curbs lasting all this week on short-selling to help deal

with the tariff-induced market. Panic, but quiet panic.

China’s Ugly Monday: It’s All About Confidence (Or Lack Thereof)

Let’s zero in on China for a second, because if there’s one country

that hates losing face, it’s the one that just got hit with another round of

U.S. tariffs. Beijing announced 34% tariffs on all imports from the US and

stocks of Chinese companies listed in the US fell by 8.9% on Friday. The China

stock market opened to what local analysts are calling an “ugly

Monday,” with sectors like tech and exports taking the brunt of the damage.

When Donald Trump intentionally crashes the stock market, you don’t call it Black Monday. It’s Orange Monday. pic.twitter.com/LHCzYq7FN3

— Piyush Mittal 🇺🇸🇺🇦🇬🇪🇨🇦🟧🌊🌈 (@piyushmittal) April 7, 2025

Investors in Shenzhen and Shanghai are pricing in a prolonged trade

war, and the sentiment is grim. Traders are selling first, asking questions

never. Domestic confidence in the government’s ability to retaliate without

blowing up the economy is dwindling fast.

And while Beijing hasn’t fired back just yet, make no mistake: a

response is coming. Whether it’s through counter-tariffs, currency devaluation,

or a strongly worded memo (written in bold font), China’s not going to sit this

one out.

And there ends our global tour, but if you’d like to Google, you’ll

find it’s happening everywhere.

Brokers Get Hit, Too

The shares of publicly traded online brokers are also taking a hit

due to the newly imposed tariffs. Taking a quick look at the numbers at the time of writing, it’s not

great reading for the likes of Robinhood (down 9.80%), NAGA (down 2.75%), XTB

(down 2.55%) and Plus 500 (down 1.14%) to name just a few.

If your business is involved in international trade, no matter the

type, it seems that Trump’s tariffs are causing absolute chaos.

Bill Ackman Calls for a Pause

Enter Bill Ackman, billionaire investor and part-time economic

lifeguard. He’s been sounding the alarm about the tariffs and is calling for a 90-day

pause to reassess the situation before the global economy gets tossed into a

blender.

Ackman warned that Trump’s tariff

policy is alienating business leaders and destabilizing markets. He didn’t

mince words either, saying the current approach will lead to “an economic

nuclear winter” and calling for a strategic timeout before this turns into a

self-inflicted recession.

The country is 100% behind the president on fixing a global system of tariffs that has disadvantaged the country. But, business is a confidence game and confidence depends on trust.

President @realDonaldTrump has elevated the tariff issue to the most important geopolitical…

— Bill Ackman (@BillAckman) April 6, 2025

Ackman’s not alone. According

to CNBC, other business leaders are quietly losing confidence in Trump’s

economic leadership. Publicly, they’re toeing the line. Privately? They’re

dusting off their crash helmets and updating their résumés for a move to

Zurich.

Bitcoin is No Safe Haven—It’s a Punching Bag

You’d think crypto would thrive in chaos, right? Wrong. Instead of

rising from the ashes like a digital phoenix, Bitcoin belly-flopped into the

trading week, plummeting

nearly 7% as Asian markets opened. According

to Bloomberg, BTC got caught in the “risk-off” firestorm and sold off with

everything else.

It gets worse. XRP shed 10% in just 24 hours, according to Investing.com,

while Binance users reported heavy liquidations and margin calls galore. Crypto

bros Tweeting “buy the dip” are now just waving a white flag.

The theory that crypto is a hedge against geopolitical instability

is—let’s face it—looking shaky. When panic hits, people don’t turn to Bitcoin .

They turn off their phones and Google “how to file for bankruptcy.”

Jim Cramer Isn’t Panicking—But Everyone Else Is

Jim Cramer, Investment Pro and Media Personality (LinkedIn).

In the midst of the madness, everyone’s favorite Cassandra, Jim Cramer –

he of “I

feel like a sucker” fame – went on CNBC to say he’s “not

going to panic.” Which is exactly what someone says right before they

panic. While that might sound comforting, it’s like saying you’re not afraid of

sharks while your foot is bleeding in the water.

According to Cramer, the fundamentals are still intact, and he’s

looking for buying opportunities. Meanwhile, the rest of Wall Street is

frantically rebalancing their portfolios and adding canned food stocks to their

watchlists.

Buckle Up, It’s Going to Get Bumpy

So here we are—smack in the middle of another Trump-induced market

tantrum. Tariffs are back on the menu, crypto is crying in a corner, and even

the big-money guys like Bill Ackman are begging for a timeout. If this is a

taste of what a second Trump term looks like, investors might want to start

practicing their deep breathing exercises—or learning how to trade from a cabin

in the woods.