Key Takeaways:

- A prominent whale on Hyperliquid closed out a colossal 50x leveraged ETH long as the market crashed to new lows.

- Ethereum’s plunging price caused a cascade of liquidations, applying pressure on Hyperliquid and raising fears about market stability.

- The whale’s rapid changes in position mirror a fast-moving environment, in which leveraged bets can turn sentiment in seconds.

Hyperliquid Whale Close 50x ETH Long Amidst Market Plummet

Ethereum’s latest collapse has shaken the crypto world, with Hyperliquid standing out as one of the most visible places where the effects were felt. ETH hit a low of $1,411 on April 7, its lowest price since March 2023, triggering a wave of liquidations and rapid shifts in market positioning.

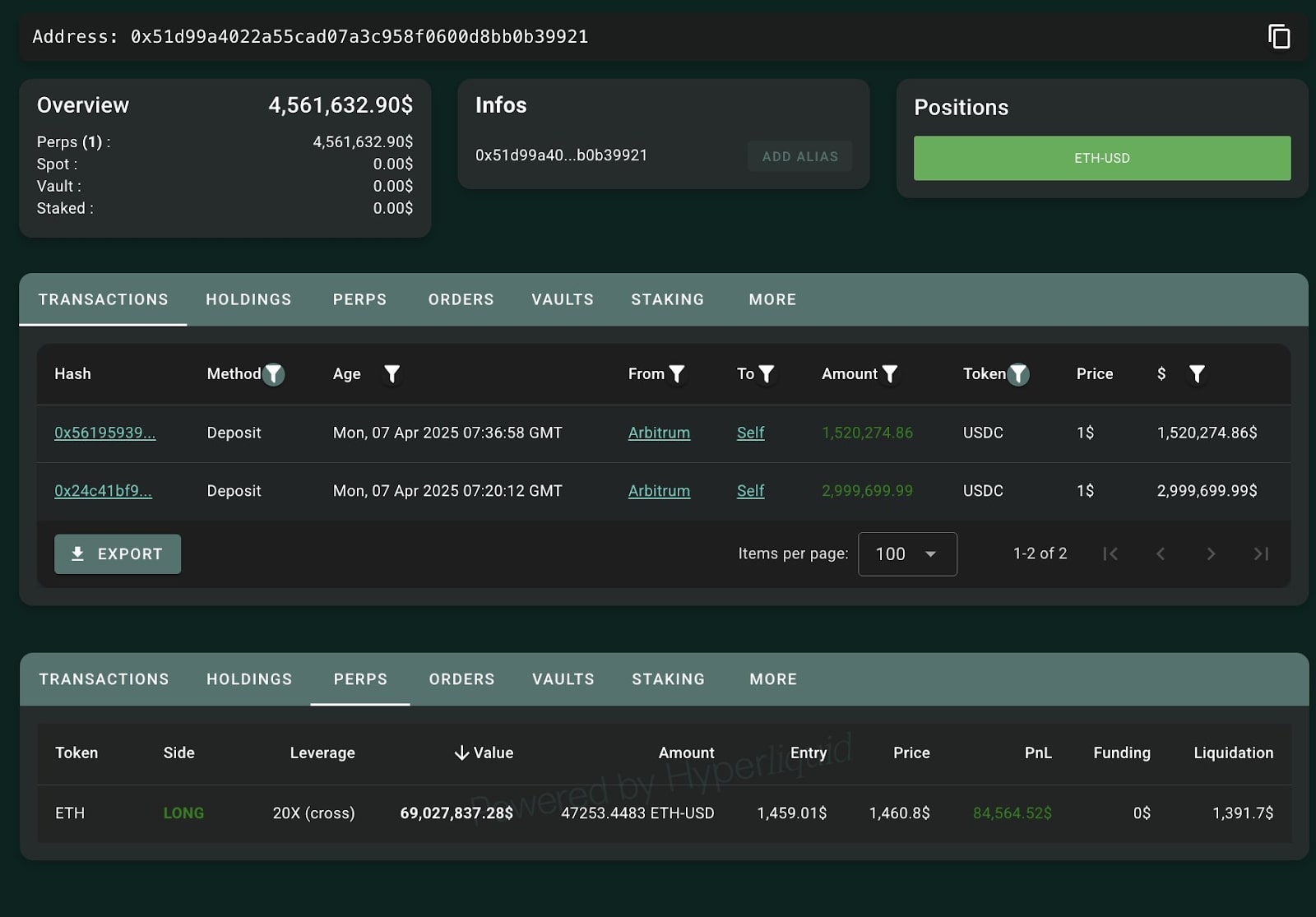

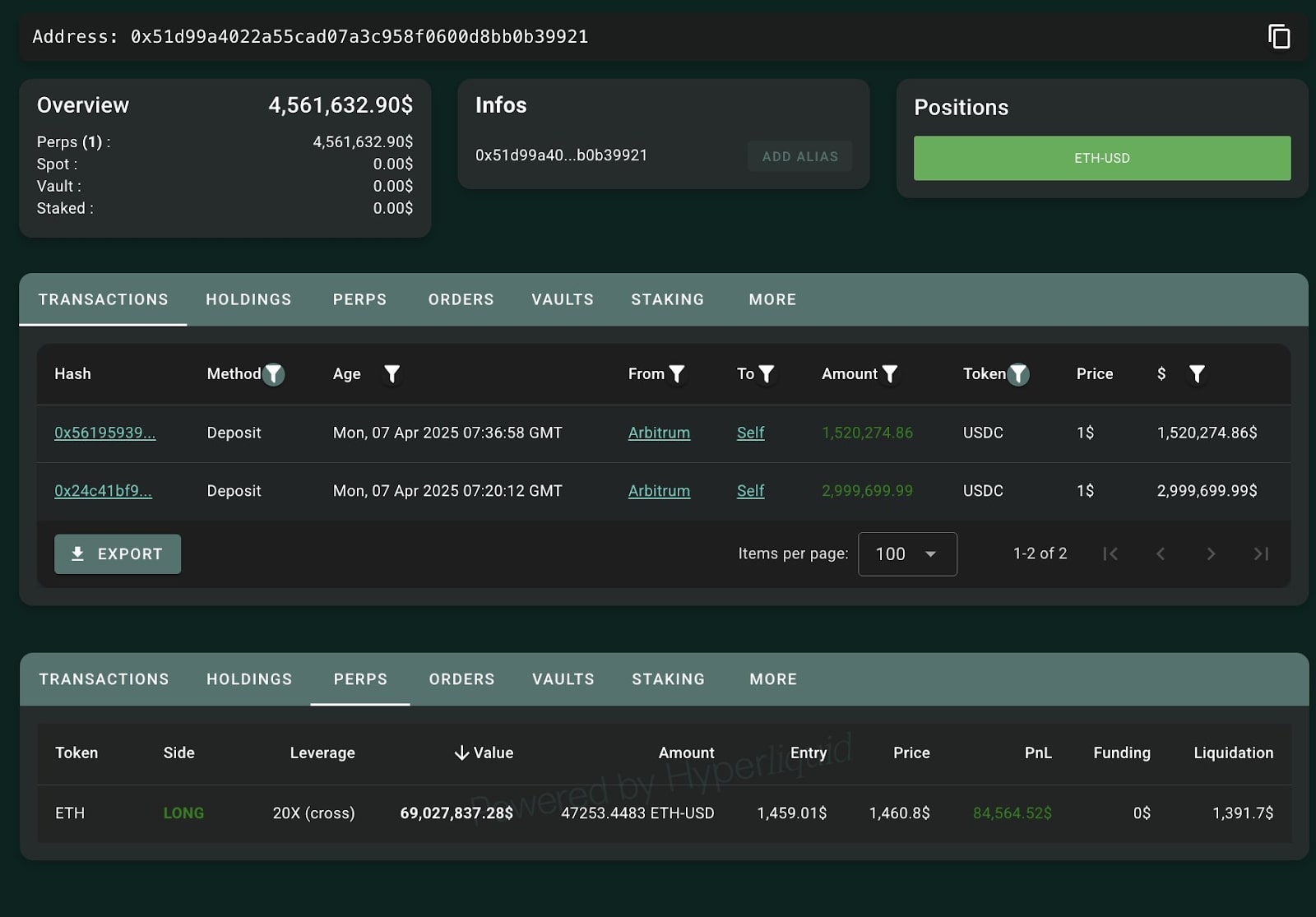

One of the more notable moves: a whale who has a penchant for high-risk trading on Hyperliquid closed an enormous 50x leveraged long on ETH. This same address had benefitted from a 50x short in the past and had just switched to a bullish stance by opening a 20x long near $1,459. However, as ETH crashed and dove toward the whale’s liquidation threshold of $1,391, the position was force-closed or cashed out to prevent full wipeout.

According to on-chain data from Hyperrscan, the whale deposited 3 million USDC to open a 20x leveraged long position on 32,800 ETH at $1,461.6 — a $47.62 million bet. With ETH in freefall, the high leverage meant even small moves carried huge risk, and it seems the position was either force-closed or exited by the whale, likely to avoid a full liquidation.

This is not the whale’s first rodeo. They made a $1.87 million profit shorting ETH with 50x leverage (also Hyperliquid) earlier this year. The rate at which that flip went from short, to long, to now closed underscores how fast sentiment changes in leveraged DeFi trading — especially when betrayed by whales.

More News: Crypto Whale Exits Bitcoin Shorts, Pockets $1.4M Profit – Then Re-Opens Position

Liquidations Have Spread Across Hyperliquid and Other Platforms for ETH

The whale’s dramatic exit is just one story in a larger wave of liquidations sweeping the Ethereum market. More than 440,000 ETH, worth about $640 million at current market prices, are on the verge of liquidation between the $1,000 and $800 price range, according to DefiLlama data. Many of them are highly leveraged positions concentrated at the top addresses in the market, leaving it susceptible to cascading liquidations.

Hyperliquid is at the center of this drama. As one of the fastest growing DEX for perpetual futures, it also has ultra-high leverage options with minimal collateral required. While this draws the interest of aggressive traders, it also exacerbates market fragility.

Hyperliquid faced scrutiny earlier this year when whale-driven moves like this helped crash the price of the JELLY token. At the time, massive liquidations raised questions about whether the platform’s architecture could withstand extreme volatility. For now, Hyperliquid seems to be absorbing the blow — in part due to its vault mechanism, which diffuses the losses among vault participants (similar to liquidity providers) when large positions are liquidated.

Staking Constraints and ETF Outflows Fuel Hyperliquid Turbulence

While the recent events focus on Hyperliquid, broader structural forces are also affecting Ethereum’s price action. In this way, both Ethereum staking and ETF products may be ramping up the sell pressure on downturns.