Robinhood’s ($HOOD) recent “Lost City of Gold” event has triggered widespread concern among SoFi investors. However, is this anxiety justified, or is it presenting a prime buying opportunity within a fundamentally robust company that Wall Street may be overlooking?

Since reaching its January highs, SoFi shares have declined by approximately 36%. Across social media platforms, panic-driven commentary dominates, warning investors to “dump SoFi ($SOFI) before it’s too late.” Phrases like “Robinhood just killed SoFi’s business model” are everywhere. But is this market reaction grounded in sound analysis, or is it a product of emotional overreaction? Let’s examine the facts.

What Did Robinhood Announce?

During its “Lost City of Gold” event, Robinhood introduced three ambitious products aimed at challenging SoFi’s core business pillars: wealth management, banking, and AI-driven trading insights.

1. Robinhood Strategies (Wealth Management):

- Expert-managed portfolios with a 0.25% management fee, capped at $250 for Gold members.

- Management fees drop to zero for balances over $100,000.

- New features include tax optimization, portfolio insights, and Monte Carlo simulations to predict returns across market scenarios.

- Robinhood claims to have over 50 years of cumulative Wall Street expertise among its investment team.

- These products are aggressively priced, undercutting SoFi Invest’s fees.

2. Robinhood Banking:

- Launching in Fall 2025, offering a 4% APY on savings accounts.

- Private banking services with estate planning, FDIC insurance up to $2.5 million, and 24/7 support.

- Luxury perks like tickets to events (Met Gala, Oscars, F1 Monaco).

- Cash delivery services and the ability to create family accounts with parental controls.

- Designed to appeal to high-net-worth clients by providing personalized services traditionally offered by private banks.

3. Robinhood Cortex (AI Investment Tool):

- Expected to launch later in 2025, this AI-powered tool aims to deliver sophisticated market analysis and investment strategies in accessible, straightforward language.

- Includes advanced data analytics and tailored market insights designed to enhance user engagement.

- Part of a broader effort by Robinhood to diversify its revenue streams beyond transaction-based income.

Comparing Robinhood and SoFi: Strengths and Weaknesses

Robinhood’s recent announcements are ambitious, but how much of this innovation is genuinely transformative versus promotional posturing? Let’s evaluate each company’s strengths and weaknesses.

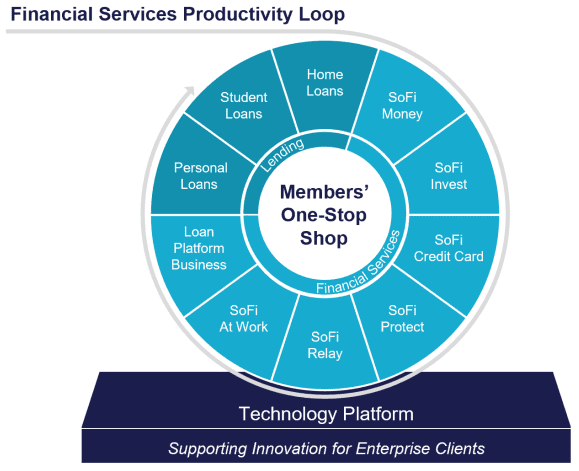

SoFi’s Approach

- Comprehensive financial services ecosystem, including lending, banking, and investment products.

- Consistent revenue growth across market cycles.

- Diversified business model provides resilience during economic downturns.

- Regulatory advantages due to SoFi’s established banking license.

- Steady, albeit less sensational, approach to product development and expansion.

SoFi Is focusing on building out a robust eco system with its core offerings, not something RobinHood can replicate easily.

Sofi Q4 2024 IR Report

Robinhood’s Approach

- Rapid expansion into diversified financial services beyond core trading operations.

- Highly effective marketing targeting younger, technology-savvy consumers.

- Significant growth in assets under custody and revenue per user.

- Attempting to expand revenue sources through premium services and AI-driven insights.

- Branding and user engagement are industry-leading, though heavily reliant on transaction volume.

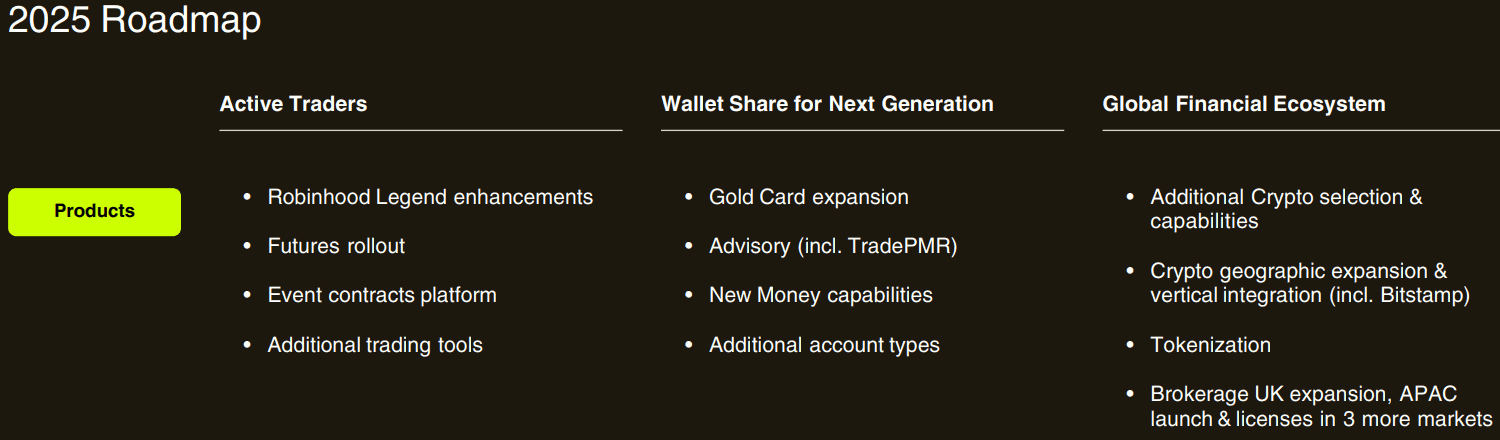

Primarily RobinHood has been focussed on providing more products to their investing platform except for Tax Lots and Gold cards. Looking at their Q4 2024 road map for 2025 on their investor relations page we can see most of their future products are still geared towards that user base.

The recently promoted products lean heavily towards this investing focus, where as the banking products they want to offer aren’t all the unique. They do offer a more wholesome money management solution though.

Comparing Business Models

While Robinhood is targeting SoFi’s core business sectors, it’s important to note the differences in their business models:

- SoFi: Relies on stable revenue generation through diversified offerings such as loans, investment platforms, and banking products. This integrated model provides a steady growth trajectory, less influenced by market fluctuations. SoFi wants to be your One-Stop shop for everything from student loans to mortgages. Being a regulated bank, SoFi can provide services Robin Hood isn’t able to.

- Robinhood: Still heavily reliant on trading volume, making its revenue more volatile and cyclical. However, its push toward more stable revenue streams are promising. Their marketing is also very effective, they take a slightly different approach to SoFi on this, making their product seem exclusive and, in a way, addictive. Their entire user experience is designed to give you those little dopamine hits that keep you coming back. Sofi targets a slightly more mature audience, young professionals and high-income earners whose focus is getting their financial life in order.

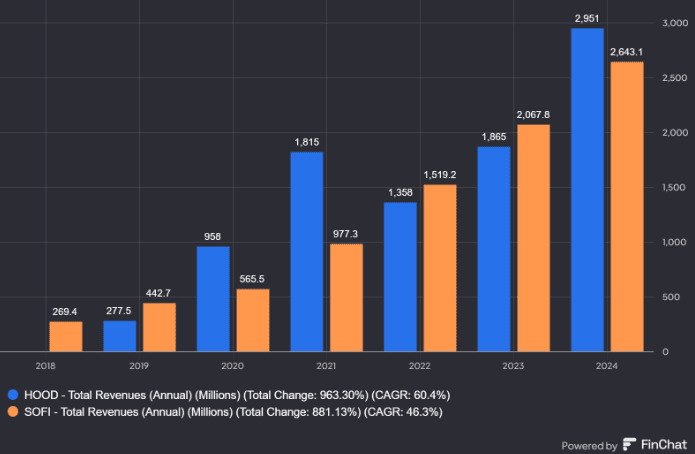

The chart below shows the difference between SoFi’s steady Revenue growth and the cyclical nature of RobinHoods. Robinhood recently posted over $1 billion in quarterly revenue where Sofi Is still hunting for that milestone but it’s possible that could be in the bag for Q1 2025.

Interestingly, Robinhood’s efforts to replicate SoFi’s diversified approach suggest an acknowledgment of the inherent weaknesses in a purely transaction-based model. The question remains whether Robinhood’s new initiatives can genuinely compete with SoFi’s established infrastructure.

Should Investors Be Concerned?

The market’s negative reaction to Sofi due to Robinhood’s announcements doesn’t seem justified. The new features Robinhood is introducing will not be available until late 2025, giving competitors ample time to respond. Moreover, the impact of these innovations remains speculative until they are fully operational.

While Robinhood’s marketing strategies are undeniably effective, much of the announced functionality remains theoretical. Investors would be wise to focus on fundamentals rather than react impulsively to well-crafted promotional campaigns.

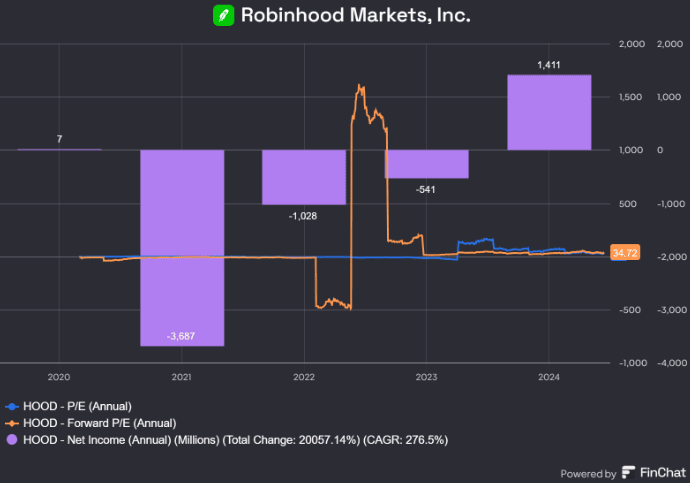

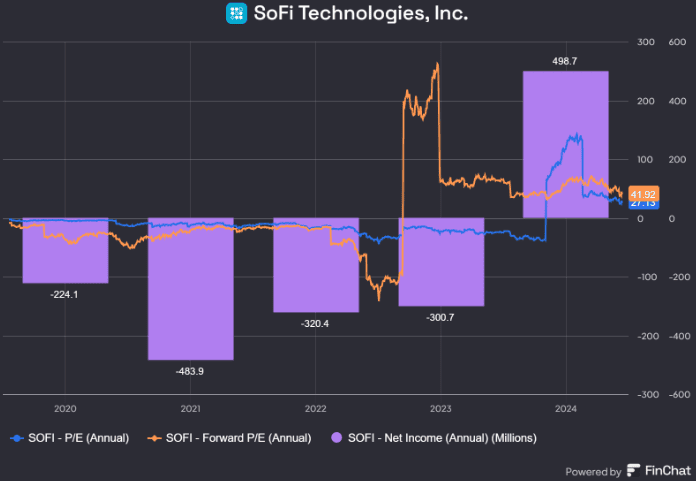

Valuations

I wouldn’t say that either of these companies were cheap by any classic metric. Both have a P/E higher than their peers, the same can be said of their forward P/E’s but I do think each company has growth engines that aren’t reflected in these numbers. Both companies became profitable again in 2024 after pivoting their business considerably and both are still aggressively expanding their profitable service offerings. A price to earnings ratio can be a somewhat unreliable measurement of a business that’s still in its growth phase for a variety of reasons such as, reinvesting revenue into tech, marketing, and customer acquisition. These investments suppress short-term profit but can boost long-term value. Which is exactly what I want to see.

Once these companies have consistent profitability with stable margins, P/E will become more meaningful. That said, many investors will still supplement it with other ratios to account for growth and an alarmingly high P/E would certainly trigger some alarm bells.

Conclusion

Robinhood’s bold initiatives demonstrate its ability to expand beyond transaction-based revenue, but they are not the existential threat to SoFi that many fear. In fact, Robinhood’s strategic pivot toward a diversified model only serves to validate SoFi’s long-term approach. The two companies are playing different games: Robinhood is chasing engagement and rapid user acquisition, while SoFi focuses on building a comprehensive, resilient financial ecosystem designed for sustained growth.

While Robinhood’s marketing is aggressive and its new features intriguing, much of their functionality remains hypothetical until launch. By contrast, SoFi’s integrated model continues to deliver steady growth, reinforced by a well-regulated banking infrastructure and diversified revenue streams.

For investors, the real opportunity lies in discerning marketing hype from substantive value. The current panic surrounding Robinhood’s announcements may be more of a reflection of short-term sentiment than long-term fundamentals.

Personally, I view SoFi as a steady-growth play, with a robust ability to adapt across market conditions, particularly through its expanding tech platform and innovative loan platform-as-a-service. Robinhood, while a newer addition to my portfolio, has already rewarded me with significant returns in 2024. Its rapid go-to-market strategy and appeal to new investors position it well for future growth—though whether its new products will convert that appeal into profitability remains uncertain. I’m still confident in their potential based only on existing products.

Ultimately, both companies bring unique strengths to the market. Robinhood is an investment-first platform pushing into banking. SoFi is a bank-first platform pushing into investment. Both are relatively young and disruptive and Investors who can look beyond the noise and focus on fundamentals may find compelling opportunities in both.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.