On-chain data shows the Bitcoin Hashrate has observed a sharp decline recently and has reversed its growth from the last few weeks.

Bitcoin Hashrate Has Plummeted Over The Past Week

The “Hashrate” refers to an indicator that keeps track of the total amount of computing power that the miners as a whole have connected to the Bitcoin blockchain. This metric is traditionally measured in terms of hashes per second (H/s), but today, its value has grown so much that units like terahashes per second (TH/s) are used instead.

The trend in the Hashrate can provide a look into the sentiment among the miners. An increase can imply mining is looking profitable to these chain validators, so new ones are joining in and/or old ones are expanding their facilities.

On the other hand, a decrease can be a sign that some of the miners are unable to break-even on BTC mining, so they have decided to take their machines offline.

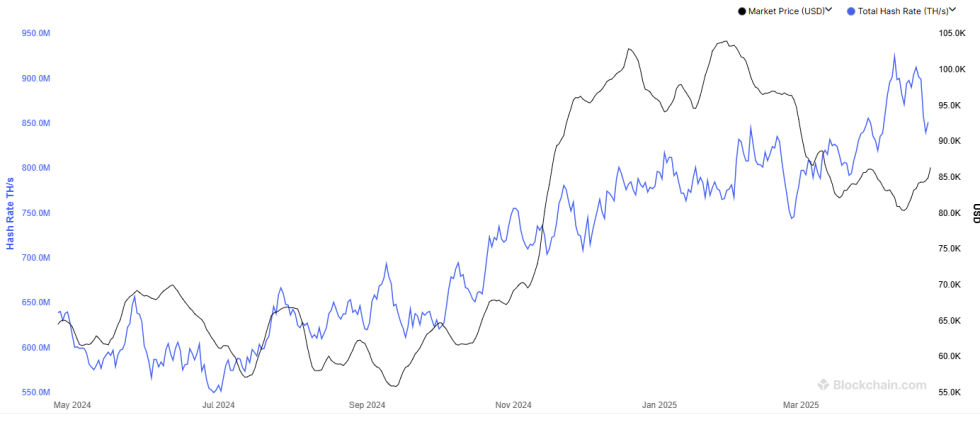

Now, here is a chart that shows how the 7-day average of the Bitcoin Hashrate has changed during the past twelve months:

Looks like the value of the metric has plummeted in recent days | Source: Blockchain.com

As is visible in the above graph, the 7-day average Bitcoin Hashrate observed a sharp surge in the first third of this month and set a new all-time high (ATH), suggesting the miners aggressively expanded their farms.

After hitting the top, though, the metric saw its growth plateau out, and in the past week, the trend has outright seen a reversal. From the chart, it’s apparent that the indicator has now returned to almost the same level as at the start of the month.

Interestingly, the earlier surge in the indicator came while the price of the cryptocurrency was heading down, while the recent drawdown has come alongside a rally.

Miners make the major part of their income from the block subsidy, a reward that remains fixed in BTC value (aside from special events called Halvings, where it’s permanently slashed in half about every four years) and is given out at a more or less constant rate over time.

The only variable related to these rewards is the USD price of Bitcoin, so whenever the asset rallies, miner income goes up. As such, the chain validators tend to expand in bullish periods.

Sometimes, however, miners expand in advance, anticipating that the cryptocurrency would surge in the near future. This may be what happened earlier in the month.

As mentioned before, miners receive the block subsidy at a nearly constant rate of time. The feature of the Bitcoin network that makes this possible is the Difficulty.

Difficulty defines how hard the miners would find it to mine a block on the BTC chain. Whenever miners increase their Hashrate, they naturally become faster at their task of mining. The network responds to this by upping its Difficulty just enough that the miners slow back down to the standard pace.

A consequence of this is that if new miners join the network, the share of rewards for everyone involved becomes smaller. The aggressive Hashrate expansion earlier meant that the network had to continuously increase its Difficulty, which is now sitting at a new record.

The trend in the Difficulty over the past year | Source: Blockchain.com

Perhaps this Difficulty increase was too much to cope for some miners and the relief in the form of the price rally came too late, which could be why the Bitcoin Hashrate has seen a massive pullback recently.

BTC Price

At the time of writing, Bitcoin is floating around $92,700, up more than 9% in the last seven days.

BTC appears to have been on the rise during the last few days | Source: BTCUSDT on TradingView

Featured image from Dall-E, Blockchain.com, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.