The Daily Breakdown takes a closer look at Nvidia, given the stock’s poor performance despite strong underlying fundamentals.

Friday’s TLDR

- Breaking down Nvidia’s business

- A look at its growth estimates

- And sizing up its valuation

What’s Happening?

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Earlier this year, Nvidia was the world’s largest company by market cap. But shares have been roughed up lately. While the stock has rebounded from the lows, shares were down a breathtaking 43.4% from the highs.

Did Nvidia lose its position in the AI race or something?

Nvidia Is the Building Blocks for AI

Nvidia’s positioning itself at the forefront of technology’s next great frontier. Mega-cap tech can’t get enough of the company’s top-of-the-line GPUs right now, which fuel the super-computing needs of today’s AI applications.

These GPUs are hardware, but Nvidia also offers software solutions, a business that creates a “stickier” moat and tends to generate solid growth with strong, defensible margins. Aside from robust demand for its best-in-breed GPUs, this is partly why Nvidia has avoided some of the cyclicality that can accompany chip stocks.

A few months ago, mega-cap companies laid out big spending plans for 2025. A lot of that spend — referred to as CapEx — is going toward building out their AI products. However, the worry is that an economic slowdown would cause these companies to reel in their spending plans, hurting firms like Nvidia.

That fear isn’t coming to fruition, though.

Microsoft just reiterated its lofty spending plans for 2025, echoing that of Alphabet’s approach. Meta actually raised its CapEx outlook for the year.

Fundamentals

Earlier this week, we took a look at the big increase in sales and net income for Nvidia. The growth has been impressive, but even more impressive has been the margin expansion, as more revenue makes its way to the bottom line.

In its most recent fiscal year (FY 2025), Nvidia grew its earnings and revenue 146% and 114%, respectively. But as we’ve talked about many times before, it’s not about what a company has done…it’s about what it’s going to do. In that regard, analysts remain optimistic.

For fiscal 2026 (which is this year), consensus expectations call for earnings growth of 49% and revenue growth of 54%. For fiscal 2027 (next year), earnings are projected to climb 29% and revenue is forecast to grow 23%. Free cash flow is forecast to jump 57% and 33% for these periods, respectively.

The Bottom Line

Remember that estimates are just educated guesses. Nobody knows for certain how the next six months will shake out, let alone the next two years. So investors can’t necessarily bank on these estimates playing out. For instance, export restrictions are an ongoing overhang for Nvidia.

However, estimates are good points of reference to get a general sense of future growth expectations.

Now let’s look at the valuation 👇

Want to receive these insights straight to your inbox?

Sign up here

The Setup — Nvidia

We know that Nvidia has done well over the last few years and it’s clear that analysts expect it to keep doing well going forward. But what exactly are investors paying for this growth?

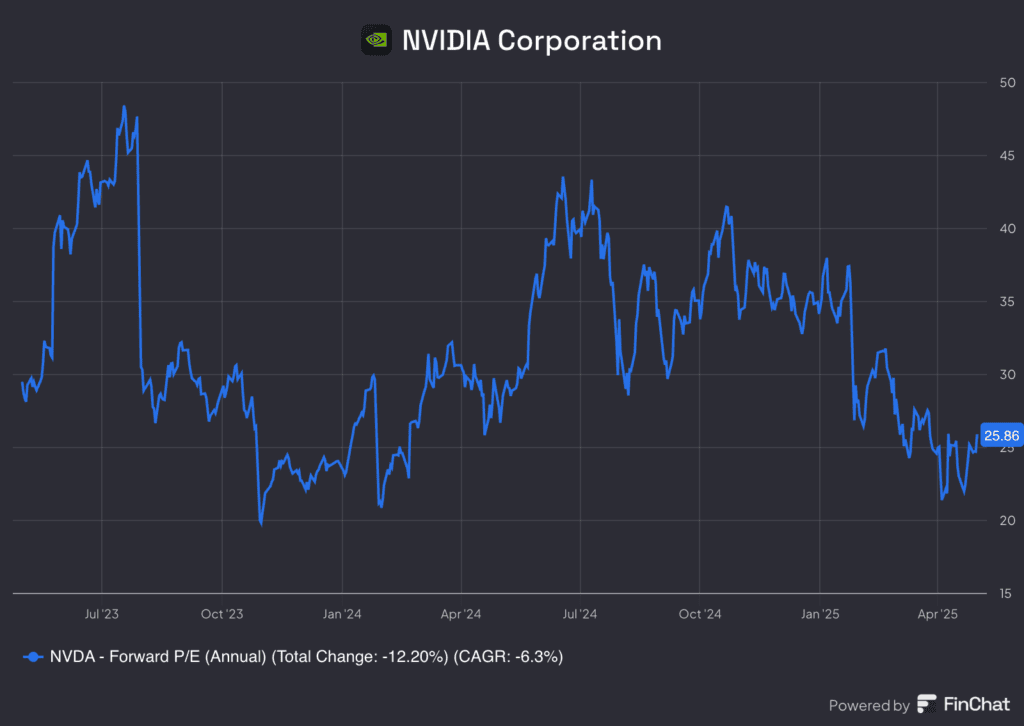

This is a chart of the forward price-to-earnings ratio. This ratio takes the current stock price (P) and divides it by the expected earnings (E). If the company is profitable, using the P/E ratio can help gauge whether the stock is cheap or expensive compared to its historical valuation. Under these circumstances, the lower the P/E ratio, the cheaper the valuation is considered (and vice versa).

In the case of Nvidia, the chart above spans the last two years. By that comparison, the valuation is near the lower end of the range over that period. That’s reassuring for investors, because despite the recent rally, there’s less of a concern about overpaying for the stock at today’s prices.

For what it’s worth, the consensus analyst price target is near $165, implying almost 50% upside from current levels.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.