Key Takeaways:

- Amid continuing digital asset volatility, iShares Bitcoin Trust ETF submits SEC modification.

- The past price fluctuations of Bitcoin—peaking at $67,734 and dropping to $15,632—show long-term volatility.

- SEC filings reveal continuing concerns for both Bitcoin and Ethereum ETFs, especially about regulatory ambiguity and market manipulation.

To highlight ongoing concerns with digital asset volatility, regulatory uncertainty, and investor trust, BlackRock’s iShares Bitcoin Trust ETF submitted a pre-effective amendment to the U.S. Securities and Exchange Commission (SEC) on May 9, 2025. Though increased regulatory attention as well, the application comes at a time of rising political focus on cryptocurrencies.

A Sharp Reminder of Crypto Market Volatility: iShares Bitcoin Trust ETF

Submitted by iShares Delaware Trust Sponsor LLC, the revised Form S-3 presents a gloomy image for investors. With the possibility of total loss of investment value, it emphasizes again that Bitcoin and other digital assets stay very volatile and speculative.

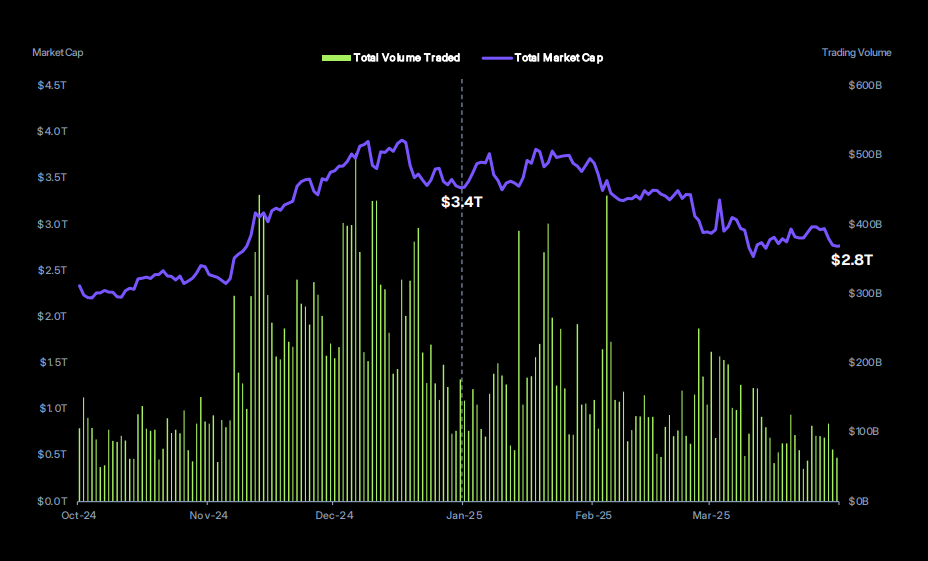

Bitcoin’s 77% drop from $67,734 in late 2021 to $15,632 in 2022 and successive pulldowns, according to the paper, highlights the inherent systematic risk of crypto assets. The asset’s trailing one-year volatility is 65%. Early in 2025, 2011, 2013, 2014, 2017, and 2018 all saw comparable boom-bust cycles. Such fluctuations continue to deter mainstream institutional capital, despite increasing ETF involvement.

Digital Asset Contagion: FTX and the 2022 Collapse Still Cast a Long Shadow

The iShares filing also references the devastating events of 2022 that unraveled investor trust in the digital asset ecosystem. Bankruptcy filings by Celsius, Voyager, and Three Arrows Capital, followed by the dramatic collapse of FTX, triggered a wave of liquidations and severe liquidity crunches across the sector.

FTX’s implosion—once a top-tier global crypto exchange—was more than a financial loss; it marked a pivotal moment in regulatory attention. U.S. agencies including the DOJ, SEC, and CFTC launched coordinated legal actions against FTX’s leadership, setting off a sustained era of enforcement pressure that still weighs on the industry.

The filing warns that market liquidity remains vulnerable. If institutions tied to FTX or other distressed platforms continue to retreat or fold, investor confidence may erode further, sparking additional sell-offs and regulatory responses.

Read More: SEC Drops Lawsuit Against Helium: A Win for Web3 and Regulatory Clarity

U.S. Policy Momentum: Supportive Signs, but Uncertain Outcomes

President Trump’s March 2025 executive order to establish a Strategic Bitcoin Reserve and a Digital Asset Stockpile was hailed by crypto advocates as a landmark policy shift. A legislative proposal followed, aiming to authorize the accumulation of up to 1 million BTC using seized digital assets or budget-neutral mechanisms.

Yet, the iShares filing cautions that such initiatives, while symbolic, carry no guarantees. Laws can fail in Congress. Executive orders can be reversed. And execution challenges—ranging from storage to political resistance—could delay or dilute the intended impact.

Several state-level bitcoin acquisition bills have already stalled, signaling that political momentum may not be uniform across the U.S. The market’s expectations must align with realistic policy timelines to avoid speculative bubbles and sharp corrections.

Read More: SEC Officially Drops XRP Lawsuit, Ripple Celebrates Landmark Victory

Ethereum ETF risk increases complexity even more

Alongside the Bitcoin ETF progress, the SEC published a second paper on Ethereum ETF suggestions. The application brings up important questions concerning Ethereum’s move to proof-of-stake and whether U.S. law would classify it as a security.

Pending Ethereum ETF approvals could be affected by this regulatory gray area. All noted as unsolved are questions about Ethereum’s governance, concentration of staking systems, and possible market manipulation. ETH’s legal classification issue causes Ethereum ETFs to face much more severe regulatory hurdles than Bitcoin ones.

The SEC’s position on both Bitcoin and Ethereum investment products emphasizes that ETF approval is not a universal endorsement of digital assets. Rather, it reflects a narrow regulatory pathway carved for specific structures under existing frameworks.

Conclusion: A Market Still Defined by Volatility and Uncertainty

Despite the growth of institutional interest in crypto ETFs, the latest SEC filings by BlackRock suggest a market still deeply defined by volatility, legal ambiguity, and fragmented investor sentiment.

Crypto-linked ETFs like those from iShares and other major companies will keep carrying significant risk until there is more clear regulatory policy, consistent enforcement methods, and a more developed digital asset infrastructure. These facts have to be considered by both retail and institutional investors against the benefit of getting exposure to developing digital assets.