- Key drivers include capital controls and Treasury devaluation.

- US election outcomes could accelerate or delay BTC gains.

- European policy divergence adds regulatory uncertainty.

Bitcoin is trading around $103,025, but forecasts for its long-term growth are becoming increasingly ambitious.

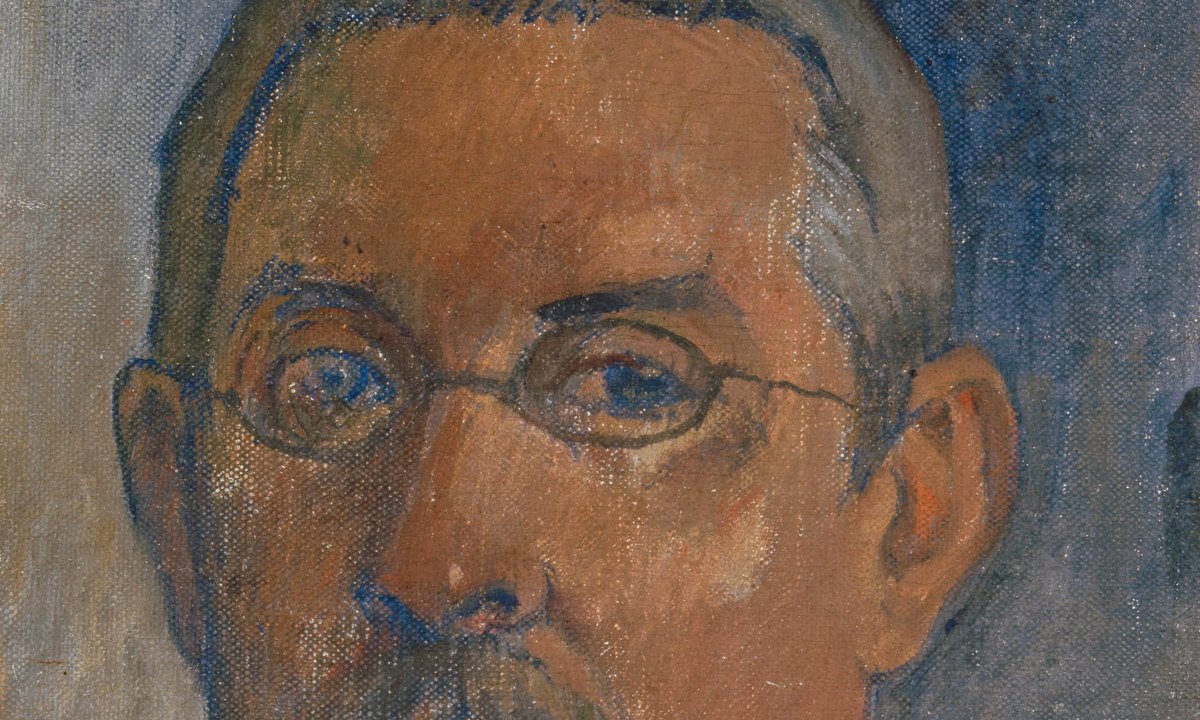

One of the most widely discussed predictions comes from Arthur Hayes, co-founder and former CEO of crypto exchange BitMEX, who believes Bitcoin will soar to $1 million within the next three years.

Hayes shared this estimate in a blog post published on 15 May, citing global macroeconomic factors as the primary catalysts behind such a dramatic rise.

His comments follow a recent surge in institutional interest and ongoing concerns around fiat currency stability.

Global capital controls and US Treasury risk fuel bullish case

Hayes argues that two key developments are paving the way for Bitcoin’s potential seven-figure price point: capital repatriation and the devaluation of United States Treasurys.

According to him, as governments impose tighter capital controls and attempt to manage sovereign debt, investors will seek refuge in decentralised assets.

He suggests that Bitcoin, given its finite supply and growing institutional legitimacy, will become a preferred store of value, especially in regions where economic instability undermines confidence in traditional banking systems.

He emphasises that “foreign capital repatriation” and the diminishing purchasing power of massive holdings in US Treasurys will act as core accelerants for BTC’s price trajectory.

Hayes claims these pressures are likely to intensify depending on the outcome of the next US presidential election in 2028.

His logic hinges on how the next administration might shift economic and fiscal policy, potentially hastening investor flight into alternative assets like Bitcoin.

Central banks and policy uncertainty boost Bitcoin’s appeal

Hayes’ forecast coincides with a broader divergence in policy responses across regions.

While some countries are increasing their acceptance of Bitcoin, others, especially in Europe, are considering more stringent controls.

He criticised the European Central Bank for being overly restrictive, contrasting its stance with that of China, which, despite banning crypto trading, has not outlawed private Bitcoin ownership.

He warned that attempts to suppress Bitcoin in the eurozone could backfire, likening such policies to ineffective central planning.

In his view, institutional and retail investors in these regions should act quickly to shift wealth into decentralised assets before tighter restrictions come into force.

These geopolitical risks, combined with concerns over inflation, currency debasement, and ballooning government debt, are helping to solidify Bitcoin’s image as a hedge against systemic risk.

Big players see long-term growth potential

Hayes is not alone in his optimism. Institutional leaders, including Michael Saylor, CEO of business intelligence firm Strategy, and asset management giants like Fidelity Investments, have echoed similar sentiments.

Saylor, whose firm holds the largest Bitcoin reserve among public companies, has projected a long-term valuation of $10 trillion for Bitcoin.

His personal prediction stretches even further, with a price target of $13 million per coin by 2045.

Meanwhile, Hayes’ near-term forecasts have proven to be relatively accurate.

In April, he anticipated a return to the $100,000 level, while also identifying the mid-$70,000 range as a local bottom.

These predictions aligned closely with recent price movements, bolstering his credibility among retail and institutional investors.

Although a 900% price gain from current levels might seem far-fetched, proponents argue that in an era of growing debt and diminishing trust in fiat currencies, Bitcoin’s asymmetric upside cannot be ignored.