LyondellBasell’s ($LYB) recent stock performance highlights significant changes in the polymer giant’s financial fundamentals, market position, and strategic initiatives since I sold my entire position at $94.11 about a year ago. In this short form blog post I want to provide an answer to whether current share price levels reflect the changed business (environment) enough, considering industry cycles, raw material costs and of course the recent trade war.

Business profile

In the case you’re unfamiliar with LyondellBasell (from here on out I will reference it as LYB), which I would not blame you for as it’s not a consumer oriented company, the company produces a wide range of petrochemical products including polyethylene (PE), polypropylene (PP), oxyfuels and propylene oxide (PO) used in industries spanning from packaging to automotive and construction. It’s one of or even the largest in the world in these segments.

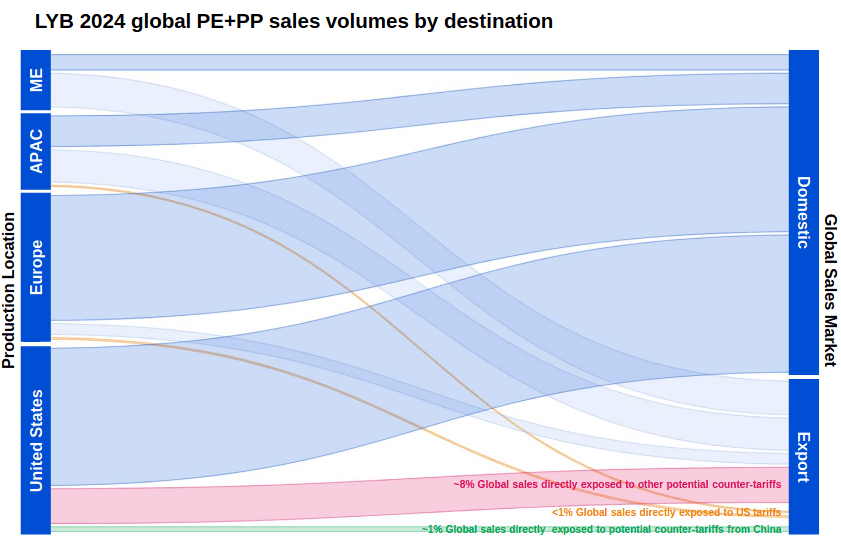

It’s mostly Europe and US focused and mostly produces for domestic markets.

Figure 1: Supply network, Q1 2025 results

Investment case

Initially I found LYB interesting because of their shareholder friendly management, huge high quality cash flow generation and competitive position.

So let’s explore these points, first of all, management. Bob Patel was replaced by Peter Vanacker. Patel was more focused on generating cash from the existing core operations while Vanacker is reshaping the portfolio and divesting non core assets.

Here’s an overview of the decisions management has made over the last few years:

| Management Decision | (Tentative) Outcome |

| Portfolio Management | Since 2023, LyondellBasell has reduced its annual fixed cost expenditures by approximately $300 million, net of one-time costs. This has been a positive move towards cost efficiency. |

| Closure of Dutch PO JV | The decision to permanently close the Dutch PO JV with Covestro was made to ensure strategic asset alignment. |

| Flex-2 Project | The final investment decision on the Flex-2 project is expected to provide an EBITDA benefit of approximately $150 million per year post-startup. |

| Saudi Arabia Feedstock Allocation | LyondellBasell secured a new feedstock allocation in Saudi Arabia, enabling a joint project with Sipchem. |

| European Strategic Review | Progress is being made on the European strategic review, with updates expected by mid-2025. |

| Refinery Closure | The decision to close the Houston Refinery, which was executed in February 2025 is expected to have a net cash benefit of $175 million in 2025, but this estimate was at Brent Crude at $80 |

| Advanced Recycling Technology | Investments in advanced recycling technology, including the MoReTec plant in Germany, are part of the strategy to grow the Circular & Low Carbon Solutions business. |

| Divestment and Acquisitions | The divestment of the EO&D business and acquisition of a stake in the NATPET joint venture in Saudi Arabia are strategic moves to focus on core businesses and leverage cost advantages. |

| Value Enhancement Program | This program is on track to unlock significant recurring annual EBITDA improvements, contributing to the company’s financial strength. |

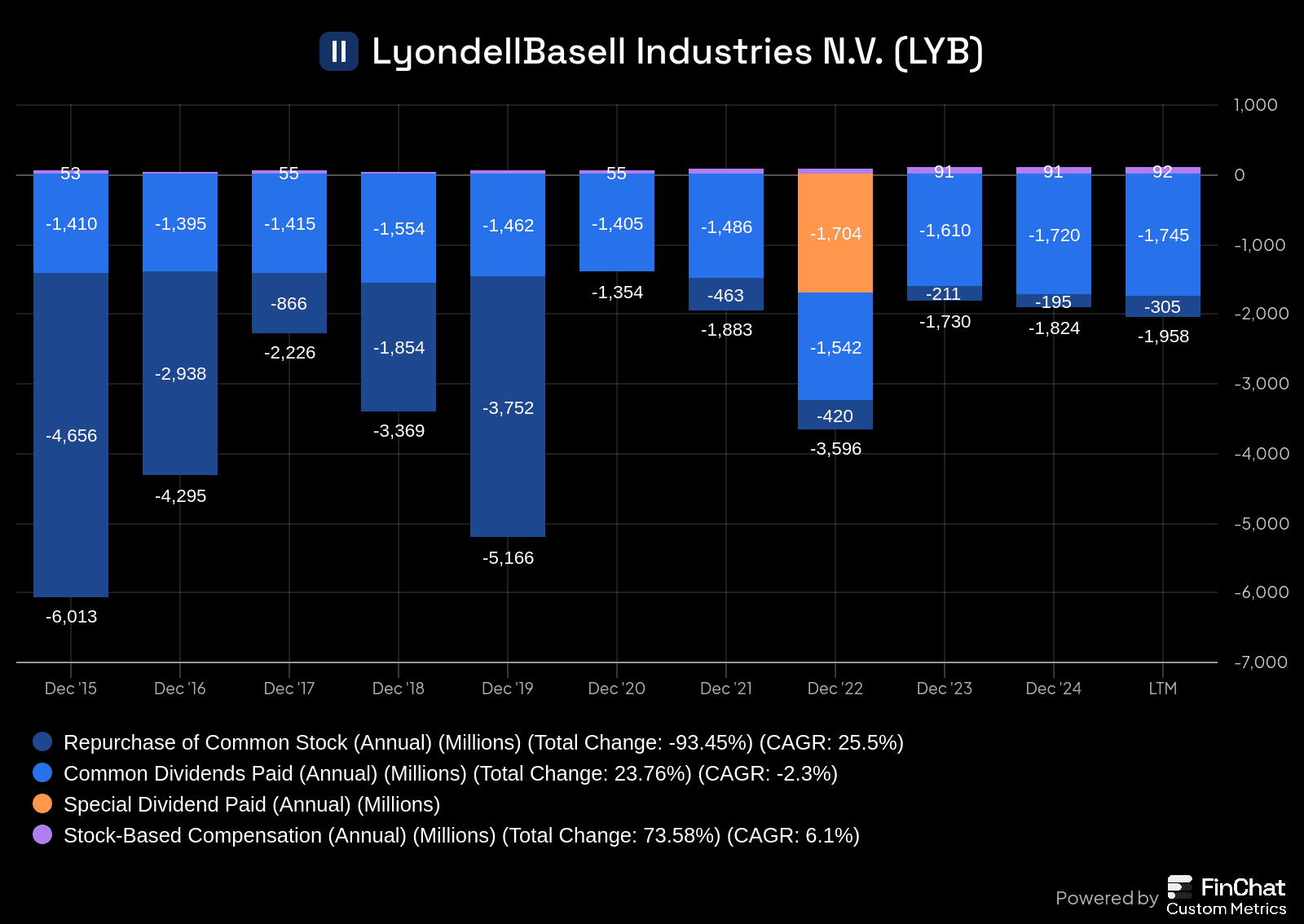

Additionally LYB has always had strong shareholder return policies focussing on dividends and share repurchases over the last decade. As illustrated by where their financing cash flow ended up:

Figure 2: Financing cash flow and SBC, from FinChat

Most profits generated by the business end up as usable cash flow, which also is why in times of higher earnings cash distributions follow so quickly. LYB operates steam crackers that primarily use natural gas liquids, mainly ethane and propane, as feedstocks, while many competitors use naphtha. When oil prices rise relative to natural gas prices, LYB benefits from lower feedstock costs. However, when oil prices fall or natural gas prices rise, this cost advantage diminishes or even turns into a disadvantage, as has occurred in recent years.

From the demand side pricing follows naphtha production. Although European naphtha crackers are shutting down. The industry has reversed its strategy of previously building plants near customers, now locating them near affordable feedstock instead. All of this puts LYB in a difficult position.

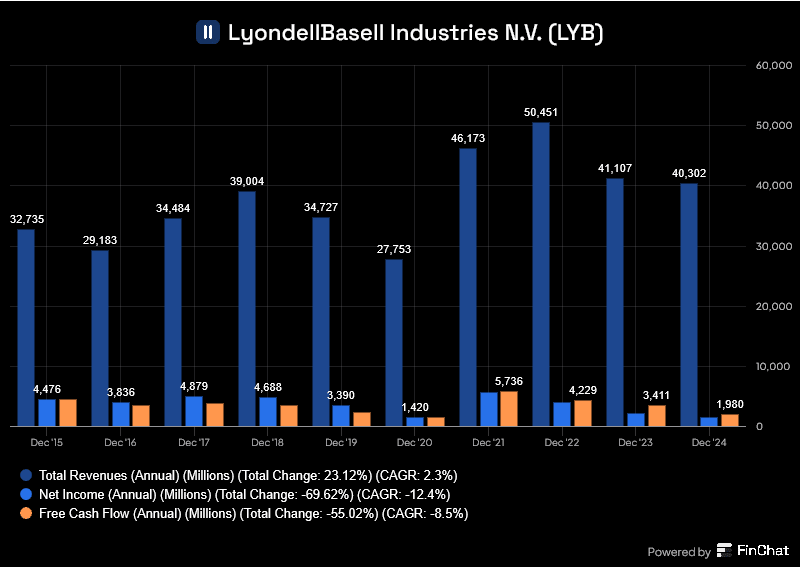

In Recent years supply and demand mismatches (2021 and 2022) have provided great temporary ups for LYB but long term their fundamentals are worsening.

Figure 3: Revenue, net income and FCF, from FinChat

Risks

In summary LYB is reliant on macro economic factors deciding demand. This is an inherent risk to the company which they have not been able to transition away from by cutting costs or investing more in circular solutions. Any recession will impact them greatly.

Furthermore the aforementioned oil and gas price changes can really change the margins, this is already happening.

Conclusion

Overall while LyondellBasell is nearly 40% cheaper price wise I would still be very hesitant of actually adding onto or starting a position now. The outlook for oil and gas could of course become more positive (and if you only buy after such news you of course might already have missed the boat) but I personally do not expect a better oil and gas price relation in the long term based on global energy transition trends, and the increasing competitiveness of alternative feedstocks and production methods. As such, despite the attractive valuation, the structural headwinds may continue to weigh on LYB’s cost advantage and profitability. The company itself however is well run but the business environment is changing. If anything changes with feedstock trends this could be a very attractive company which has a tendency to shell out cash to shareholders in such cases.