A bad bond auction weighed on US stocks, while Bitcoin hit new highs, and The Daily Breakdown takes a closer look at the charts of T-Mobile.

Quick TLDR

- Bonds dealt a blow to stocks

- Checking the charts for TMUS

- BTC notches fresh record

What’s Happening?

There were some worries about bonds yesterday, which weighed on stocks as the S&P 500 fell 1.6%. There are two pieces to that equation.

First, 10-year bond yields keep grinding higher. The worry is that the 10-year yield will gain too much momentum, stirring fears that it will make another run toward 5%. Now at its highest level since January — when it topped out around 4.75% — this concern is gaining steam.

The other worry came from yesterday’s 20-year bond auction — demand was low. A lack of demand results in a higher yield (and remember, bond prices and bond yields are inversely correlated, so as yields go higher, bond prices go lower).

Yesterday’s disappointing 20-year Treasury auction created a selloff in bonds, particularly in longer duration bonds like 10-, 20-, and 30-year Treasuries.

Don’t stop reading! I know bonds can be a little dry, so that’s as complicated as I’ll get with them.

Yesterday’s combination of a bond selloff and a multi-month high in yields pushed stocks lower. But stocks have done really well lately, with the S&P 500 still up more than 20% from its April low. Further, coming into this week, the index had rallied in four consecutive weeks as well (and in five of the last six).

The Bottom Line: Stocks were due for a pause and the bond auction was the justification that investors needed for markets to take a breather. For technical investors, keep an eye on the 200-day moving average in the indices, and for the QQQ, here’s a reminder of potential support.

Want to receive these insights straight to your inbox?

Sign up here

The Setup — T-Mobile

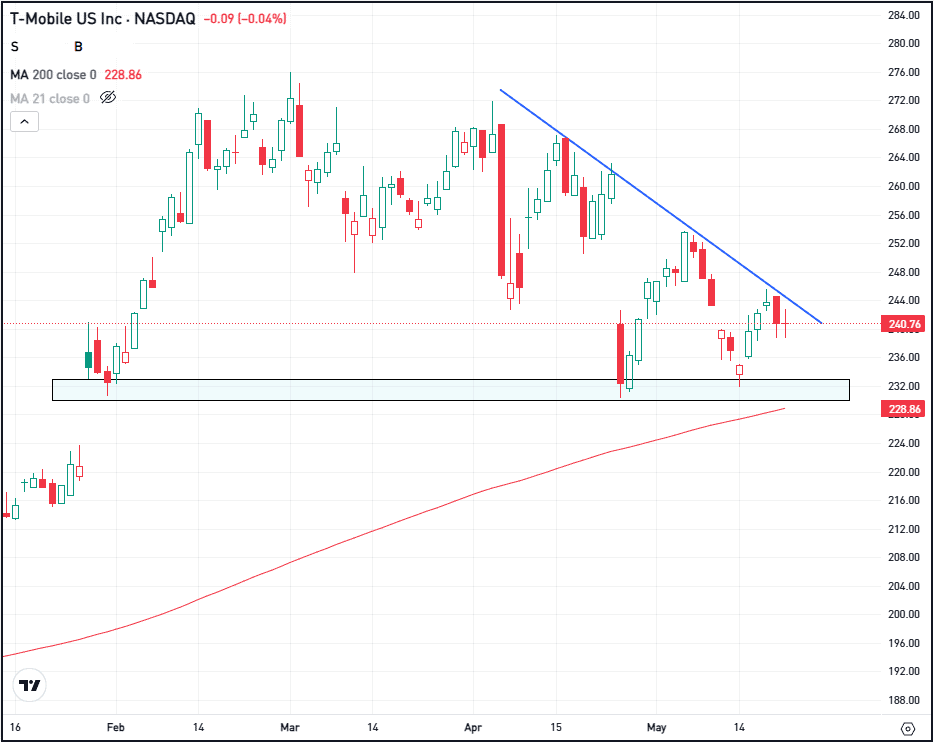

Shares of T-Mobile rallied over 35% last year, then ran to new all-time highs in late February while the overall market was under pressure due to tariff worries. After a lot of sideways action, shares dipped on earnings in mid-April, but found support in low $230s.

Some investors will bemoan the stock’s negative reaction to earnings, but others may argue that it helped set up a stronger potential technical situation.

The stock has continued to find support around the $230 mark, an area that the 200-day moving average is now approaching. If TMUS dips to this level, bulls might consider it a buy-the-dip opportunity — as long as support holds.

On the flip side, there’s also a downtrend resistance line (drawn in blue), which is noticeable by the stock’s series of lower highs. If TMUS can break out over this measure, it could trigger more upside momentum.

Of course, investors should be open to the idea that T-Mobile shares continue to pull back, fail to hold support, and then continue to trade lower, too.

Options

If TMUS is going to remain in an uptrend, bulls will want to see these measures hold as support.

For options traders, calls or bull call spreads could be one way to speculate on support holding on a pullback. In this scenario, buyers of calls or call spreads limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is Watching

SNOW

Shares of Snowflake are climbing in pre-market trading, up roughly 10% after the firm delivered an earnings and revenue beat. Investors are cheering the company’s steady full-year guide, while bulls are hoping today’s gains hold and shares are able to clear the current 52-week high near $193. Check out the charts for SNOW.

BTC

Yesterday we talked about Bitcoin quietly nearing its record highs, then a few hours later, it went on to set new all-time highs. Although Bitcoin quickly retreated after the new milestone, it rallied again as bulls are enjoying more new highs this morning.

AAP

Shares of Advanced Auto Parts are surging this morning, with shares up more than 30% at one point in pre-market trading. The rally comes after the firm reported better-than-expected earnings, while management reaffirmed its full-year outlook.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.