Strategy has launched a $2.1 billion At-The-Market (ATM) equity program for its Strife (STRF) preferred stock, marking another step in the firm’s long-term strategy to build a Bitcoin-backed financial architecture.

The announcement was made by CEO and President Phong Lee during an investor update alongside Executive Chairman Michael Saylor. According to Lee, strong year-to-date results from the firm’s Bitcoin-linked securities Strike (STRK) and Strife (STRF) gave Strategy the confidence to expand its fundraising strategy.

“We’re currently at 16.3% BTC yield for the year, against a 25% target,” Lee said. “BTC dollar gain is $7.7 billion so far, on track toward our $15 billion target.”

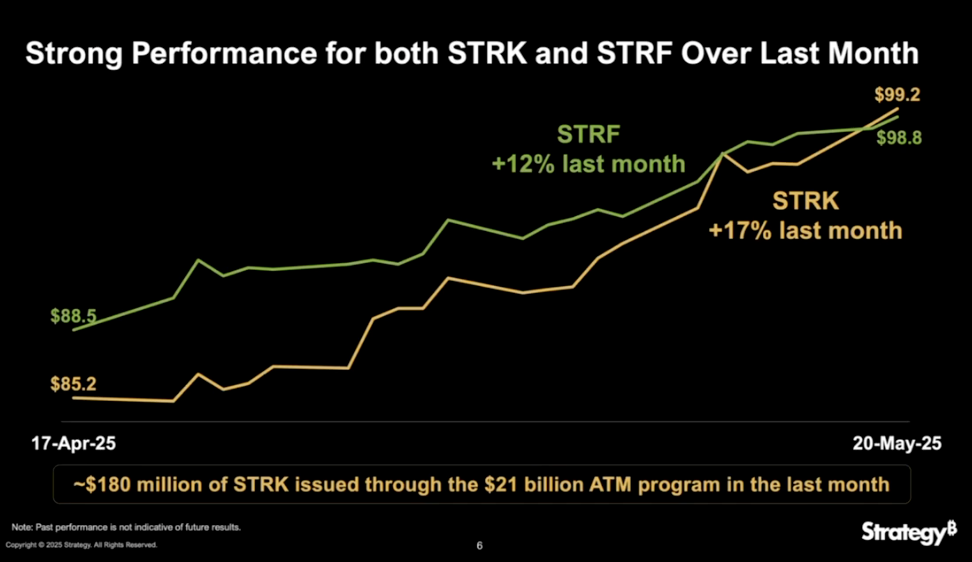

Both instruments have outperformed expectations since launch. Strike is up 24% from its initial price of $80 to nearly $100. Strife, which was priced at $85 just two months ago, now trades around $98.80, a 16% increase. By comparison, similarly structured preferreds in the market have declined by 3–5% over the same period.

In the last 30 days alone, Strike rose 17% and Strife 12%, bringing both close to par value. Lee emphasized the liquidity profile of these instruments, citing average daily trading volumes of $31 million for Strike and $23 million for Strife. “That’s 60x what we typically see in comparable preferreds,” he noted.

The company previously issued $212 million through Strike’s ATM, with no adverse pricing pressure. Based on the trading volume and investor demand, Lee said the company believes the $2.1 billion Strife ATM can be executed in a similar fashion.

Strife is a perpetual preferred stock with a 10% coupon and sits at the top of Strategy’s capital stack. Saylor described it as “the crown jewel” of the company’s preferred offerings. “We’re going to be ten times as careful with Strife,” he said. “Our goal is for it to be seen as investment-grade fixed income — a high-quality instrument with robust protections.”

Strike, by contrast, is positioned for what Saylor called “Bitcoin-curious” investors. It carries an 8% coupon and includes upside through Bitcoin conversion. “Think of it like a Bitcoin fellowship with a stipend,” Saylor said.

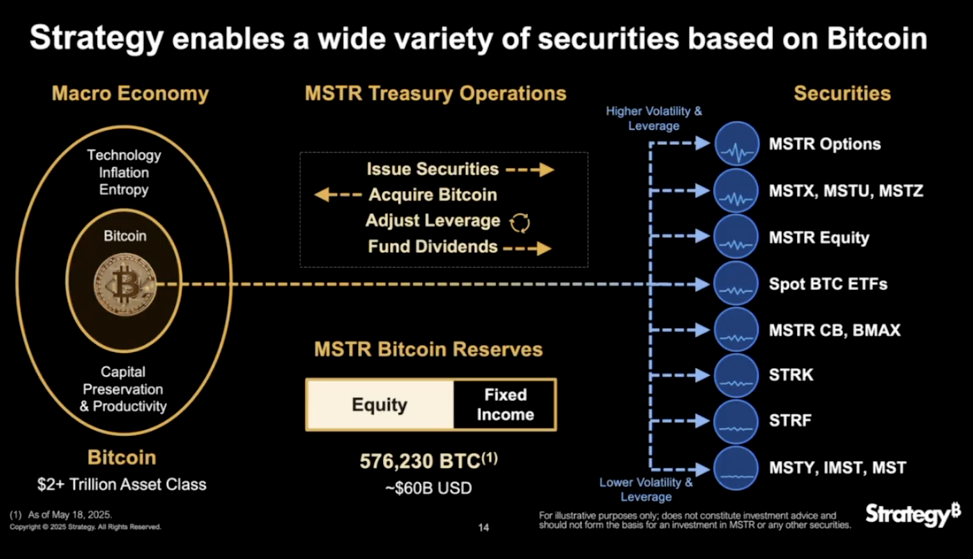

Strategy now operates three ATM programs: $21 billion each for MSTR equity and Strike, and $2.1 billion for Strife. These are rebalanced daily, with issuance adjusted based on market conditions, volatility, and investor demand. According to Saylor, this dynamic structure allows the company to optimize Bitcoin acquisition and capital deployment across changing market environments.

Behind this strategy sits Strategy’s Bitcoin treasury, now totaling 576,230 BTC — roughly $60 billion in value. “That permanent capital is the foundation for everything we’re building,” Saylor said.

While spot Bitcoin ETFs cater to investors looking for direct price exposure, Strategy continues to offer a more nuanced set of instruments — each targeting different levels of risk, return, and compliance. The Strife ATM is the latest move in that broader strategy.