By Lale Akoner

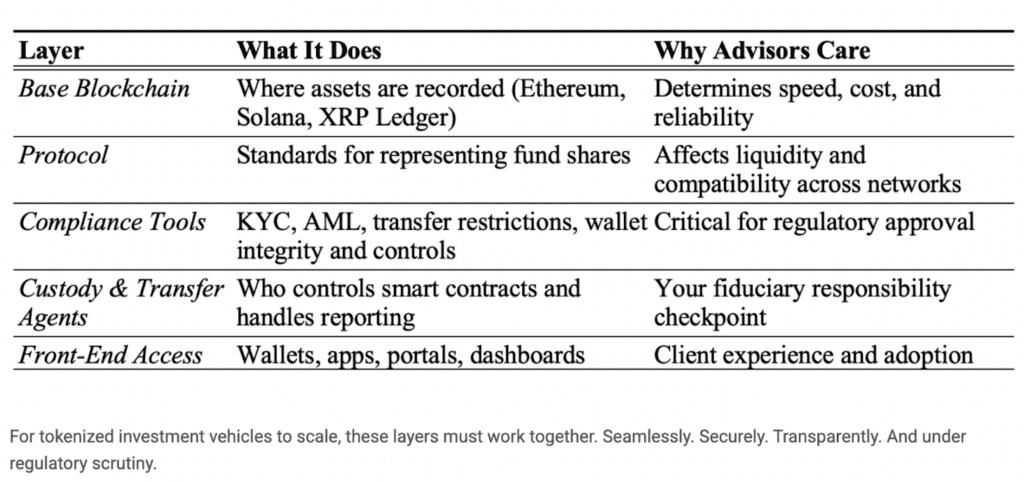

When it comes to investing in tokenized assets, there are five key layers working behind the scenes to make the system secure, fast, and easy to use. The base blockchain (like Ethereum or Solana) is where assets are stored: it affects how fast and affordable transactions are. The protocol layer sets the rules for how digital funds are created and traded. Compliance tools handle things like ID checks and fraud prevention, helping platforms stay legal and safe. Custody and transfer agents manage who holds your assets and how they’re reported, key for protecting your investments. Finally, the front-end access, like apps and dashboards, is what you actually see and use to manage your investments. When all five layers work well together, you get a smooth, secure, and trustworthy investing experience.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.