The US Securities and Exchange Commission (SEC) has acknowledged a Nasdaq filing proposing an amendment to BlackRock iShares Ethereum Trust (ETHA). This proposal seeks to enable the ETF to stake its Ethereum holdings, allowing it to participate in the ETH proof-of-stake consensus mechanism and potentially earn staking rewards.

What Happens When Institutional Staking Goes Mainstream?

BlackRock just received regulatory acknowledgment to include staking in its Spot Ethereum ETF. As mentioned by Çağrı Yaşar on X, acknowledging the filing isn’t a minor regulatory checkbox. It’s the US Securities and Exchange Commission (SEC) handing institutions a key, and not just to ETH price action, but to its engine.

Related Reading

This staking isn’t about price speculation. It’s about alignment, incentives, governance, and yield. Unlike traditional asset holding, staking involves actively securing the network by validating transactions and supporting ETH’s consensus.

With recent regulatory approvals allowing BlackRock and other institutions to include staking in Spot ETH ETFs, this will enable Wall Street to hold ETH as a speculative asset. Thus, they can begin earning from the yield generated by the ETH core protocol mechanics, and integrate deeply into the network infrastructure.

However, if ETH staking becomes ETF-native, it will redefine what it means to invest in a financial network. ETH would become the first global-scale digital infrastructure where traditional capital markets not only invest, but they become active participants in the protocol. The SEC has effectively validated ETH’s consensus model as not only secure but worthy of institutional involvement.

This is how empires shift, and not with headlines, but with details no one expected. This highlights that major shifts in power or systems don’t always announce themselves loudly. Instead, they often happen quietly, through small regulatory changes.

ETH isn’t becoming Wall Street-friendly. Wall Street is becoming ETH-compatible. This is when a new technology enters mainstream finance, and people assume it’s being reshaped to fit traditional systems. Furthermore, Yaşar noted that the network effect has just turned financial. This means that the value of a network grows as more participants join.

Why Institutions Are Backing Protocol Infrastructure

In an X post, VirtualBacon stated that BlackRock and JPMorgan aren’t investing in Ethereum for speculative hype or short-term price gains. Instead, their focus lies on ETH’s growing role as a foundational platform for real-world asset (RWA) tokenization and stablecoin infrastructure.

Related Reading

Larry Fink, the CEO of BlackRock, has been unequivocal about his vision for ETH’s future, stating that he aims to tokenize stocks and build investment funds directly on the ETH blockchain. This marks a significant institutional endorsement of ETH as a platform for next-generation finance.

Meanwhile, Jamie Dimon of JPMorgan has softened his previously cautious stance on cryptocurrencies, especially following recent regulatory clarity provided by initiatives under the GENIUS Act. This shift signals growing openness among traditional financial leaders to integrate blockchain technology into mainstream finance.

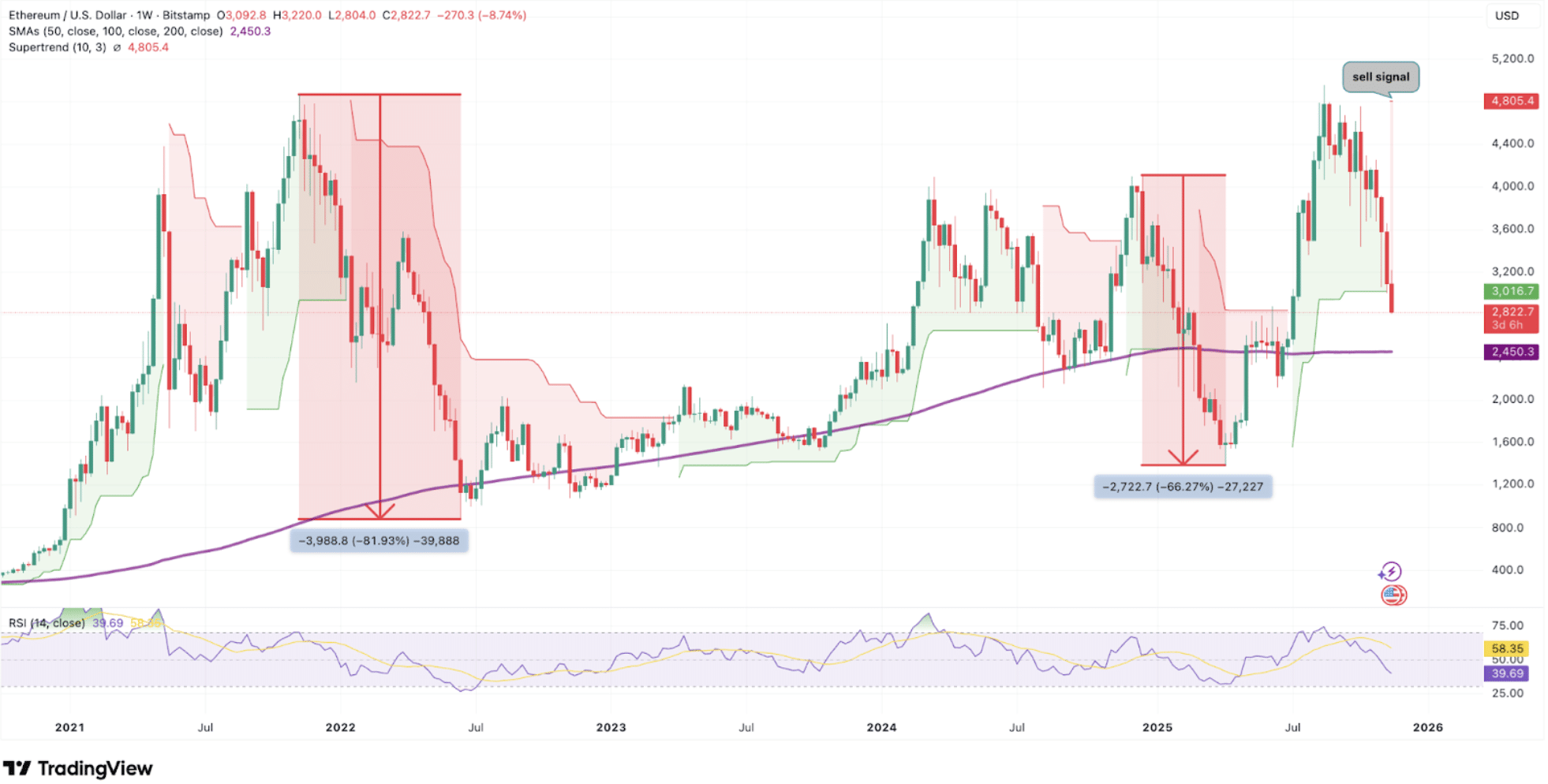

Featured image from iStock images, chart from tradingview.com