Microsoft and Meta crushed their earnings expectations, while Bitcoin consolidates its run to record highs. The Daily Breakdown dives in.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Thursday’s TLDR

- META, MSFT beat earnings

- PANW buys CYBR

- BTC bulls look for next move

What’s Happening?

This week features four Magnificent 7 stocks reporting earnings. Two reported last night, and two more — Apple and Amazon — are set to report this afternoon. For its part, Amazon is already trading higher, up about 3% in the pre-market, helped by strong results from Meta and Microsoft.

Microsoft posted earnings of $3.65 a share and revenue of $76.4 billion, beating estimates of $3.37 a share and $73.9 billion, respectively. Azure revenue grew 39% in constant currency, topping the 34% consensus and pushing annual Azure revenue past $75 billion.

Meta stock is jumping more than 10% in pre-market trading after earnings of $7.14 a share blew past expectations of $5.88, while revenue of $47.5 billion topped estimates of $44.8 billion. Even better? Management’s third-quarter revenue outlook of $47.5 billion to $50.5 billion was well above consensus, which called for $46.2 billion.

Key Takeaways

First, Alphabet, Microsoft, and now Meta have all reported strong growth. The read-through is positive not only for other cloud companies — like Amazon — but for the broader tech sector.

Second, like Alphabet, both Microsoft and Meta emphasized aggressive CapEx plans as they continue building AI infrastructure. That’s more good news for chip stocks, which is why names like Advanced Micro Devices, Nvidia, and others are rallying this morning.

Want to receive these insights straight to your inbox?

Sign up here

The Setup — BTC

We started this month by looking at Bitcoin and we’ll end this month by doing the same thing. Coming into the quarter, bulls wanted to know if Bitcoin and crypto could lead the way for risk-on assets. The ensuing rallies within the crypto space — including in Ethereum, Stellar, Ripple, and even Pudgy Penguins — showed just that, as crypto surged higher.

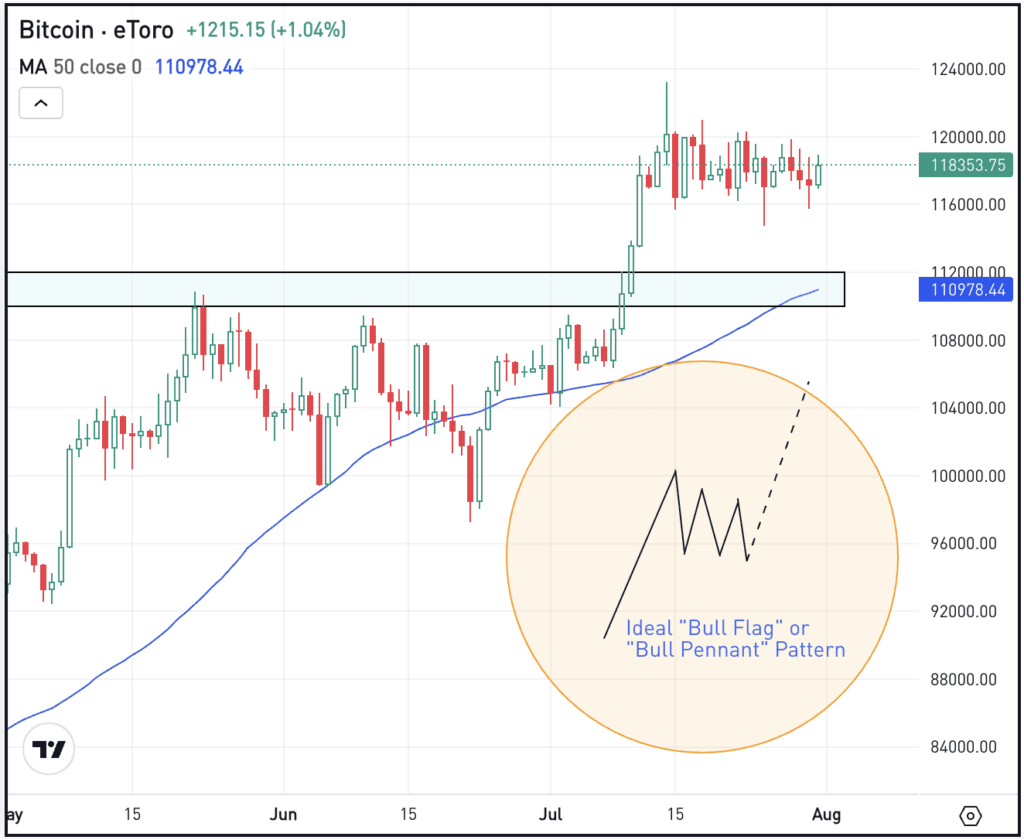

Bitcoin broke out early in the month, surging from around $107,500 to more than $123,000 as it rallied in 6 out of 7 trading sessions. Since then, it’s been consolidating, with buyers emerging in the $115K to $116K range and sellers putting a lid on BTC around $120K.

It’s a very tight, very narrow range — especially for an asset that hasn’t been shy around volatility. Bulls are looking at this constructively, viewing this consolidation after the breakout as healthy price action. Ideally, they’ll want to see BTC push through $120K resistance and make new highs above $123K as it begins a new trend higher.

On the downside, they want to see support come from the breakout area around $110K to $112K, which was prior resistance.

Options & ETFs

For investors who can’t trade or aren’t comfortable trading cryptocurrencies outright, they can consider ETFs for BTC and ETH. On the BTC front, IBIT remains the largest ETF by assets, while also supporting options trading.

Bulls can utilize calls or call spreads to speculate on upside, while bears can use puts or puts spread to speculate on downside. In either case, investors may consider using adequate time until expiration.

For what it’s worth, the September $60 puts, then the September $60 calls, had the highest open interest for IBIT as of July 30th.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

CYBR

Shares of Cyberark are up roughly 15% so far this week on news that Palo Alto Networks will acquire the company for $25 billion in a cash and stock deal. The company will pay $45 a share plus 2.2005 shares of PANW stock for each share of CYBR. The deal implies a 26% premium for Cyberark. Analysts currently have a consensus price target of ~$217 for PANW. Check it out.

SPY

Lost in the shuffle here is yesterday’s Fed meeting. The Fed did not cut interest rates and Chair Powell remained tight-lipped about a rate cut in September. Market odds have now shifted away from a rate cut at the next meeting, but the Fed will remain data dependent as several labor and inflation reports will drop between now and then — including today and tomorrow.

CVNA

Carvana stock is jumping in pre-market trading, up more than 15% after the company beat on earnings and revenue expectations as sales jumped 42% year over year. Shares of Carvana were up 64% as of yesterday’s close as bulls look to add to those gains. Check out the chart for CVNA.

We’ve updated our Privacy Policy

Our Privacy Policy has recently been updated. You can view the latest version and related notices anytime in the eToro Privacy Section on our website.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.