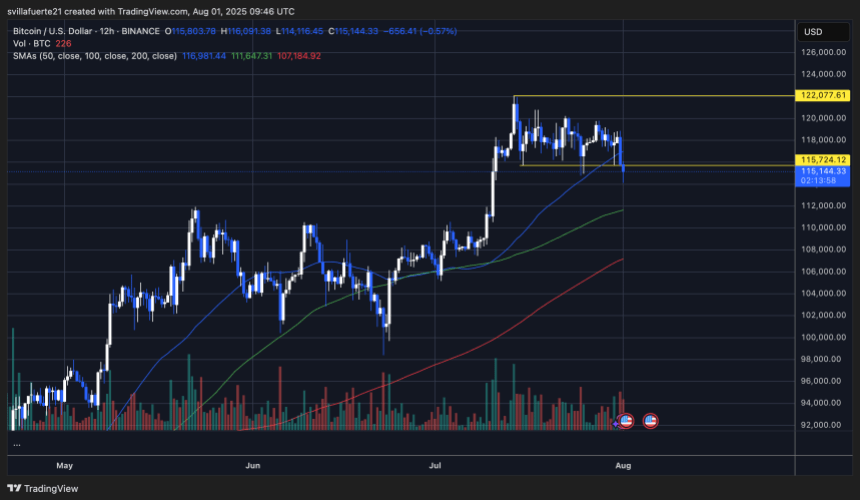

Bitcoin has broken down from the two-week consolidation range that held the market between $115,724 and $122,077, reaching a new local low near $114,000. The drop confirms a shift in short-term momentum, putting bulls on the defensive. The $117,000 level—previously a key support zone—now serves as the immediate resistance that must be reclaimed to signal a possible reversal.

Related Reading

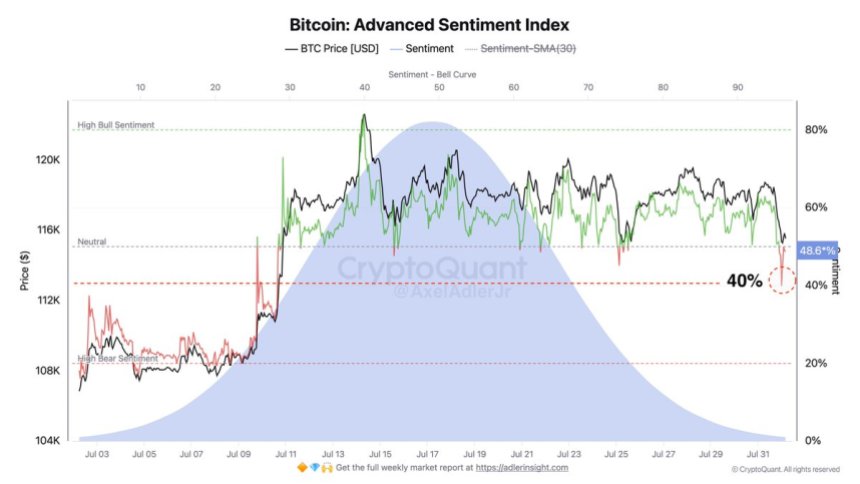

The breakdown comes at a critical time, as sentiment across the market begins to shift. According to fresh data from CryptoQuant, futures sentiment turned bearish today, falling sharply before bouncing back slightly to 48%. While still close to neutral, any reading below 50% signals bearish dominance in positioning. This adds pressure to an already fragile technical structure and suggests traders are bracing for more downside.

Unless bulls can recover $117K quickly and close with strength, Bitcoin risks entering a deeper correction phase. With long-term support levels still intact, the broader bull trend remains in place—but this breakdown marks the first significant loss of momentum in weeks. The coming sessions will be critical in determining whether this is just a shakeout or the start of a larger trend reversal.

Bitcoin Advanced Sentiment Index Signals Rising Bearish Pressure

Top analyst Axel Adler has shared new insights into the Bitcoin Advanced Sentiment Index, a key metric used to gauge futures market positioning and broader investor mood. According to Adler, the index recently dropped to 40%—a sharp decline that reflected growing risk aversion and bearish positioning. Although the metric has since rebounded to 48%, it remains below the critical 50% threshold, which separates bullish from bearish territory.

This rebound signals a temporary pause in negative sentiment, but the broader trend shows a shift from bullish caution to bearish fear. Adler notes that as long as the index remains below 50%, the market lacks the confidence needed to sustain upward momentum. Traders are growing increasingly defensive, reducing long exposure and bracing for further downside.

If momentum continues to deteriorate, BTC could test the $112,000 level—the previous all-time high set in May. This zone may act as psychological and technical support, but failure to hold it could trigger a deeper correction.

With the Advanced Sentiment Index stuck in bearish territory and price action weakening, the market appears to be entering a riskier phase. While this doesn’t yet signal a full trend reversal, it does reflect growing uncertainty. Until sentiment and price reclaim higher ground, caution is warranted. The next move will likely depend on whether bulls can defend $112K—or if bears gain full control of the trend.

Related Reading

BTC Loses Key Support After Breakdown

Bitcoin has officially broken down from its two-week consolidation range, losing the critical $115,724 support level highlighted in the chart. The price reached a new local low at $114,116 before recovering slightly to the $115,100 zone, where it’s currently attempting to find footing. This marks a significant shift in momentum, as bulls failed to defend the lower boundary of the range, which held firm throughout July.

The 12-hour chart shows rising volume accompanying this breakdown, adding weight to the bearish move. BTC now trades below the 50-day SMA ($116,981), confirming weakness in short-term structure. The next major support sits around $112,000—the prior all-time high set in May—which could act as a psychological and technical floor.

Related Reading

The 100-day and 200-day SMAs remain well below current price action, suggesting that the macro trend is still intact. However, immediate momentum has clearly shifted, and bulls must reclaim the $117,000 area quickly to invalidate this breakdown.

Featured image from Dall-E, chart from TradingView