Bitcoin is trading at a decisive level after surging to fresh all-time highs, touching $124,000 before pulling back. Bulls remain in control, but the market now shows signs of hesitation, with BTC struggling to confirm momentum above $120,000. This price action reflects indecision among traders as the market balances profit-taking with renewed accumulation.

Related Reading

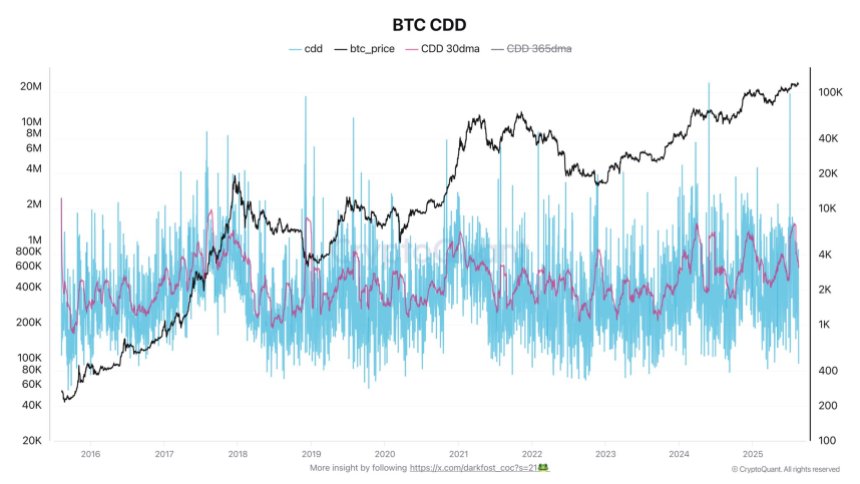

On-chain data highlights a key shift in dynamics. After a sharp increase in the 30-day average Coin Days Destroyed (CDD) — a metric often used to track long-term holder activity and selling pressure — the indicator has now dropped significantly. This decline suggests that selling pressure from older coins has eased, even after recent profit-taking.

For investors, the message is clear: while Bitcoin remains in a powerful uptrend, the inability to stay firmly above $120K highlights a critical juncture. If selling pressure continues to ease, BTC could consolidate and prepare for another breakout attempt. However, failure to hold these levels may embolden bears who are already speculating on a potential top. The coming sessions will be pivotal in defining Bitcoin’s next move.

Bitcoin Selling Pressure Eases As CDD Drops

According to top analyst Darkfost, the Coin Days Destroyed (CDD) indicator remains one of the most reliable tools for gauging selling pressure, particularly from long-term holders (LTHs). The metric measures how long a Bitcoin has been held before being moved, essentially combining both volume and coin age. In most cases, older BTC are moved in preparation for selling, making CDD spikes a strong indicator of distribution phases in the market.

On July 23rd, the 30-day moving average of CDD surged to its highest level of this cycle, reaching nearly 1.35 million. This suggested that a significant amount of long-held Bitcoin was moved — and likely sold — as investors looked to lock in profits at or near record prices. Despite this wave of selling, however, Bitcoin’s price action has held up remarkably well, signaling robust demand and the ability of the market to absorb supply without major breakdowns.

Since late July, this selling pressure has notably eased. The 30-dma CDD has been steadily declining throughout August, indicating fewer older coins are hitting the market. This trend highlights renewed stability and suggests accumulation is regaining dominance over distribution.

For Bitcoin’s broader outlook, the decline in CDD is a bullish signal. It shows that despite profit-taking, strong demand underpins current price levels, allowing BTC to consolidate near highs. If this trend continues, the groundwork may be laid for another leg higher in the ongoing bull cycle.

Related Reading

Price Analysis: Testing Key Support Level

Bitcoin is consolidating just below its recent all-time high, with the chart showing clear resistance at $123,217. After briefly touching the $124K region, BTC retraced and is now trading around $117,497, sitting on top of key moving averages. The 50-day SMA (~$117,337) is acting as immediate short-term support, while the 100-day SMA (~$115,366) provides an additional safety net for bulls. The 200-day SMA (~$110,551) remains far below, reflecting the strong momentum of the current uptrend.

The structure suggests indecision, with buyers defending support but failing to break above the $123K–$124K zone. A clean breakout above this level could open the path toward $130K and beyond, confirming continuation of the bull run. Conversely, a breakdown below $115K would signal weakness and expose BTC to deeper retracements.

Related Reading

Momentum indicators suggest consolidation, not distribution, which aligns with the broader narrative of long-term holders selling into strength while new buyers step in. This healthy churn has allowed Bitcoin to sustain high levels without collapsing, a sign of structural resilience.

Featured image from Dall-E, chart from TradingView