Larry Fink, CEO of BlackRock, turned one of the world’s leading financial institutions into a crypto powerhouse. What Michael Saylor and (Micro)Strategy did for Bitcoin treasuries, Fink did for ETFs:

- BlackRock’s $IBIT leads Bitcoin ETF offerings with a market cap of ~$87B

- On the Ethereum side, $ETHA – also from BlackRock – leads the market with $14B market cap

Two blue-chip crypto ETFs, two winners for Fink’s BlackRock.

And now that Fink has been appointed as interim co-chair of the World Economic Forum (WEF) – serving alongside Roche’s André Hoffmann – what’s next? Will the WEF take a more explicitly pro-crypto stance? And if so, which are the cryptos best-positioned for explosive growth?

Fink Appointed as Schwab Exits, Could Signal New Direction

Fink’s appointment arrives just as WEF closed an internal investigation that found no material wrongdoing by founder Klaus Schwab. The WEF framed the move as part of a reset to ‘strengthen the organization.’

For their part, Fink and Hoffmann emphasized revitalizing public-private cooperation in a ‘fragmented’ world.

The Forum has an opportunity to help drive international collaboration in a way that not only generates prosperity but distributes it more broadly. This renewed vision can promote open markets and national priorities side by side, while advancing the interests of workers and stakeholders globally.

—Fink and Hoffman, Statement from Interim Co-Chairs of WEF

For crypto, the headline isn’t just who chairs WEF – it’s that the leading gatekeeper of institutional crypto exposure now has a formal hand on one of the world’s most influential finance convening platforms.

BlackRock ETFs a De-Facto On-Ramp for Crypto

Because BlackRock dominates spot crypto ETFs with iShares Bitcoin Trust ($IBIT) and the iShares Ethereum Trust ($ETHA), it controls real, regulated pipes through which pensions, RIAs, corporates and sovereigns can touch $BTC and $ETH at size.

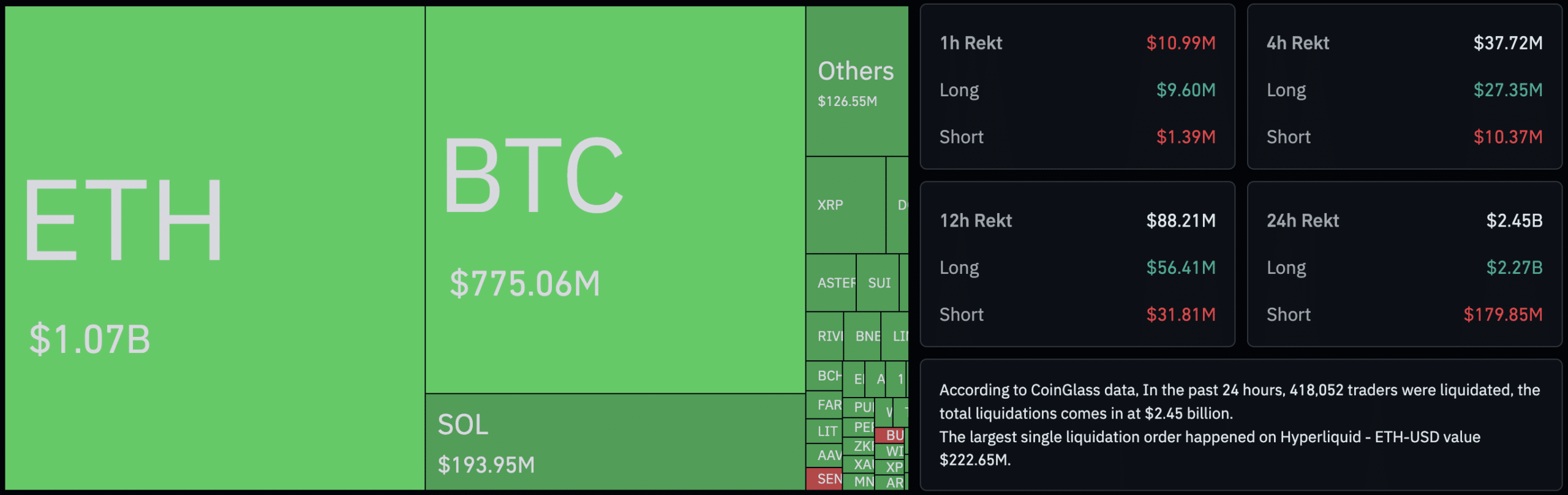

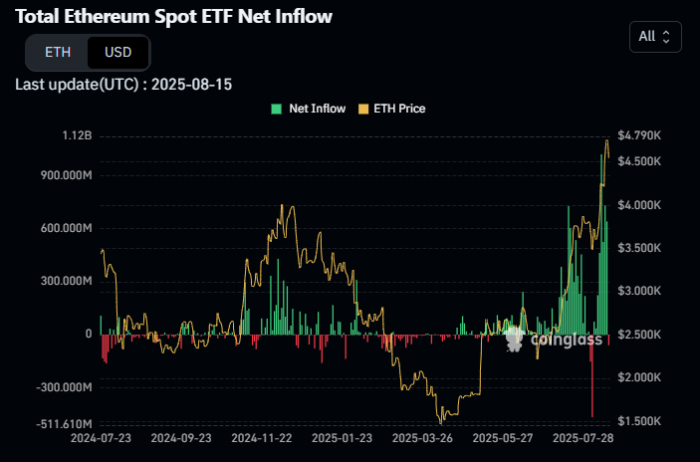

Just last week, Ether ETFs saw record single-day inflows (topping $1.02B), with BlackRock’s ETHA capturing $640M in one session.

Earlier this summer, IBIT’s held coins crossed 700K BTC, further illustrating its market heft.

Beyond ETFs, BlackRock put tokenization on the map for TradFi.

Its $BUIDL fund – tokenized U.S. dollar liquidity issued on Ethereum – launched in March 2024, surpassed $1B AUM by March 2025, and later expanded share classes across multiple chains.

$BUIDL forms a practical bridge between on-chain finance and institutional balance sheets. Crucially, WEF already runs programs that touch digital assets, like the Digital Currency Governance Consortium (DCGC), and the Crypto Sustainability Coalition. The programs launched between 2021-2022, but have fallen quiet in recent days.

With Fink at the table, expect tokenization, ETF-based access, and sustainability narratives to feature more prominently, and for those earlier efforts to perhaps roar back to life.

What’s the likely outcome? Probably not a single policy edict – Fink spoke in only general terms in his statement – but a faster convergence around best practices for custody, market data, disclosures, and interoperability.

Those are all areas where BlackRock possesses both operating experience and great success, and which can translate into global templates.

And with Fink at the helm of the WEF, look for these three projects to quickly become some of the best crypto to buy.

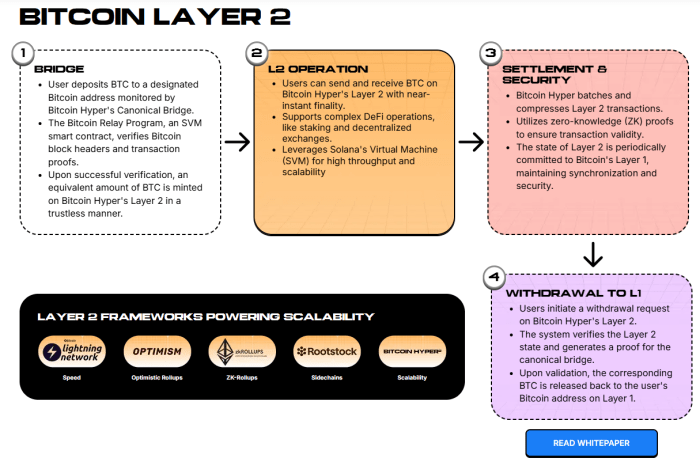

1. Bitcoin Hyper ($HYPER) – Innovative, Faster-Than-Ever Bitcoin Layer 2

Bitcoin Hyper ($HYPER) delivers a faster-than-ever Bitcoin experience. How? By combining Bitcoin’s original Layer 1 with the Solana Virtual Machine (SVM).

The result is a lightning-fast Layer 2 that leverages the SVM’s transaction speeds and smart contract execution – but keeps final transaction settlement on Bitcoin.

When it comes to Bitcoin itself, $BTC tokens are deposited into the Bitcoin Canonical Bridge and emerge on the Hyper Layer 2 as wrapped $BTC. There, your $BTC can be staked, deployed in liquidity pools, used in DeFi operations, and more as the case may be.

Learn how to buy Bitcoin Hyper in our guide, and don’t miss out on our Bitcoin Hyper price prediction; we think $HYPER could reach $0.32 by the end of the year, up 2,415% from its current $0.012745. The presale is already well over $10.3M raised.

Visit the Bitcoin Hyper presale page to learn more.

2. Best Wallet Token ($BEST) – The Best Crypto Presale Wallet Offers Higher Staking Rewards, Lower Fees with $BEST

Web3 wallets are rapidly becoming far more than simply places to store your crypto; they’re the gateways to a whole new world of DeFi and crypto tools.

And non-custodial wallets – where you control your own private keys – are critical, as a new wave of crypto users learns the truth of one of crypto’s founding principles:

‘Not your keys, not your crypto.’

Best Wallet is a non-custodial wallet with some truly innovative features. In addition to swapping, sending, and storing your crypto, Best Wallet users can access and purchase promising top presales.

Find whitepapers and tokenomics, browse new meme coins, and purchase tokens – all from within Best Wallet.

And the $BEST token is key of this growing Best Wallet economy. Hold $BEST and gain lower trading fees and better staking rewards within Best Wallet.

During the presale, you can stake $BEST for an additional 90% APY — learn how to buy $BEST here.

What is $BEST, if not the best utility token for the Best Wallet? Our price prediction is also bullish, seeing a chance for the token to reach $0.072 by the end of 2025, up 182% from its current level of $0.025495.

Check out the Best Wallet Token presale now.

3. Chainlink ($LINK) – Oracles and Asset Tokenization Drive Chainlink Utility

The crypto ecosystem is, as Fink pointed out, fragmented. Chainlink ($LINK) helps bind it together. Blockchain oracles feed real-world-data into the blockchain, allowing smart contracts to execute correctly based on price points, timestamps, and more.

But Chainlink has grown beyond a simple oracle network. It’s a web that binds blockchains and TradFi together. It also secures data, offers cross-chain interoperability and decentralized computations to enable finance to operate on-chain, and blockchains to access financial networks.

Chainlink notable partners include:

- Swift

- Euroclear

- Mastercard

- Fidelity

On the token side, $LINK is the network’s utility token. Revenue from on-chain and off-chain operations has provided a hefty reserve:

$LINK’s performance has been impressive as well, up 143% in the past year.

Will Fink Effect Real Change at WEF?

Implementing fundamental changes to the world economic order requires far more than simply an interim head of the WEF. Real change will still flow through the SEC, ESMA, FCA, MAS, and countless other agencies.

But Fink’s appointment, combined with IBIT/ETHA’s scale, record ETF flows, and BlackRock’s tokenization push, could make him nudge the global conversation toward treating crypto as core market infrastructure, instead of a side bet.

If that happens, look for $LINK (oracle networks), $BEST (non-custodial wallet token), and $HYPER (cutting-edge Bitcoin Layer 2) to be among the next crypto to explode.

Do your own research, of course; this isn’t financial advice.

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.