Bitcoin has recently set new all-time highs, yet many of the leading Bitcoin treasury companies have been underperforming significantly. Despite Bitcoin itself recently pushing well above $120,000, the share prices of firms such as (Micro)Strategy remain far from their peaks. Are these companies likely to see a sustained recovery, or has their period of outperformance already passed?

Bitcoin Treasury Companies: Massive BTC Holdings in 2025

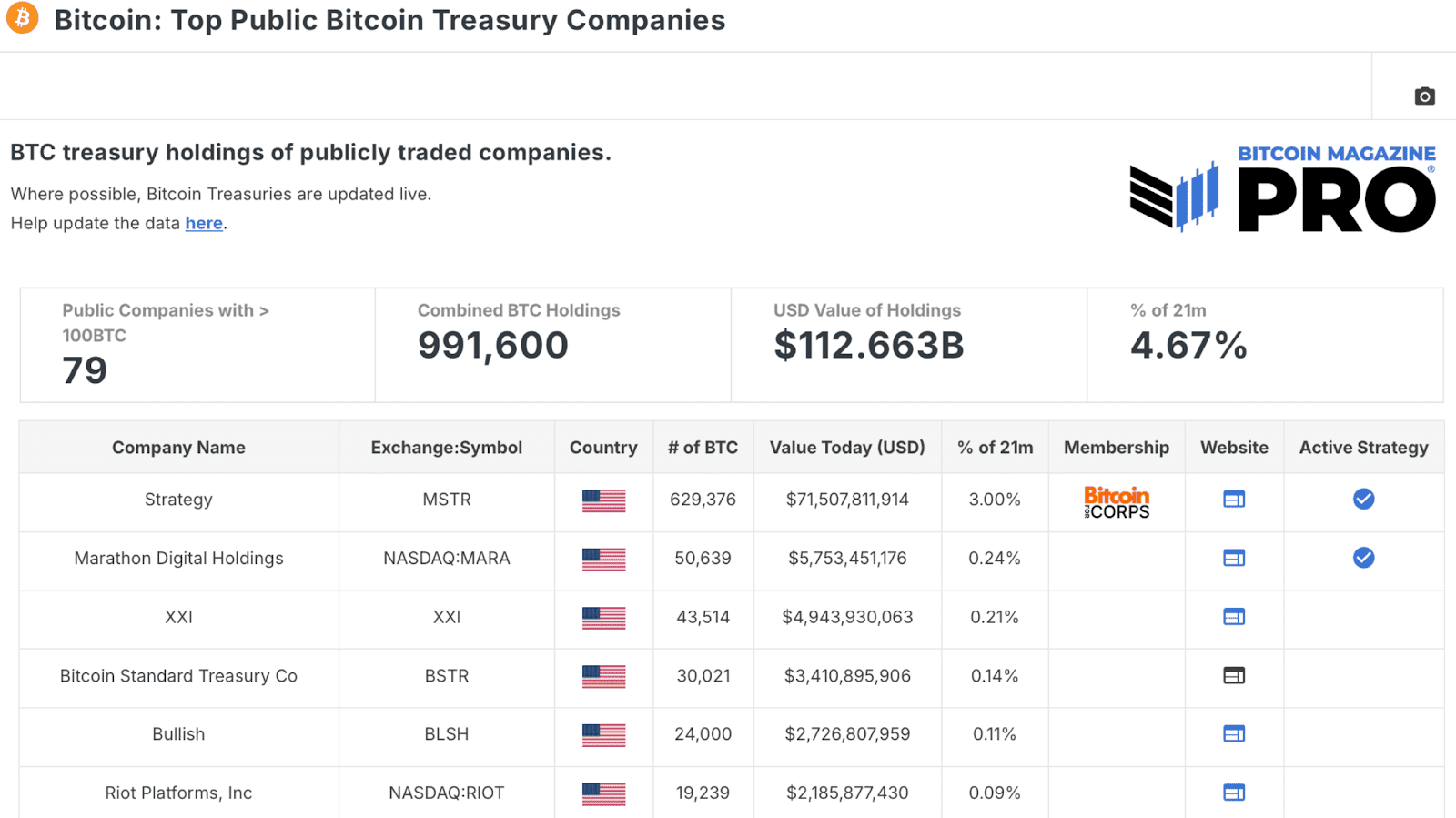

Examining the table of Top Public Bitcoin Treasury Companies reveals a total of 79 public companies hold at least 100 BTC, amounting to almost a million Bitcoin, valued at over $110 billion. A monumental amount, considering a majority of these companies only started accumulating in the past couple of years!

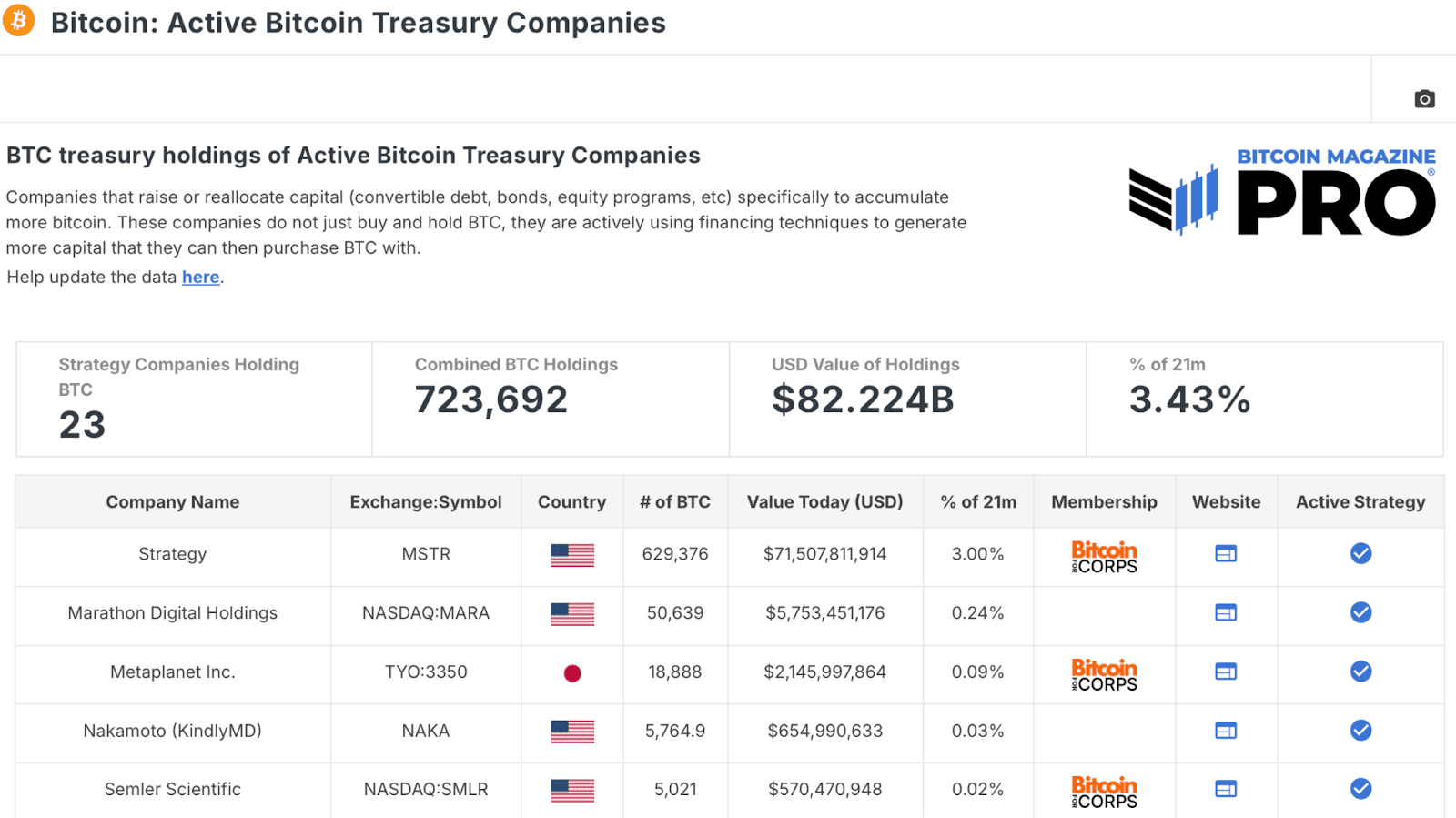

Of these, twenty-three companies are Active Bitcoin Treasury Companies, those that are actively using financing techniques to generate more capital for BTC accumulation, holding a combined 723,000 BTC and growing rapidly. Unsurprisingly, (Micro)Strategy dominates this group with the largest allocation of close to 630,000 BTC.

This massive level of institutional accumulation highlights the growing importance of Bitcoin on corporate balance sheets. Still, investors have begun to question whether the once-explosive stock performance of these companies can continue.

Why Bitcoin Treasury Companies Are Underperforming in 2025

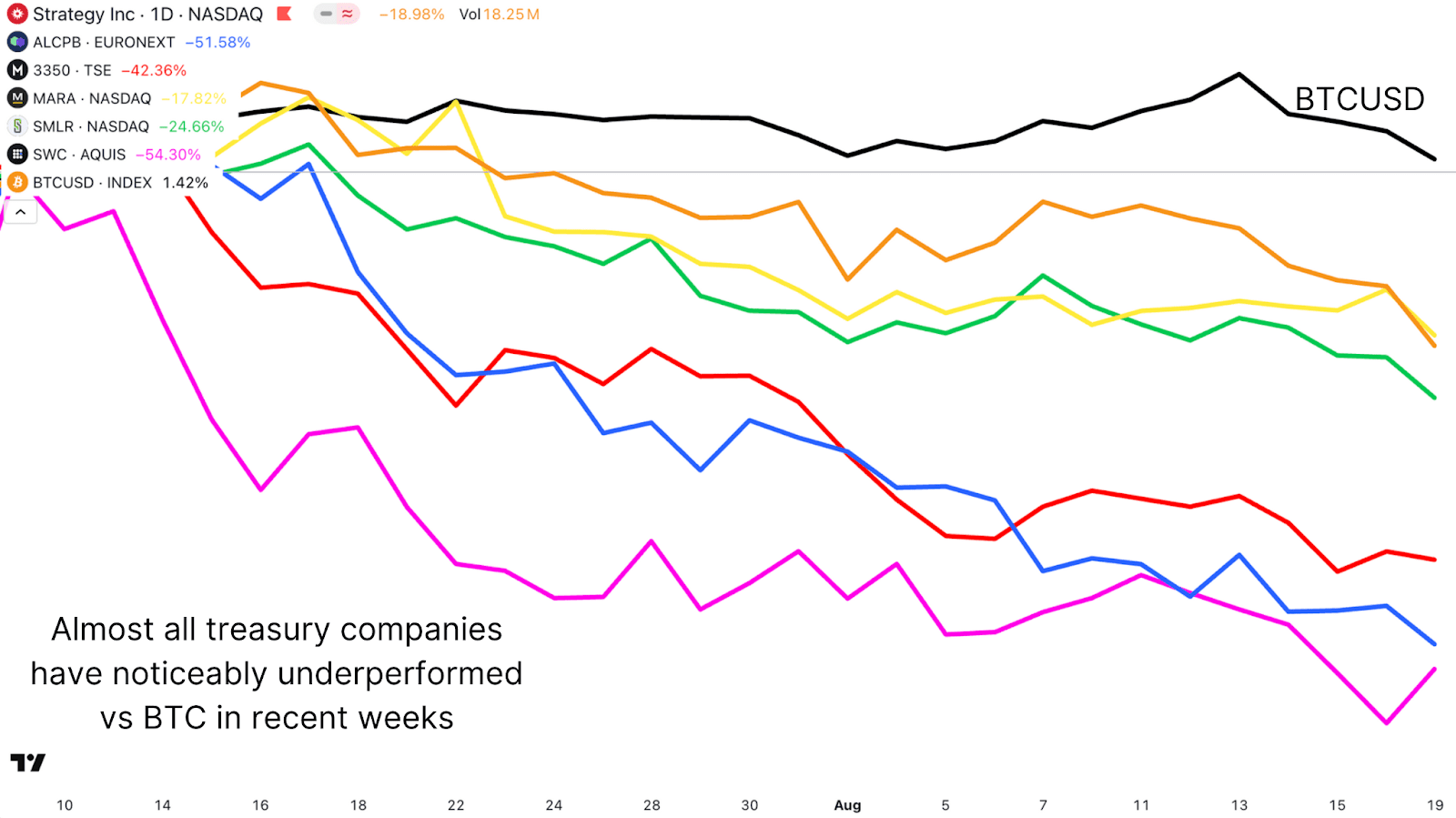

(Micro)Strategy has been the flagship Bitcoin treasury company, but its stock price has not reflected Bitcoin’s strength in recent months. While BTC surged past $124,000 before its recent retracement, MSTR’s share price has languished to as low as $330 recently, well below its $543 highs. In recent weeks, almost all of these treasury companies have significantly underperformed in comparison to Bitcoin.

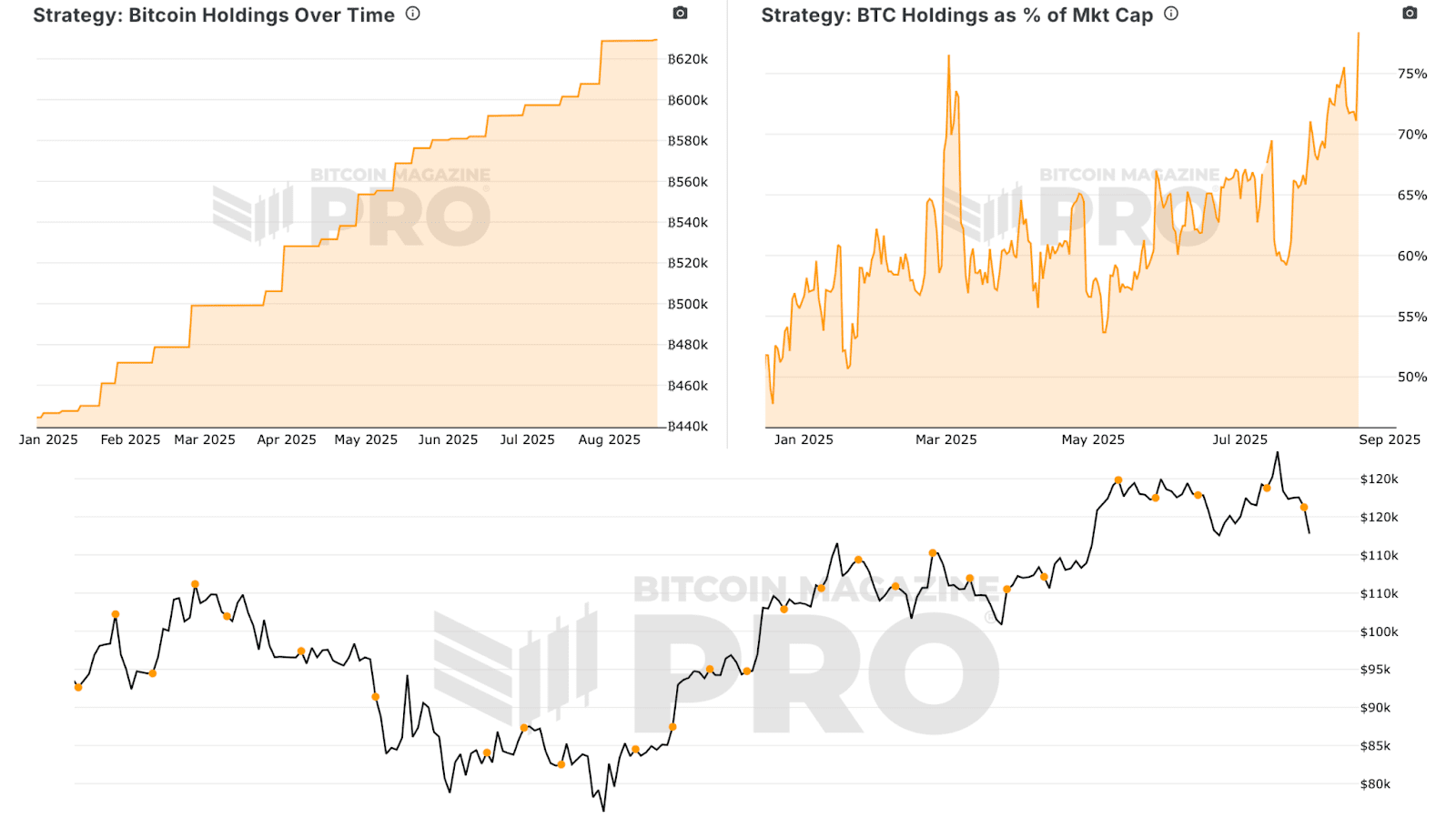

A key reason is the slowing accumulation. While (Micro)Strategy made a large purchase in July 2025, we can see from their Bitcoin Holdings Over Time that the pace has noticeably tailed off compared to its aggressive buying in prior years. Without continuous and significant accumulation, investors may be less willing to pay a premium for shares.

Share Dilution’s Impact on Bitcoin Treasury Companies’ Stock Prices

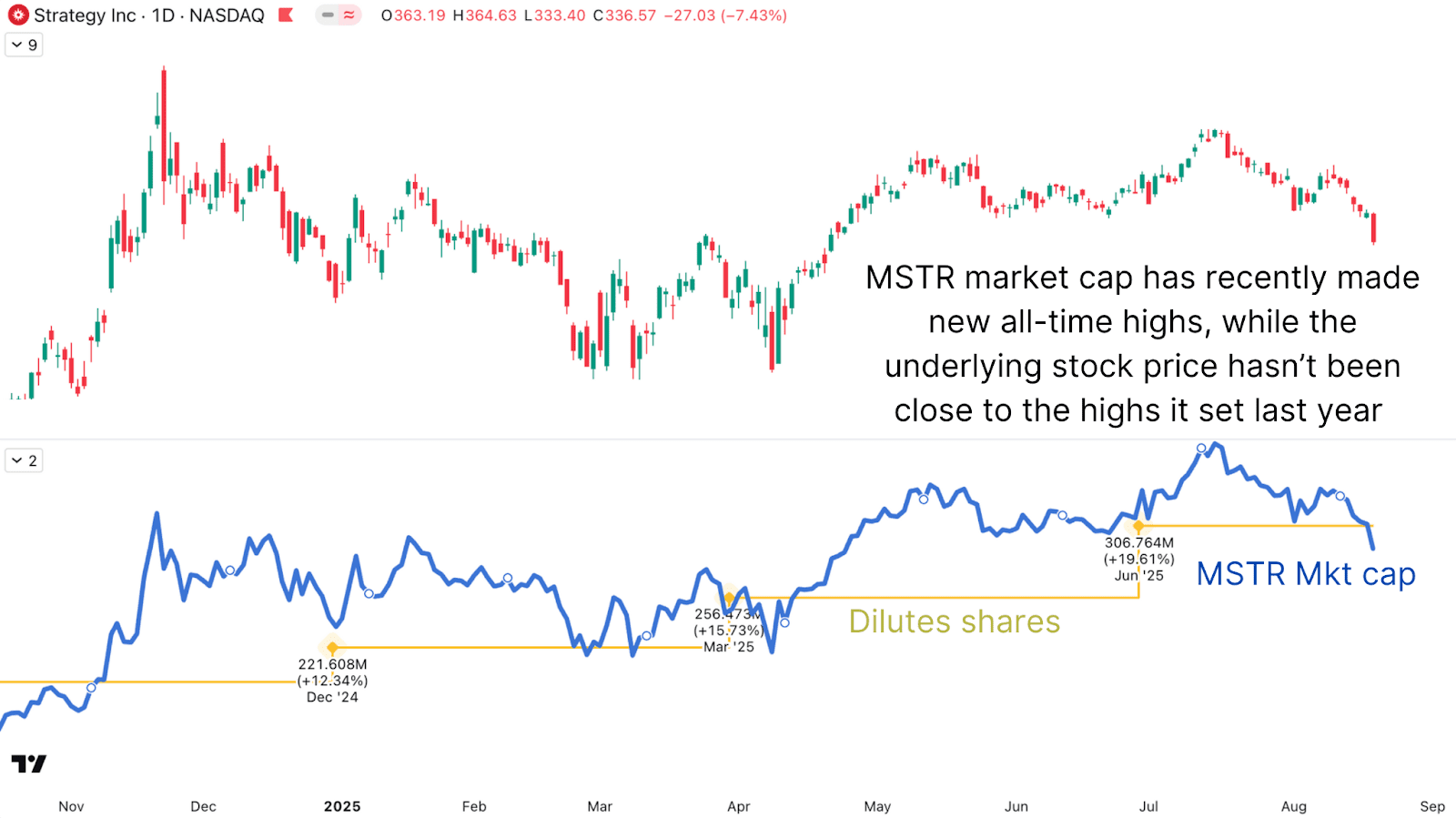

(Micro)Strategy frequently issues new shares to raise capital for Bitcoin purchases. While this increases total holdings, it dilutes existing shareholders and weighs on the stock price. From 2020 to 2025, (Micro)Strategy’s diluted share count rose from around 97 million to over 300 million, reflecting the scale of capital raising for Bitcoin purchases. While this strategy has succeeded in amassing enormous BTC reserves, it has also capped share price appreciation.

Looking at the company’s market cap rather than its share price paints a different picture. Market capitalization, which accounts for outstanding shares, actually reached new highs in July 2025, closely tracking Bitcoin’s rise. The share price alone tells a more negative story because of this heavy dilution.

Bitcoin Treasury Companies: NAV Premiums and Valuations in 2025

The net asset value (NAV) premium, the premium investors pay for shares compared to their Bitcoin per-share value, has fallen considerably. Historically, (Micro)Strategy commanded a significant NAV premium as one of the only ways for investors to gain leveraged Bitcoin exposure. Now, with dozens of treasury companies and ETFs available, that “first mover” advantage has diminished. As more companies adopt Bitcoin as a reserve asset, the NAV premium across the sector will likely trend toward one.

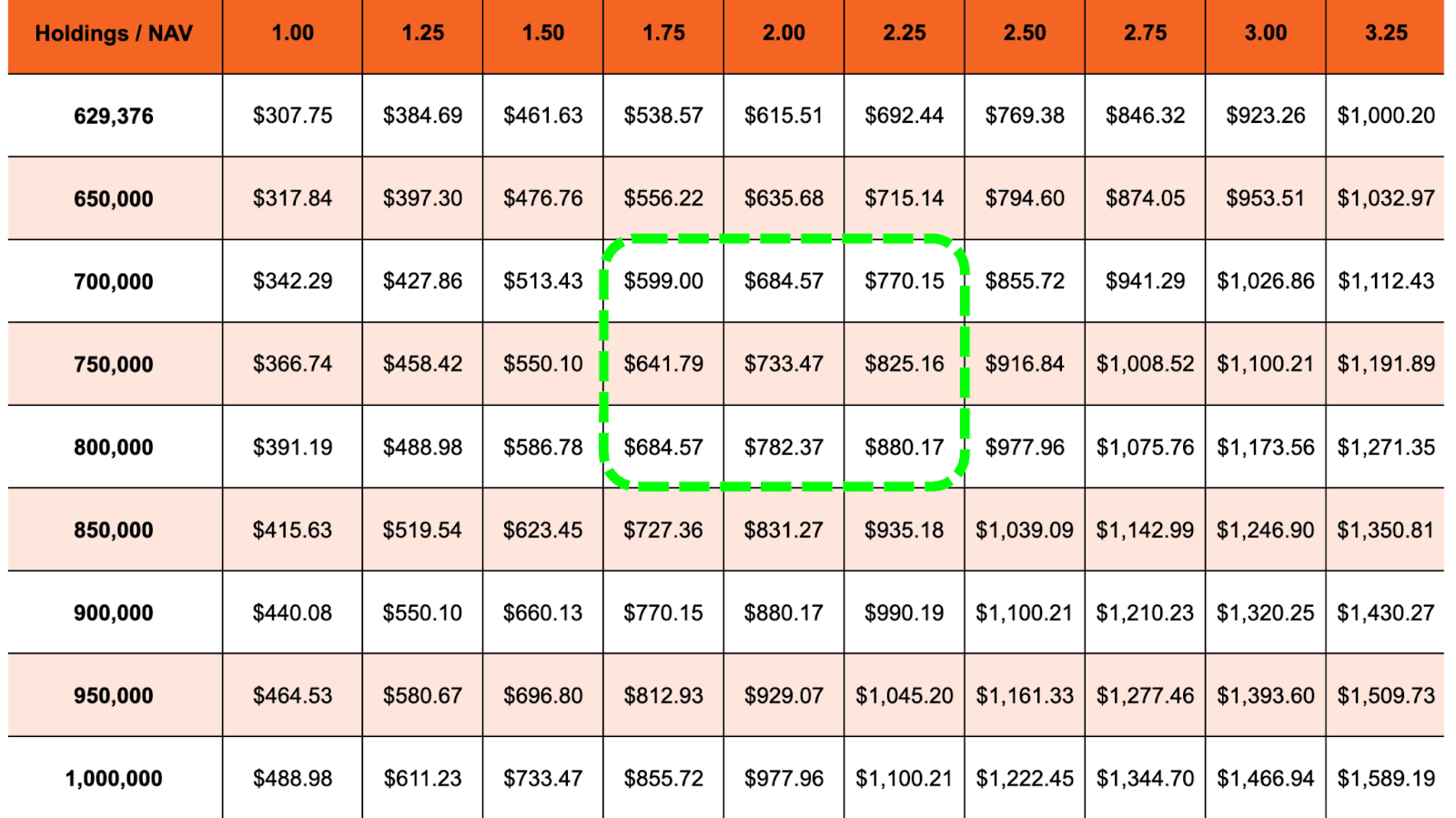

Treasury Companies and their mNAV will have boom/bust cycles, as all markets always have. If Bitcoin reaches $150,000, (Micro)Strategy’s own end-of-year prediction, based solely on its current holdings and assuming no additional accumulation or share issuance, its fair value, with a 1.00x NAV, would sit around $308 per share. With continued accumulation (potentially reaching between 700,000 – 800,000 BTC) and a modest NAV premium of 1.75–2.25x, share prices could reach the $600–$880 range. This still seems to be a realistic possibility, especially if we see an S&P 500 inclusion in the coming months alongside a more sustained BTC upside move.

Bitcoin Treasury Companies’ Future: Investment Outlook for 2025

Bitcoin treasury companies like (Micro)Strategy have faced a difficult period of underperformance despite Bitcoin’s surge to new highs. Dilution, slowing accumulation, and increased competition have weighed heavily on share prices. Still, their fundamental role in locking up vast amounts of Bitcoin makes them strategically important, and in certain market phases, they may still offer leveraged upside relative to BTC.

The asymmetric opportunity remains, but investors should temper expectations: the “easy outperformance” of the early (Micro)Strategy days has likely passed, replaced by a more mature and competitive landscape.

Loved this deep dive into bitcoin price dynamics? Subscribe to Bitcoin Magazine Pro on YouTube for more expert market insights and analysis!

For more deep-dive research, technical indicators, real-time market alerts, and access to expert analysis, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.