The Daily Breakdown takes a closer look into Costco stock. Does this premium company deserve this much of a premium valuation? Let’s dive in.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Deep Dive

Costco has established itself as a premier retailer as its market cap has swelled to more than $400 billion. By establishing a high-margin membership and an elevated shopping experience, Costco has differentiated itself from most other retailers in the US. This has allowed the company to focus on quality, while growing its membership base and opening new stores (both in the US and abroad).

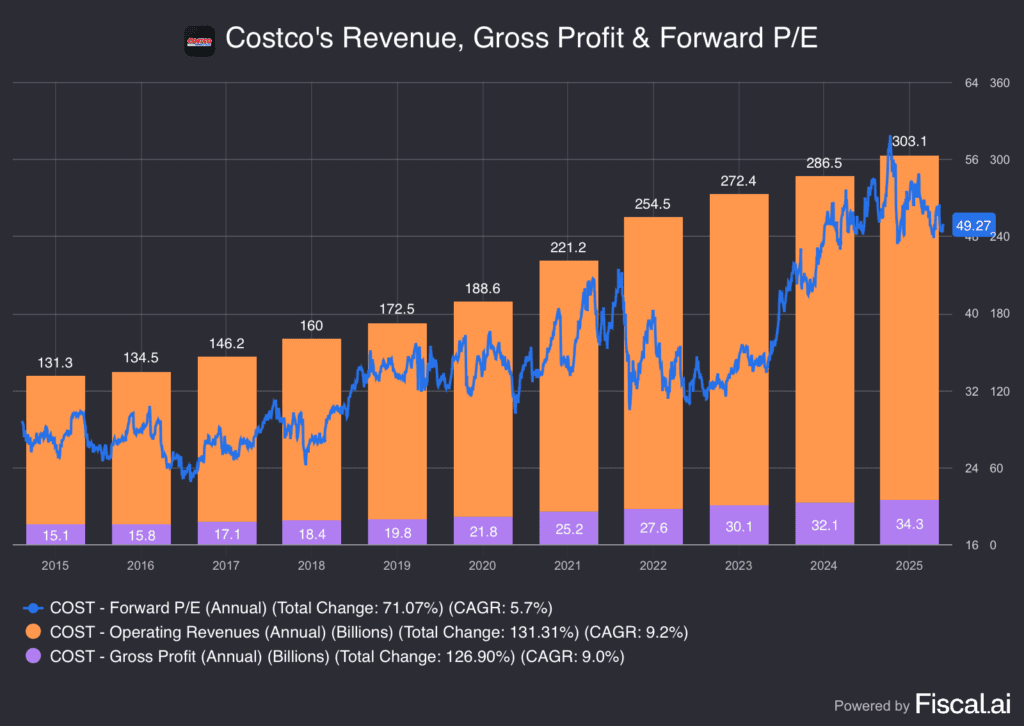

As such, we’ve seen the company’s earnings and revenue steadily climb over the years (shown below) — along with its stock price. Shares are up 102% over the past three years, 169% over the past five years and 561% over the past decade. Costco stock has outperformed the S&P 500 on all three of these timeframes.

Growth Is Good, but Valuation in Question

Analysts expect about 13% earnings growth this year, followed by 10% to 11% growth in 2026 and 2027. On the revenue front, estimates call for sales growth of roughly 7% to 8% in each of those three years (2025 through 2027).

That’s very steady, consistent growth. However, one hang-up could be Costco’s valuation.

Shares trade with forward price-to-earnings ratio (fP/E) of approximately 48 times (48x). As shares have pulled back over the past few months — down about 11% from the February highs — that’s allowed the stock’s fP/E to shrink from its 2025 highs (near 58x).

For reference, the S&P 500 currently trades with a fP/E ratio of about 23x.

Just about every valuation metric for Costco is elevated on a relative basis — meaning when we look back at its own historical measures (in this case, about 10 years). Investors often justify paying a higher valuation for a premium company. Regardless, while Costco is a premium company, the stock’s valuation is a risk.

Some investors will see this and shrug, arguing that they’ll pay the elevated valuation now with a plan to hold for years. Others may be more tactical, opting to wait for the valuation to potentially move lower, allowing them to buy at a cheaper price. Both parties assume risk — those who buy now risk a valuation contraction that sends the share price lower, while those who wait for a lower valuation may never get it and miss out on further upside.

Note: Consensus price targets currently assume about 15% upside potential in COST stock.

Want to receive these insights straight to your inbox?

Sign up here

Diving Deeper

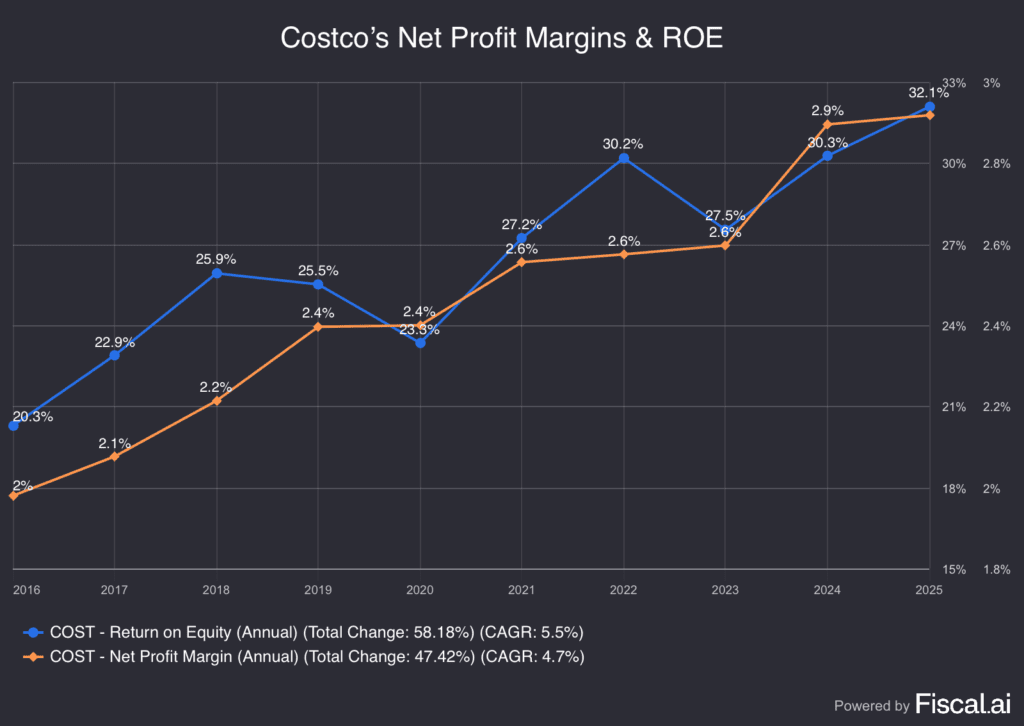

Our discussion has centered on two facts: The company’s consistent revenue and profit growth, and its elevated valuation. However, another part of the discussion hinges on what Costco’s done in other areas. For example, consider its increase in margins and return on equity (ROE).

Notice how the company’s net profit margins have increased 45% over the past decade, while the company’s ROE — or “Return on Equity,” which shows how well a company utilizes investors’ money — has climbed 58% in that span.

Some investors will use these metrics — and others — to justify the stock’s current valuation. Others may not find those numbers attractive enough to justify the current valuation. However, it’s up to them to determine whether the stock is worth a premium, and if not, at what price — if any — they feel Costco is worth it.

Lastly, it’s worth mentioning that while Costco pays a meager 0.5% dividend yield, it has dolled out two special dividends in the last five years, with a $10 per share payout in 2020 and a $15 a share payout in 2024.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.