Join Our Telegram channel to stay up to date on breaking news coverage

As competition to build crypto treasury firms accelerates, shares of market leaders like Strategy, Metaplanet, and BitMine are taking a beating.

Metaplanet has plummeted more than 31% over the past month, BitMine Immersion Technologies has shed 18% of its value, while Strategy (formerly MicroStrategy) shares have plunged 15%.

Those falls came exactly as firms around the world found crypto treasury religion. In the last month alone, the number of corporate Bitcoin holders has soared above 300 after 21 new companies joined the trend. Combined, Bitcoin treasury firms now hold 3.7 million BTC.

Digital Asset Treasury Companies (DATCOs) held over $100 billion in digital assets at the end of July, according to Galaxy Research, with $93 billion in BTC and more than $4 billion in ETH, led by BitMine and SharpLink Gaming.

Treasury companies have launched holdings in at least ten other digital assets, including SOL, XRP, BNB, and HYPE.

A `Bumpy Ride Ahead,’ Says NYDIG

Greg Cipolaro, global head of research at New York Digital Investment Group (NYDIG), warned in a Sept. 5 report that “a bumpy ride may be ahead” for the firms as incoming mergers and financing deals risk a “substantial wave of selling” from shareholders.

The combination of falling stock prices and ongoing accumulation is compressing premiums on these companies, he said. Their share prices are increasingly trading closer to, or even below, their underlying net asset values (NAV) after Bitcoin and Ethereum fell from recent new all-time highs.

Cipolaro cited multiple pressures behind this compression, including “investor anxiety over forthcoming supply unlocks, changing corporate objectives from DAT management teams, tangible increases in share issuance, investor profit-taking, and limited differentiation across treasury strategies.”

Substantial Wave Of Selling May Occur

Many DATCOs also have pending mergers or incomplete equity and debt financings. Once these transactions are completed and shares are freely tradable, NYDIG warned that a “substantial wave of selling” could occur, adding more stress to already declining stock prices.

If treasury firms fall below their NAVs, Cipolaro said they could buy back shares, but noted that none of the major bitcoin treasury firms currently have buyback programs in place, except for Empery Digital (EMPD), which trades at a 24% discount to NAV.

“If we were to give one piece of advice to DATs, it’s to save some of the funds raised aside to support shares via buybacks,” he said.

Galaxy Research said that if equity premiums collapse or capital dries up, larger, better-capitalized treasury firms may potentially acquire smaller firms at NAV discounts. While that would allow buyers to purchase crypto at favorable terms, it also highlights potential fragility.

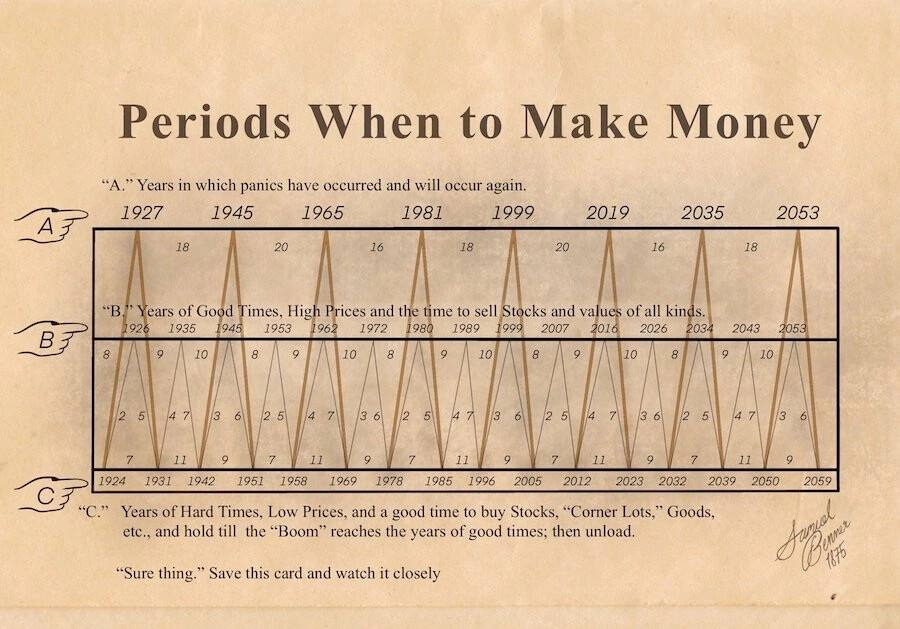

Galaxy Research noted that the mechanics of raising equity to buy assets, then seeing premiums fluctuate, resemble the 1920s investment trust boom, which amplified gains and losses.

“When sentiment turned, those same mechanics amplified the downside,” it said. “Collapsing premiums choked off access to capital while leverage magnified losses on falling assets. These cascading failures were an accelerant of the 1929 crash and subsequent Great Depression. DATCOs may be more transparent and better regulated than 1920s trusts, but the mechanics of mNAV-driven capital formation are eerily similar.”

mNAV, or market to Net Asset Value, is a valuation metric for public companies that hold cryptos as treasury assets, like Strategy.

Capital Keeps Flowing, Despite Risks

Still, investor appetite for crypto treasury firms remains strong. Hong Kong-based crypto exchange HashKey unveiled plans today to build a $500 million fund to invest in DATCOs, according to a company announcement, demonstrating continued inflows even as share prices fall.

📢 HashKey Group Unveils #DAT Strategy: Pioneering the Institutional Bridge Between #TradFi and Crypto

🌐 Launching Asia’s largest multi-currency Digital Asset Treasury (DAT) fund — targeting >$500M, focusing on mainstream crypto assets with an initial focus on $ETH and $BTC… pic.twitter.com/dZxsBEUFDw

— HashKey Group (@HashKeyGroup) September 8, 2025

As crypto treasury firms multiply, HashKey said the segment is now moving into a “survival of the fittest” stage.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage