Ethereum has cooled after months of strong buying pressure and bullish momentum, with the market now entering a consolidation phase. Over recent weeks, ETH has traded sideways just below its all-time high, leaving investors uncertain about the short-term outlook. While the lack of follow-through has tempered some of the optimism seen earlier this year, fundamentals suggest that Ethereum’s position in the market remains resilient.

Institutional accumulation continues to be one of the defining themes supporting ETH. Large-scale withdrawals from exchanges point to a steady trend of investors moving coins into long-term storage rather than keeping them liquid for trading. According to Lookonchain, a newly created wallet identified as “0x9d2E” recently withdrew 21,925 ETH, valued at $102 million, from Kraken. Such activity highlights the growing presence of deep-pocketed buyers who are unfazed by short-term volatility and are instead positioning themselves for Ethereum’s long-term potential.

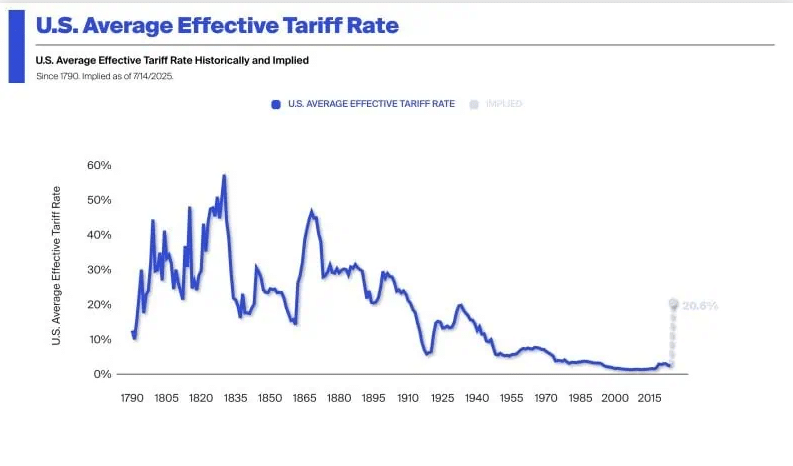

At the same time, macroeconomic uncertainty that weighed heavily on risk assets earlier in the year is beginning to dissipate. With institutions stepping in and broader conditions stabilizing, Ethereum’s consolidation may prove to be a healthy reset before its next decisive move. The coming weeks will be crucial in determining whether ETH can break higher or extend its sideways pattern.

Whales Continue Accumulating Ahead of Key Test

Lookonchain also reports that a newly created wallet “0x9D99” recently withdrew 5,297 ETH, worth $24.7 million, from Binance and Bitget combined. At nearly the same time, another major player, wallet “0x7451,” received an additional 13,322 ETH, valued at $61.65 million, from FalconX. These transactions highlight the persistence of institutional-scale accumulation even as short-term traders remain hesitant.

This wave of withdrawals adds to a broader trend where ETH supply on exchanges continues to shrink. As coins move into private wallets and cold storage, available liquidity for immediate trading decreases, setting the stage for supply-driven price pressure. Historically, periods of heavy whale accumulation have coincided with consolidation phases that later gave way to decisive rallies.

The timing is particularly critical now. Ethereum is trading just below its all-time highs, with market participants watching closely for signs of whether the next move will be a breakout or an extended sideways range. Whales appear to be positioning ahead of a potential push into uncharted territory, treating current price action as an accumulation opportunity.

If Ethereum maintains structural strength while institutions keep absorbing supply, the groundwork could be laid for a breakout beyond prior highs. At the same time, broader macro conditions—including the Fed’s rate policy—will likely influence the pace and scale of the next move. Regardless, persistent whale buying suggests confidence in ETH’s long-term trajectory remains intact.

Price Analysis: Short-Term Pullback In Play

Ethereum (ETH) is currently trading at $4,533, showing a 1.44% decline after failing to sustain momentum above $4,700. The chart highlights a recent rejection near the local highs, leading to a pullback toward short-term moving averages.

The 50 SMA ($4,414) now serves as immediate support, closely aligned with the 100 SMA ($4,452). This cluster of moving averages is crucial, as holding above it could stabilize ETH and prevent a deeper downside. A breakdown below this zone would open the door for a retest of the 200 SMA at $4,052, a level that has historically provided strong support during consolidations.

On the upside, Ethereum faces resistance near the $4,700–$4,750 range, which has capped price advances over the past few sessions. A decisive close above this level would likely trigger a push toward the $4,900–$5,000 zone, putting ETH closer to retesting its all-time highs.

For now, ETH remains in consolidation mode, trading sideways within a broader bullish structure. Institutional accumulation and shrinking exchange balances continue to support the long-term outlook, but short-term volatility could persist. As long as ETH holds above $4,400, the setup favors buyers, with potential for renewed upward acceleration once momentum returns.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.