$WISE.L is a growth company, with the profitability of a cash cow, and the valuation of a slow grower.

Key Highlights:

- Wise offers profitable growth in a growing niche

- The company is building a wide moat and sharing the benefits with its clients

- In a worst-case scenario, returns would be positive

The business:

WISE is a company that facilitates international money transfers. They currently have a market share of less than 5% of money moved by people, and less than 1% of the market share of money moved by small businesses.

Source: Company’s FY 2025 earnings release

For further reference about the business, you can check THIS previous post by @Rayeiris, shared previously, and that describes perfectly everything about WISE.

How they are building their moat:

International money transfers have been historically very costly for individuals. As an expat, I’ve experienced this before. The fees that Wise’s competitors charge to customers are unrealistically expensive, but there was no alternative until Wise arrived. You could think that, to be a profitable company, the take rates (what the company earns with each transaction) should be high. But as a matter of fact, Wise has been growing revenue and growing earnings while lowering take rates.

Source: Company’s FY 2025 earnings release

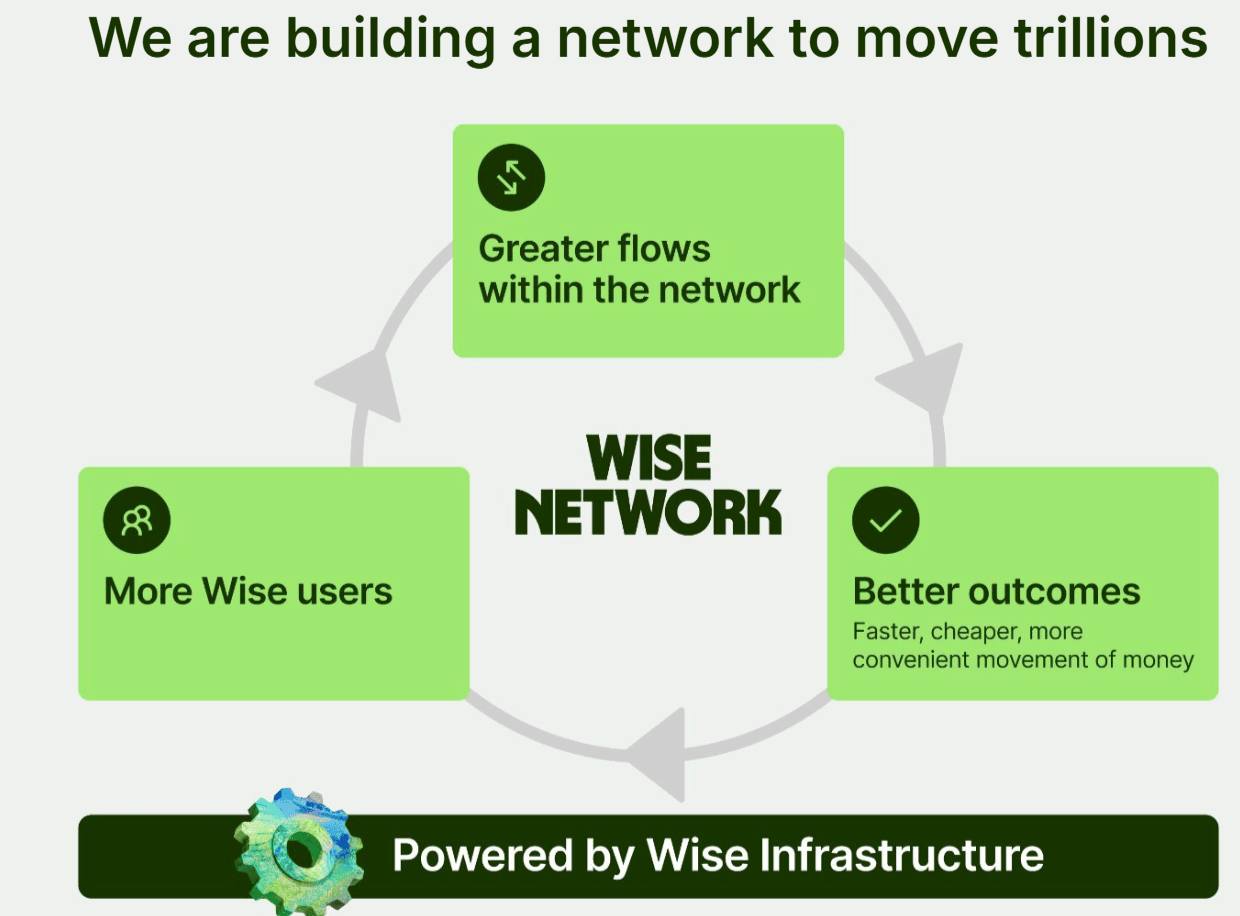

This is a proven way to grow a MOAT: You get benefits from scale, and you share it with customers. Customers see the benefits and use your product more, bringing more benefits for the company that are shared with the customer. It is a virtuous circle that feeds itself.

Source: Company’s FY 2025 earnings release

This is how Costco used to build its MOAT. And it has worked wonderfully for them during the years. But there’s so much more to it than only money transfers for individuals.

The company is also expanding into new products, like its Wise account for businesses. They are also including new features like quick pay with a QR code. But more importantly, with Wise Platform, businesses, banks, and other organizations can benefit from Wise’s infrastructure to transfer money abroad. Companies like Morgan Stanley, NU, Standard Chartered, or Google Pay have already joined, showing the potential of this product.

Valuation:

The company has established a long-term underlying profit of 13%-16%, which is lower than its current underlying profit margin (24%). With a revenue growth of 15%-20%, and an interest income growth of 10%-20% (currently over 70% year-over-year), the risk-reward ratio looks very compelling.

This basically indicates that in the worst-case scenario, with a PE ratio of 20 times earnings (which is a derating from its current multiple of over 28 times), the company will deliver an annual return of 1.77%. On the other hand, if the company keeps delivering growth and profitability, with a PE ratio of 30 times earnings, the company could deliver a yearly return of over 20% per year.

Risks:

- Revenue slowdown

- Lower interest rates

All valuations consider revenue growth and growth in the interest income above 1%. If interest rates go down significantly, this portion of the profit could vanish. Also, if more competitors, including big banks, enter the field with competitive prices, revenue could be flat, and the profit margin could be harmed.

Mitigating risks:

- Time and money-consuming process for competitors to catch up

- Growth in balances held by customers

Wise has built a strong moat for more than 8 years now. If a competitor wanted to replicate this, it could be time-consuming and expensive. Also, even if money could accelerate the process for a competitor to get where Wise is, some of the work is not about building the infrastructure itself, but about negotiating with third parties and local regulatory bodies, which is a slow process.

Regarding a lower interest rate scenario, it may be offset by higher balances held by customers. Actually, in the current environment, although interest rates are falling, the company is growing its interest income due to higher balances, which will likely be sustained in the future.

Conclusion:

Wise is potentially a multibagger. A quality business creating a wide moat while being very profitable. Given the niche the company is aiming at, competition is scarce and offers worse conditions than Wise. Any competitor wanting to compete currently would need to sacrifice profitability for a long time.

Catalysts:

- Incorporation of more companies into its Wise Platform, especially banks

- Sustained growth

- Stabilization of its take rate

I own a position in $WISE.L at the time of writing.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.