Should I revisit my thesis? Should I trim, hold, or sell Adobe $ADBE ?

As professional investors sometimes we want to make fast decisions when we see some really bad news on a stock we own. This is the case now with Adobe $ADBE. As I am drafting this Adobe just dropped -3.5% after a wave of negative headlines:

- “Adobe Stock Falls After Downgrade. The Case to Sell as AI Bites.”

- “Adobe Faces Canva Competition, Expands Firefly AI Tools to Mobile Devices.”

- “Figma has filed for an IPO.”

- “Redburn Atlantic cuts Adobe to Sell, slashing target from $420 to $280.”

As I read the news, the first feeling was fear – fear of being wrong, fear of client losses, fear of capital erosion. But after the emotional reaction comes the discipline. I pause and ask:

“What does my process say? Have the fundamentals changed?” No one can see the future, not even the best wizards/witches, so let’s focus on what we know.

What We Know

Here are the key facts I had in my thesis:

- Adobe has built one of the most predictable subscription models in the creative software space over the past 20 years.

- Adobe now faces real competition from AI tools like Canva, CapCut, and others.

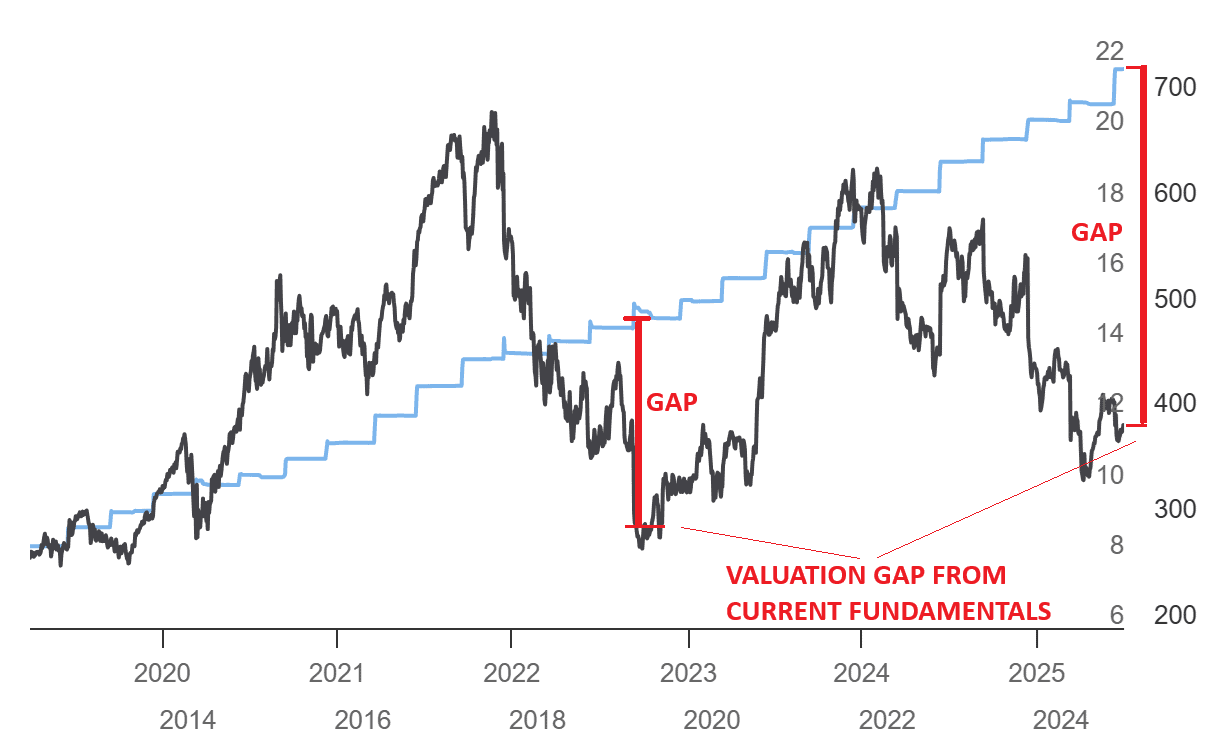

- However, the stock is now trading at a Forward P/E of 17x, a historically attractive multiple.

Source: TIKR $ADBE

- Fundamentals remain strong: High margins, strong free cash flow, high-quality balance sheet.

- Adobe passes my internal checklist with a score of 85/100.

- The base case projects revenue growth of 9% and EPS growth of 13%, which could drive an IRR of 24% per year from current levels.

- Adobe is reducing share count by ~2% per year via buybacks.

Source: TIKR

But what if my thesis is wrong?

Re-Running the Thesis: Risks & Bear Cases

To stress-test my assumptions, I challenged my own model:

- Revenue growth of 9% may mask slowing seat growth, with some of it driven by AI credit price hikes, real seat licensed growth is mid-single-digits.

- 13% EPS CAGR assumes margin expansion + continued buybacks. AI inference costs may compress margins.

- Firefly usage growth could actually hurt margins if GPU costs stay elevated.

- Competitors like Canva offer similar tools at 1/4 the price.

- Freelancers and SMBs may churn to cheaper platforms if Adobe pricing isn’t clear.

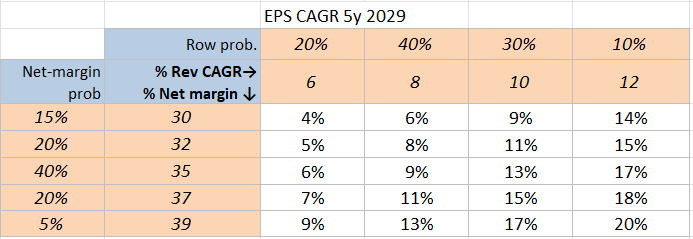

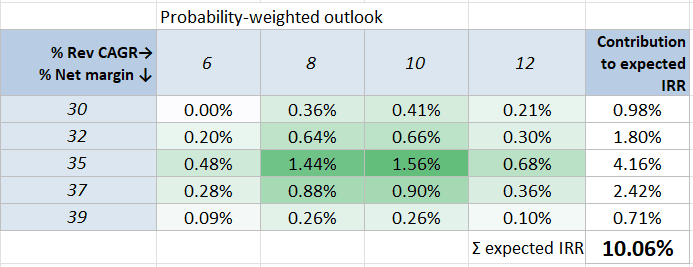

So I ran a new IRR (Internal Rate of Return) sensitivity grid, based on different growth/margin scenarios and their probabilities for Adobe $ADBE for the CAGR for the next 5 years in a more pessimistic scenario.

Source: AMWorld’s Figures

The Pessimistic Case: Still Reasonable

In the most probable “worst case,” I see Adobe $ADBE growing EPS at ~10% CAGR over the next 5 years. That would still justify holding the position at today’s valuation. But it brings up an important question:

🕛 Is this an opportunity cost, or a misunderstood tech titan in transformation?

What Could Go Right? (Opportunities)

Here’s what might make the bear case too pessimistic:

- Firefly is integrating models from Google Veo $GOOG, Open AI, Pika, Runway, so it is conglomerating all solutions under one roof.

- AI chip and infra costs decline (Google Cloud TPUs, AMD MI300 chips $AMD), improving Firefly margins.

- Freemium funnel works: Express seats grow >10%.

- Firefly credits become a net tailwind if GPU costs drop faster than usage grows (gross margin > 35%).

- Adobe can still use cashflow to buy or out-innovate smaller AI competitors.

- A breakout of >$1B in annual AI revenue could push valuation back to >20x EV/FCF.

Source: Adobe Investors Relationships

When It’s Hard to Decide… We tend to Overthink

It’s not always easy to make decisions without overthinking or relying on assumptions. In these moments, the best we can do is:

- Let the numbers guide us

- Watch how the story unfolds

- Monitor key data from earnings calls, 10-Ks, seat license trends, and churn reports

So here’s how I frame Adobe moving forward:

- Worst case scenario: EPS CAGR 10% next 5 years → Still an ok business

- Base case: EPS CAGR 10–12% → Adobe pushes AI tools successfully

- Best case: EPS CAGR 12–14% → Growth resumes, AI proves profitable, and Adobe keeps innovating

- Bull case: Not even looked at… not necessary to speculate.

But what would make me exit? I created for myself a small “Adobe Metrics Dashboard” with some KPI triggers to know when to trim or sell that will help me to make a decision.

Exit Warning Signs:

- Digital Media ARR YoY < 8% for 2 consecutive quarters

- Net-new seats < 0.4M in a quarter + visible churn

- Firefly attach < 25% of Creative Cloud subs by FY26

- Gross margin < 85% in any quarter (non-GAAP)

Bullish Confirmation Signals:

- Net-new seats > 1M per quarter

- Firefly attach > 30%

- AI ARR > $1B run-rate

Final Thoughts

We don’t have a crystal ball. Investing isn’t about making perfect predictions. It’s about buying high-quality businesses at fair prices, understanding your downside, and reassessing regularly.

So I’m staying in Adobe, watching carefully, and maintaining a modest, appropriately-sized position. If my KPIs deteriorate, I’ll trim. If the bull thesis plays out, we’ll be holding a compounder.

🕵️ What about you? Would you hold, trim, or sell? Would you rotate it for a more clear opportunity?

Let me know your thoughts. And if you want to follow how I handle these decisions in real time, you can follow or copy my portfolio on eToro.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.