Analyst Weekly, September 22, 2025

After nearly 15 years in the shadows, small caps might finally be ready for their close-up. Once the darlings of Wall Street, they’ve underperformed large caps for over a decade. They’re not as cheap as they were in the early 2000s, but history suggests that when one size group outperforms for ten years (like large caps just did), the pendulum usually swings back.

Why They’re Looking Better Now

The Russell 2000 (small-cap stocks) just hit an all-time high after four years of waiting.

1. Valuations and history are on their side. Small and mid caps tend to outperform when overall market returns are low. That’s because they act like “low beta” assets over the long haul. Thanks to time diversification, weak decades are usually followed by stronger ones.

2. A rare and bullish signal from earnings revisions. For the first time in years, more than half of small-cap companies are seeing upward earnings revisions. This might not sound exciting, but historically this measure has spent most of its time below 50% since the late 1990s. Sustained revisions above that threshold have usually meant strong forward performance.

3. Falling interest burdens. One of the biggest headwinds for small caps has been their reliance on short-term debt. But the tide is turning: interest expense as a share of total debt has dropped to 6.9%, the lowest in more than a year. With the market pricing in five additional Fed cuts by the end of 2026, small-cap financing costs should keep easing. That’s a game-changer for companies that live and die by their cost of capital.

4. Policy Tailwinds: OBBB Tax Wave. There’s also a fiscal kicker on the horizon. The fiscal tax refund from “One Big Beautiful Bill”, expected to be around $150 billion, will hit U.S. households in 2026, which could be a windfall for small caps. Here’s why:

- Consumer-sensitive exposure: Unlike mega-caps with global operations, small caps rely heavily on U.S. domestic demand. More cash in consumers’ pockets should flow directly into homebuilders, retailers, restaurants, and discretionary sectors.

- Financing relief: The bill includes tax incentives and accelerated write-offs that reduce interest expenses. That matters more for smaller firms that don’t have the pristine balance sheets of Apple or Microsoft.

In other words, OBBB is a direct shot of adrenaline to the small-cap economy.

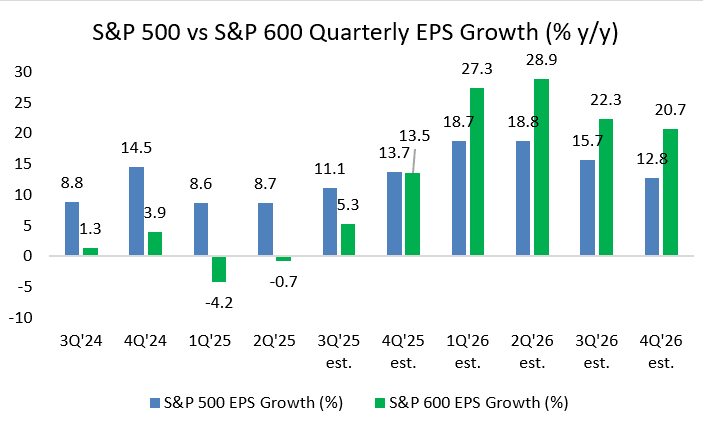

5. Growth Outlook Turns a Corner. After years of playing catch-up, the 2026 growth outlook for small caps has shifted decisively higher. For the first time in over a decade, small caps are showing a sustained path of earnings growth that could outpace their large-cap peers.

Sector Bright Spots:

Certain corners of the small-cap world stand to benefit the most:

- Homebuilders and banks – both highly sensitive to lower rates and domestic demand.

- Consumer discretionary – the first stop for tax-refund-driven spending.

- R&D-intensive SMID caps – firms boosted by policies like 100% R&D expensing.

These are the areas where fiscal tailwinds and easing financial conditions overlap most directly.

Why Upside Could Continue:

- Strong market breadth: The rally isn’t just a few stocks; many are participating.

- Short squeeze fuel: Hedge funds have been heavily betting against small caps. If prices keep climbing, those shorts may be forced to cover, pushing stocks even higher.

- Limited inflows: Investors haven’t poured money into small-cap ETFs yet. That leaves room for new buying to add fuel to the rally.

- Improving fundamentals: Earnings growth for small caps is expected to rebound strongly in 2026, and their interest costs as a share of debt are coming down.

Investor Takeaways:

- Near-Term Boost: Between upward earnings revisions, declining interest costs, and the OBBB tax wave, small caps have meaningful cyclical upside heading into 2026.

- Strategic View: Long term, business-funded R&D concentration and AI dominance still tilt in favor of large caps- scale does matter. That concentration in mega-caps remains a long-term advantage for the giants. But cheap valuations, mean reversion, and government-funded R&D support slightly favor small caps over the next decade.

- Portfolio Tilt:

- Tactical: Consider positioning for small-cap upside as stimulus and falling rates kick in.

- Strategic: Keep an eye on Washington: if industrial policy and R&D subsidies ramp up, small caps could enjoy not just a comeback, but a renaissance.

Fed Cutting Cycle & Banks

It’s unusual for the Fed to cut rates when bank stocks are sitting at record highs. In fact, it has only happened three times in the past: 1992, 1995 and 1996. Typically, the sector is down 20% or more before the Fed steps in with easier policy. What’s notable is that in those rare instances, banks actually continued to lead markets afterwards. Today, conditions look similar: credit markets remain calm, high-yield spreads are tight, and the rally is broad-based across sectors.

For retail investors, the key takeaway is that a rate cut in this environment isn’t a sign of stress, but rather an effort to extend the cycle. That could mean financials and other cyclical areas of the market still have room to run, even as policy shifts. Diversification remains important, but history suggests strength in banks can be a positive signal for equities more broadly.

Emerging-Market Stocks Outpace the S&P 500

The MSCI Emerging Markets ETF (iShares) gained 1.6% last week, marking a third straight week of gains. Since the April low, the rebound is 39%, more than the STOXX Europe 600 (21%) and the S&P 500 (37%). While both of those indices have hit record highs multiple times this year, the EM ETF still has catching up to do. The gap to its all-time high is 9%. The uptrend remains intact, so a test in the coming months is possible.

iShares MSCI Emerging Markets ETF, weekly chart. Source: eToro

A Growth Boost From The Fed?

The rally in EM equities reflects expectations of better conditions. Markets look ahead and are usually a step ahead of the real economy. Dependence on the dollar and U.S. interest rates remains crucial. Many companies borrow in dollars. If rates fall, funding becomes cheaper. If the dollar weakens, the same dollar debt costs less in local currency. After a longer pause, the Fed resumed cutting rates last week and signaled two further moves by year-end. The macro tailwind kicks in with a lag, the effects will likely filter into the real economy gradually.

It’s also higher growth. In 2024, India (6.5%), Malaysia (5.1%), China (5.0%), and Indonesia (5.0%) grew by five percent or more. Even the U.S. is far from that, Europe all the more so. Many investors are therefore looking beyond their home markets and using the global equity universe to diversify more broadly.

One-Stop Shop: Rheinmetall Enters Shipbuilding

Rheinmetall is acquiring the naval division of Bremen-based Lürssen Group, with closing planned for early 2026. The price is estimated at around €2 billion. The unit, comprising four shipyards in northern Germany and several international sites, employs around 2,100 people and generated about €1 billion in revenue in 2024. Management is targeting roughly €300 million in EBITDA by 2027, with the margin rising from 10% today to 15% by 2030. In parallel, Rheinmetall aims for at least €5 billion in naval-segment revenue. The focus will be on naval munitions, particularly rocket motors and final assembly, areas where global demand is elevated and lead times often run to several years.

Rheinmetall trades at a forward P/E of 52, a valuation that underscores investors’ exceptionally high growth expectations. The average across six major global defense companies—RTX, Safran, Honeywell, Lockheed Martin, Rheinmetall, and BAE Systems—is 28. By contrast, its LTM EBIT margin of 13.9% is above the peer average of 13.2%.

The stock briefly hit a new record high of €1,979 last week. However, the breakout above the June high didn’t stick. The RSI at 72 also points to a slightly overbought market. There are short-term warning signs, but as long as the €1,320 low holds, the long-term uptrend remains intact. If the breakout above the June high succeeds, Fibonacci extensions at €2,110, €2,279, €2,367, and €2,494 could serve as the next potential price targets.

Rheinmetall stock, weekly chart. Source: eToro

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.