Executive Summary:

Pool Corporation (NASDAQ: POOL) has established itself as the undisputed global leader in the distribution of swimming pool equipment, parts, and supplies. Coming off a period of exceptional growth, partly fuelled by pandemic-driven demand, POOL is strategically positioned to not only sustain but exceed its previous growth trajectory. The company’s consistent delivery of quality products and services underpins its market dominance and strong financial health.

Key Highlights:

POOL’s enduring strength is rooted in several core pillars:

- Market Leadership: As the world’s foremost independent distributor of swimming pool and backyard-related products, POOL commands a significant competitive advantage through its extensive network and comprehensive product offerings.

- Strategic Technology Investment: POOL continuously invests in cutting-edge technology and innovation, including robust e-commerce platforms and intuitive mobile applications. These digital tools streamline ordering and inventory management for customers, enhancing efficiency and satisfaction.

- Robust Financial Health: While long-term debt has increased, this reflects a deliberate strategic manoeuvre to bolster its balance sheet. This proactive financial positioning supports ongoing growth initiatives and potential future acquisitions within the resilient swimming pool industry.

Growth Catalysts:

The company’s future growth is propelled by a combination of strategic internal initiatives and favourable industry trends:

- Strategic Growth Initiatives: POOL is actively pursuing expansion within the swimming pool industry. Increased borrowing capacity provides the flexibility to capitalize on these opportunities, including product development, expanding its sales centre network, and investing in operational efficiencies.

- Resilient Industry Landscape: The U.S. swimming pool industry remains robust in 2025, driven by steady construction, global expansion, and rising demand for both residential and public aquatic spaces. Despite increased costs, interest in high-quality, long-lasting pool investments continues to grow. The industry is further bolstered by factors such as increased housing in warmer climates, homeowners’ increasing investment in outdoor living spaces, and the aging of the existing pool infrastructure, all of which POOL is well-positioned to leverage.

- Technological Advancements: Embracing new technologies, particularly IoT for smart pool solutions, presents significant opportunities for new revenue streams. The broader market is trending towards smart automation, eco-friendly filtration, and advanced water treatment solutions, all areas where POOL is poised to innovate and lead.

- Sustainability Trends: Growing consumer demand for environmentally friendly products provides a clear avenue for POOL to expand its “green” product lines, aligning with broader market preferences.

- Customer-Centric Approach: POOL places a significant emphasis on customer service, offering technical support, product training, and tailored business solutions. This customer-first strategy fosters high satisfaction and loyalty. The company boasts an extensive selection of over 200,000 manufacturer and Pool Corporation-branded products, encompassing pool equipment, supplies, chemicals, and recreational items, believed to be the most comprehensive in the industry. The success of its customer-centric digital platform, POOL360, is evident in increased private label chemical sales.

- Broader Economic Tailwinds:

- Infrastructure Investments: Government spending on infrastructure projects will indirectly stimulate construction activity, benefiting POOL.

- Housing Demand: Rising population, homeownership rates, and urbanization continue to drive demand for new housing and renovation projects.

- Rising Income Levels: Increased per capita income in emerging economies and favourable interest rates in developed countries are expected to further drive expansion in the construction and leisure markets.

Business Model Overview:

POOL’s revenue generation is diversified across three main product segments, catering to all aspects of pool and spa maintenance and construction:

- Pool Maintenance: Chemicals, cleaning equipment, and replacement parts.

- Pool Construction: Building materials, pumps, filters, and heaters.

- Outdoor Living: Patio furniture, lighting, and other recreational products.

The company operates over 300 locations globally through three primary networks: SCP Distributors LLC, Superior Pool Products LLC, and Horizon Distributors Inc. POOL distributes a wide array of products, including non-discretionary maintenance items, discretionary products (e.g., packaged pool kits, whole goods), irrigation and landscape products, specialty items, and golf irrigation solutions.

POOL serves a diverse customer base:

- Swimming pool re-modellers and builders

- Retail swimming pool stores

- Swimming pool repair and service businesses

- Landscape construction and maintenance contractors

- Golf courses

A key strategic focus remains on the stable and recurring maintenance and repair segments, which provide resilience despite fluctuations in new construction.

Key Brands:

- SCP Distributors LLC & Superior Pool Products LLC: Form the world’s largest wholesale distribution network for swimming pool supplies, equipment, and related leisure products.

- Horizon: Specializes in irrigation and drainage, outdoor living, landscape, and power equipment.

- NPT: Focuses on pool tile, decorative finishes, hardscapes, water and fire features, and outdoor lighting.

Market Positioning & Competitive Landscape:

The swimming pool supply industry is highly competitive. While POOL faces the challenge of differentiation in a market where customers can easily switch suppliers, its dominant distribution network and extensive product catalogue create significant barriers to entry for new competitors.

POOL consistently outperforms many competitors in profitability, growth, and market position, evidenced by its strong financial performance and robust revenue growth. Its comprehensive product range across maintenance, construction, and outdoor living segments provides a significant competitive edge.

Key competitors include:

- Leslie’s Inc.: Known for its strong retail presence.

- Pentair: A leader in water treatment solutions.

- Hayward Industries Inc.: A significant player in pool equipment.

- Fluidra: Focuses on the pool and wellness sector with a strong commitment to innovation.

| Competitors | Mkt Cap [$Billion] | PB | PE | Dividend Yield |

| Hayward Holdings Inc (HAYW) | 3.04 | 2.12 | 25.05 | – |

| Latham Group Inc (SWIM) | 0.68 | 1.92 | – | – |

| Leslie’s Inc (LESL) | 0.13 | – | – | – |

| Fluidra, S.A. (FDR.MC) | 4.12 | 4.20 | 27.85 | 2.8% |

| Pentair (PNR) | 16.38 | 4.51 | 25.72 | 1.0% |

| Pool Corporation (POOL) | 11.17 | 9.35 | 27.84 | 1.7% |

| Average | 5.92 | 3.68 | 17.74 | 0.9% |

A higher PB ratio signifies market optimism and the potential for significant returns and the dividend yield is above the average.

Management & Leadership:

POOL’s strengths are inextricably linked to its market leadership and the long-term vision of its management. CEO Peter Arvan’s statement underscores this philosophy:

“So, we tend to be very long-term focused on our investments and deliver it with where we’re investing capital on recognizing that sometimes you spend money this year to reap rewards next year or the year after or the year after. But I think if you look back historically on the investments that POOLCORP has made, that’s one of the things that has allowed us to continue to grow and to continue to expand the operating leverage.”

This long-term mindset has been instrumental in POOL’s sustained growth and operational leverage.

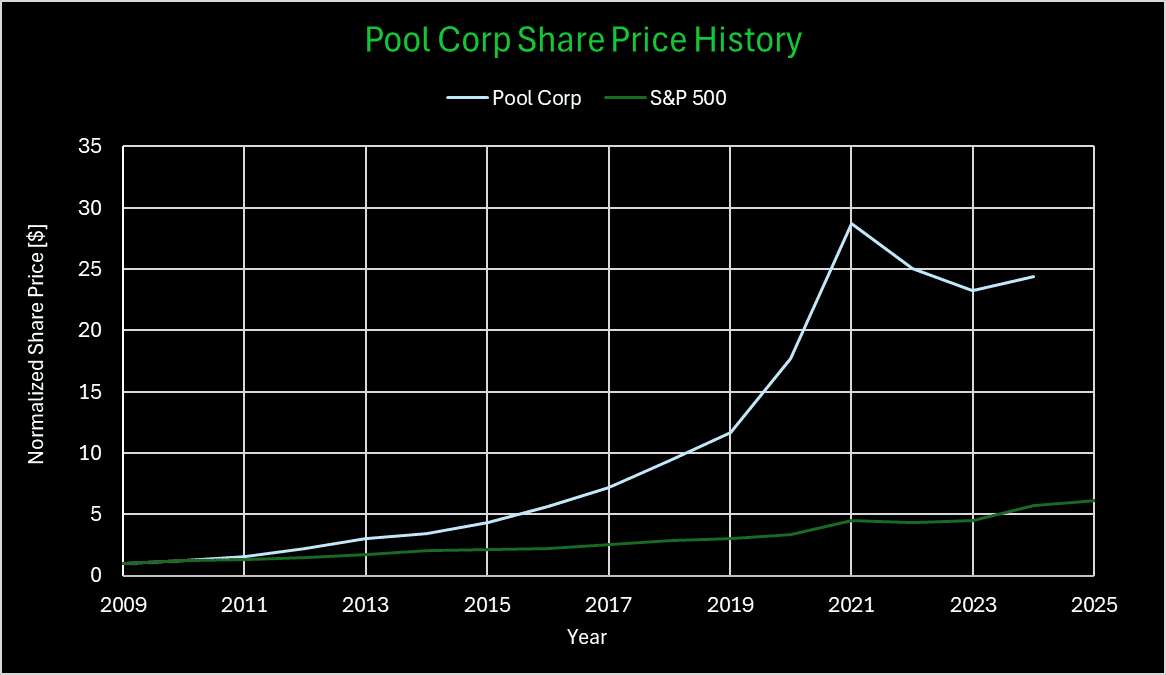

Below POOL’s share price versus the S&P500.

Risk Factors:

While the outlook is positive, potential risks include:

- Economic Uncertainty: Broader economic conditions and interest rate fluctuations could impact consumer spending on discretionary items.

- Labor Shortages: Finding skilled workers remains a challenge for some construction companies, potentially affecting pool installations.

- Supply Chain Disruptions: While improving, isolated challenges related to supply chain stability and material costs could still arise.

- Operational Efficiency: Maintaining consistent operational efficiency across a vast global network requires continuous attention.

- Customer Needs: The company must continually invest in marketing, customer service, and technology to stay ahead of evolving customer expectations and competitive pressures.

- Seasonality: The business is highly seasonal, with peak sales during warmer months, leading to potential revenue fluctuations.

- Weather Dependence: Adverse weather conditions can negatively impact sales of pool-related products.

- Stock Performance Volatility: While generally outperforming, POOL’s stock can experience periods of underperformance.

Investment Thesis: Building Shareholder Value

POOL presents a compelling investment opportunity driven by:

- Strengthened Financial Position: The increase in long-term debt is a strategic move to position the company for future growth, contributing to improved inventory turns and overall financial flexibility.

- Growing Dividend Appeal: POOL’s consistent annual dividend increases underscore its commitment to shareholders and highlight the attractive income potential of investing in its shares.

- Share Buyback Program: The recent authorization to increase the share repurchase program to $600.0 million ($309.2 million added to the existing $290.8 million) demonstrates confidence in the company’s value and is expected to enhance shareholder value by reducing the number of outstanding shares.

- Proven Growth Initiatives: POOL’s history of consistent returns on strategic long-term investments in technology, network expansion, acquisitions, and customer experience reinforce its ability to drive future growth.

Valuation:

Current valuations suggest a potential upside of 20%. The sensitivity analysis indicates how the stock price might react to lower growth rates. Positive market sentiment further strengthens the overall valuation.

| Growth | LT-growth | WACC | Fair value | Vs current | |

| High | 12.5% | 4.0% | 8.25% | $ 356.72 | 20% |

| Medium | 9.5% | 4.0% | 8.25% | $ 323.02 | 9% |

| Low | 7.0% | 4.0% | 8.25% | $ 296.91 | 0% |

| Average | $ 325.55 | 10% | |||

| Book value | $ 297.08 | ||||

| Current | $ 32.89 |

Conclusion:

POOL’s strategic investments, robust financial health, and strong positioning for long-term growth make it an attractive prospect for investors seeking capital appreciation and consistent dividend returns. The company’s market leadership, customer-centric approach, and proactive embrace of industry trends position it for continued success.

Explore Pool Corporation (POOL) on eToro today to add this market leader to your portfolio.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.