This year marks the year of the stablecoin, especially in the US. From the start of the year, we have watched as stablecoins evolved from a concept in trials overseas to a market force attracting billions in daily transaction volume, partnerships with major payment networks, active pilots among US banks, and a central focus of US financial regulation in the form of the GENIUS Act.

After the passage of the GENIUS Act in July, Ernst & Young’s (EY) strategy consulting services group EY-Parthenon surveyed more than 350 executives from financial and nonfinancial sectors about their views on stablecoins. Based on its findings, the firm generated a 31-page report that highlights adoption, usage, benefits, challenges, regulatory implications, and more. We’ve highlighted the report’s five major takeaways below.

Stablecoins are no longer fringe

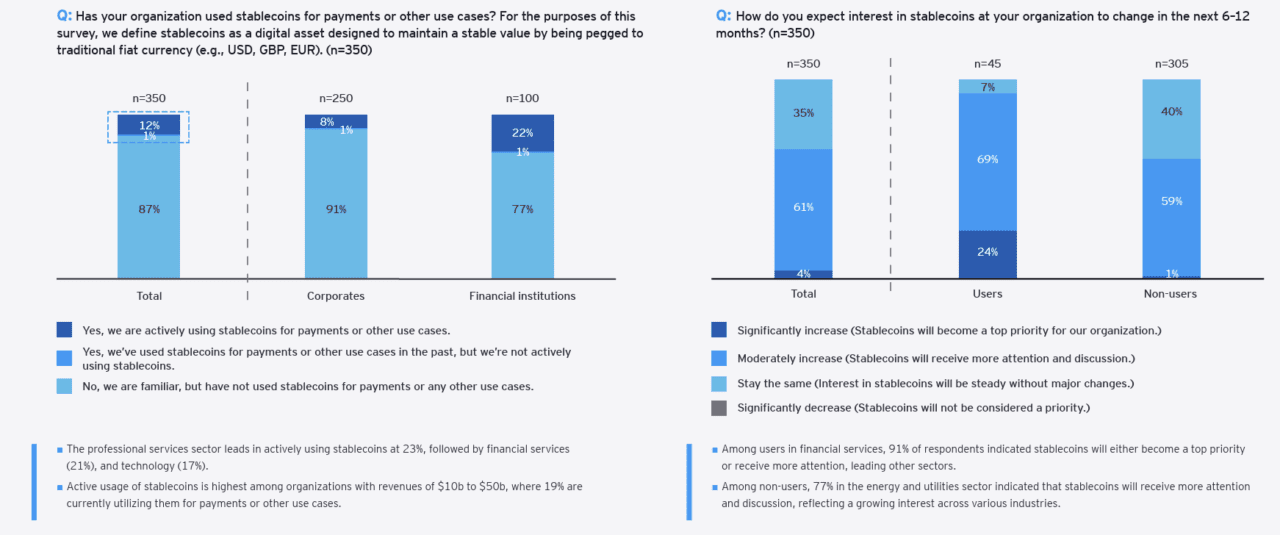

All of the 350 executives surveyed are aware of stablecoins. Of those, 13% have already used stablecoins and 65% expect interest in stablecoins to rise in the next 6 to 12 months.

The fact that 100% of executives surveyed are aware of stablecoins demonstrates how quickly stablecoins have moved into the mainstream. For banks and corporates, the conversation around stablecoins is no longer a question of “if,” but rather “how fast” adoption spreads and what role the organization should play. This shift from niche to norm shows that institutions that wait to make a move may miss out on shaping standards and capturing early market share.

Charts from EY-Parthenon

Stablecoin usage

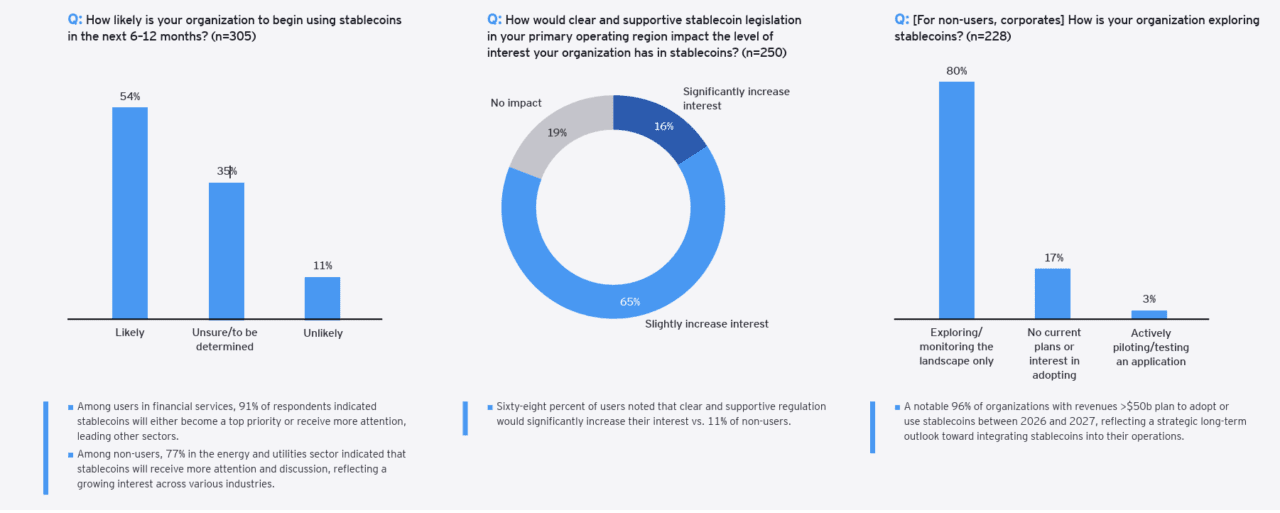

More than half, 54%, of financial institutions and corporates that are not using stablecoins expect to begin using them in the next 6 to 12 months. For 81% of participants surveyed, clear and supportive legislation increases their interest in stablecoins, either significantly or slightly.

With more than half of firms signaling plans to adopt stablecoins within a year, the market will likely see an acceleration in usage. For policymakers, this highlights the importance of regulatory clarity, given that it would directly boost adoption. For banks, it shows an opportunity to deepen their relevance by offering compliant, stablecoin-enabled services before competitors get there first.

Charts from EY-Parthenon

Cross-border fund transfers are the top use case

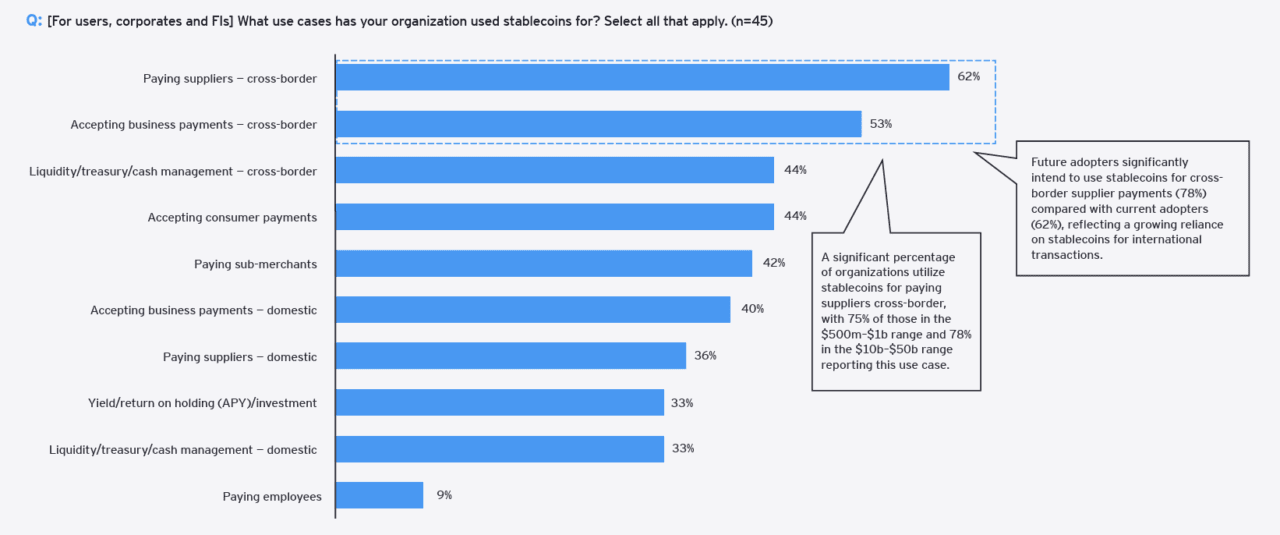

The survey asked about 10 different use cases. Of those ten, the top three use cases centered around cross-border payments.

This shows that stablecoins are tackling real, persistent pain points, especially in cross-border payments. Despite previous disruption by alternative players such as Wise, Remitly, and Revolut, international transfers remain slow and expensive. Stablecoins are a credible alternative that resonates with businesses and consumers. This focus could disrupt entrenched correspondent banking networks and give stablecoin adopters an edge in the lucrative field of cross-border payments.

Charts from EY-Parthenon

Firms most interested in reducing cost and increasing payment speed

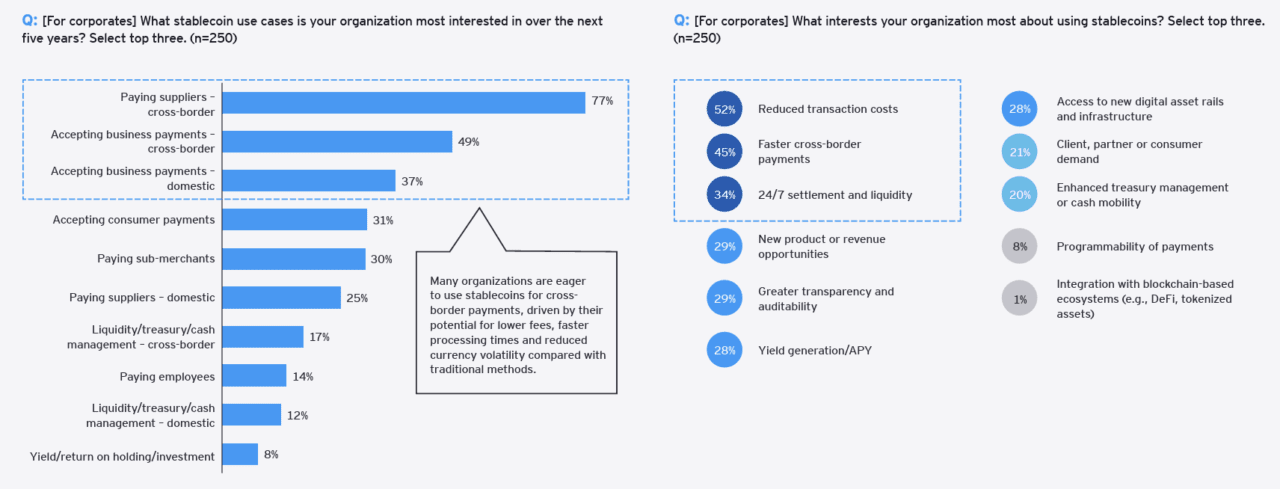

The most interesting use case is cross-border payments (77%), with interest largely driven by reduction in transaction costs and faster payments.

The overwhelming interest in cost savings and speed is a reminder that stablecoins will succeed or fail based on tangible value, not hype. For businesses, even modest reductions in cross-border fees can translate into significant savings at scale. Banks face the challenge of turning this efficiency into a competitive advantage, offering better pricing and faster settlement while managing risks.

Charts from EY-Parthenon

Practical implementation

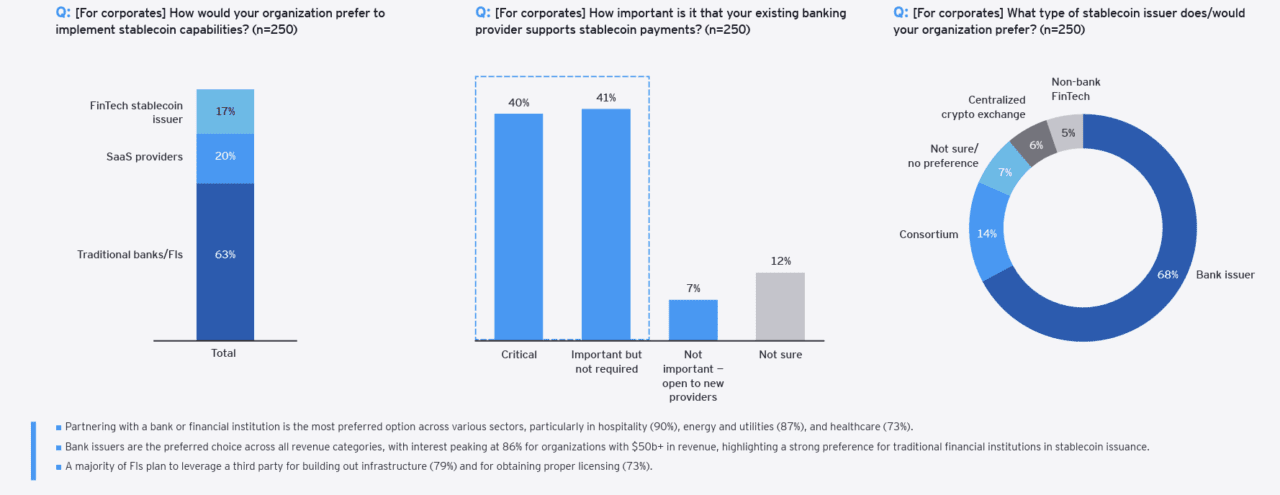

The survey found that organizations are looking to their traditional banking partners for access to stablecoins, and that most financial institutions, 79%, plan to leverage a third party for stablecoin infrastructure.

The finding that most organizations plan to access stablecoins through existing banking partners is significant. It suggests that businesses want access to stablecoins without having to deal with the complexity that comes with the new payment rail. Instead of investing in-house to leverage the new technology, they’re looking to trusted intermediaries like banks to handle the heavy lifting of facilitating the infrastructure. For banks, this is both an opportunity and a warning. Institutions that move quickly to build reliable, third-party-powered stablecoin services can strengthen client relationships, while laggards risk being bypassed entirely.

Charts from EY-Parthenon

Photo by Sebastian Svenson on Unsplash

Views: 120