The Daily Breakdown takes a closer look at markets amid the government shutdown, while Nvidia shares fly to new all-time highs.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

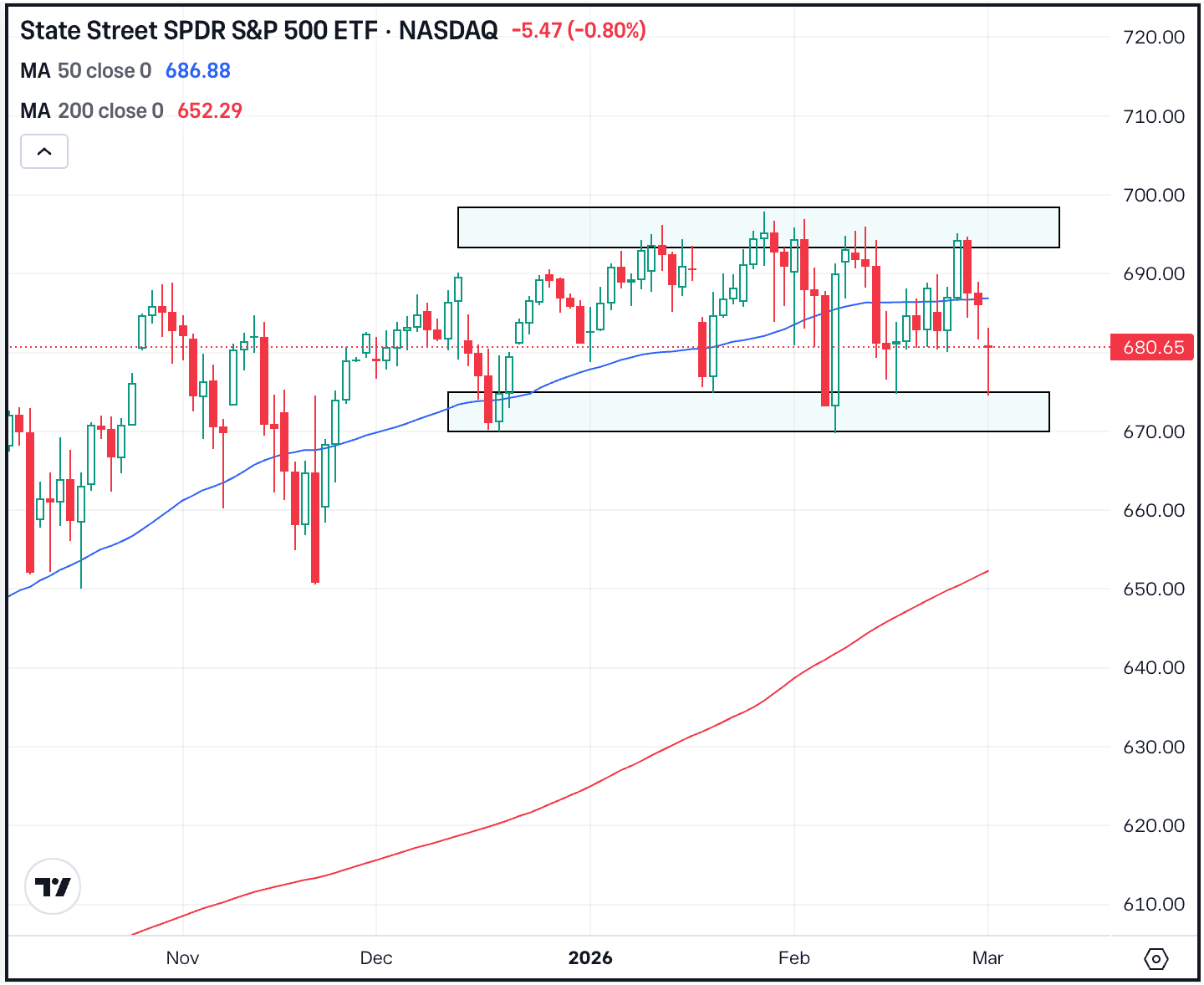

Markets do not seem troubled by the idea of a government shutdown, with both the S&P 500 and Nasdaq 100 riding four-day win streaks, both hitting record highs yesterday, and both primed to open at new highs today.

But as we discussed yesterday, markets don’t tend to make a big fuss out of the shutdowns. We’ll see if that remains the case this time around depending on how long this shutdown lasts.

Other Assets Are In Focus Too

Bitcoin and Ethereum are helping to lead the crypto rally after holding a key area of support, while gold is making a push toward $4,000 an ounce. Currently near $47.50 an ounce and silver is hitting its highest levels since 2011.

All four of these assets can also be followed by ETFs, such as IBIT, ETHA, GLD and SLV.

Jobs Worries

While the government is shut down, jobless claims and payroll reports will be shelved. But yesterday’s ADP report — a private-sector payrolls report — showed a loss of 32,000 jobs vs. expectations for a gain of 54,000 jobs. That continues the narrative of a softening jobs environment and markets are now pricing in another rate cut from the Fed later this month.

Want to receive these insights straight to your inbox?

Sign up here

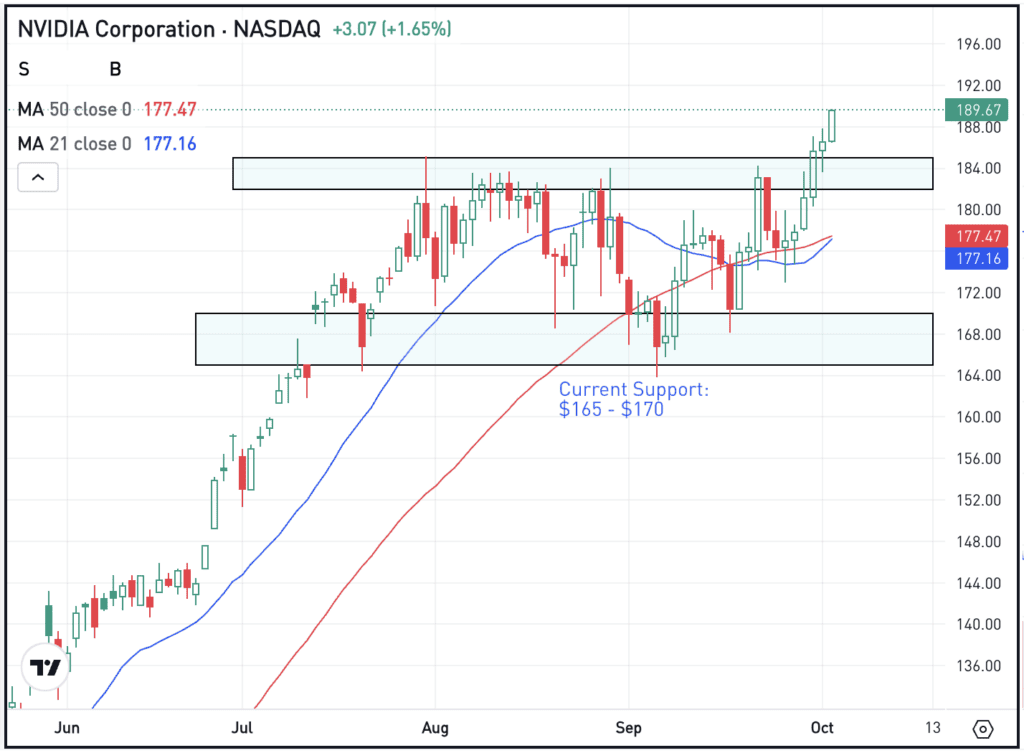

The Setup — Nvidia

Last month, we talked about Nvidia trading between key support and resistance, wondering if shares would break out or break down. Now we have our answer, as shares of Nvidia power over resistance and hit new highs. The move is happening alongside a broader push in chip stocks, as the SMH ETF booms to new highs as well. The top five holdings for that fund include Nvidia, Broadcom, Taiwan Semiconductor, ASML and Intel.

With Nvidia’s market cap topping $4.5 trillion, bulls are looking for even more upside. Moving forward, technical investors want to see former resistance — roughly $180 to $185 — turn into current support. If Nvidia can do that, its charts will remain constructive in the short- to medium-term.

Options

For some investors, options could be one alternative to speculate on NVDA. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and NVDA rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

ASML

Shares of ASML continue to power higher, with shares topping $1,000 in yesterday’s trading and up nearly another 4% in pre-market trading. The momentum with this name has been strong lately, with ASML up 35% over the past month. Dig into the fundamentals for ASML or revisit our deep dive on the stock.

RDDT

Shares of Reddit tumbled yesterday, falling nearly 12%. That’s after reports showed that ChatGPT citations for its content dropped sharply, something bulls didn’t like to see. With the fall, RDDT neared a two-month low but is still up 24% on the year. Check out the chart for RDDT.

LLY

What a rockin’ couple of days it’s been for healthcare stocks, as Eli Lilly (+8.2%), Merck (+7.4%), Pfizer (+6.8%) and others extended their gains after Trump’s drug-pricing deal boosted the sector. Pfizer is heading for its best week since 1974, while Lilly and Merck are on track for their strongest runs in years, pushing healthcare ETFs — like the XLV — to multi-month highs.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.