Join Our Telegram channel to stay up to date on breaking news coverage

Institutional investors are set to more than double their allocation to digital assets to 16% by 2028, according to a new State Street report.

The report, produced with Oxford Economics, found that digital assets currently make up about 7% of institutional portfolios, with most exposure concentrated in stablecoins, tokenized equities and bonds.

State Street said the findings highlight growing recognition of crypto as a performance driver, even as institutions remain cautious on full-scale adoption. Some 27% of respondents said Bitcoin has been their top-performing asset, followed by Ethereum at 21%.

More than half of those surveyed expect up to a quarter of global investments to be made through digital or tokenized assets by 2030, though only 1% foresee a complete move onchain, suggesting a future that combines traditional and blockchain infrastructures.

”The industry is already embracing digital assets in all their crypto, cash and tokenized forms, and sees them as a growing part of portfolios,” the report said. ”By 2030, a little over half (52 percent) of respondents expect that between 10 and 24 percent of all investments will be made via digital assets or tokenized instruments.”

The study polled more than 300 institutional investors on how they’re using digital assets and emerging technologies such as blockchain and AI. It also sought to discover where these investors will allocate their capital next.

Blockchain And AI Now Critical To Institutional Transformation Strategies

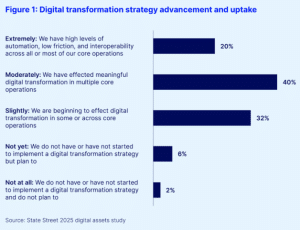

Distributed ledger technology (DLT) and AI were also found to be critical components of institutions’ digital transformation strategies.

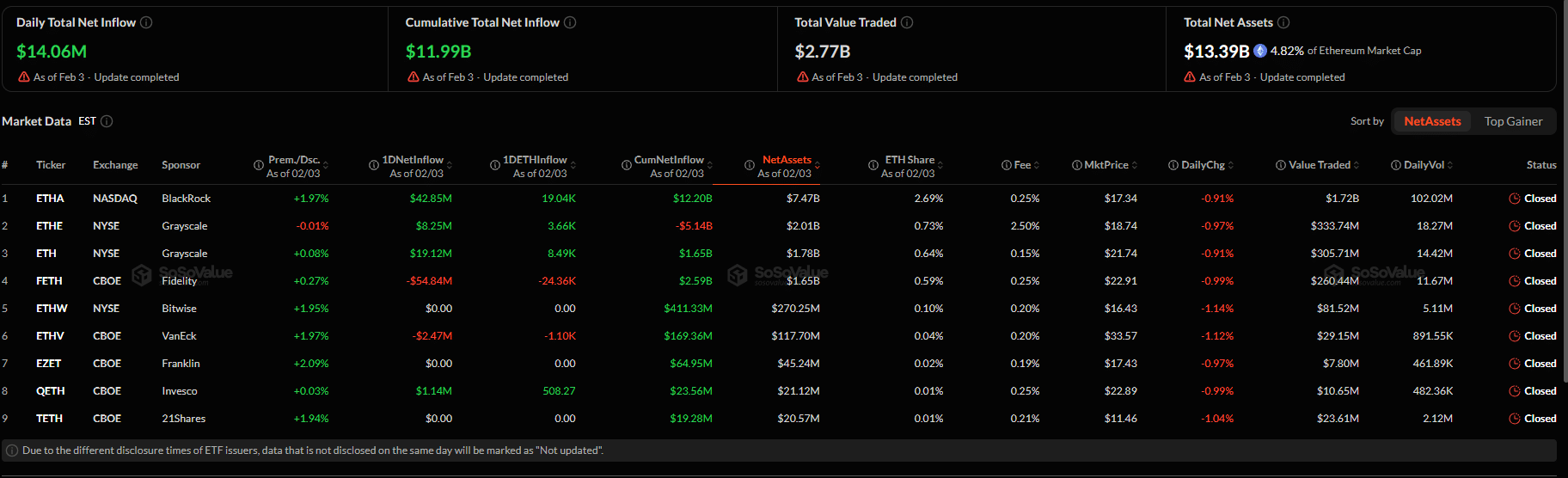

Institutions’ digital asset transformation strategy advancement and uptake (Source: State Street)

29% of the survey’s respondents named blockchain technology as a crucial component, with some even revealing that they are exploring DLT use cases beyond investment operations.

61% of the respondents said that they are looking at using blockchain for cash flow management, while 60% said they are applying the technology to business data processes. 31% of the respondents added that they are using the technology for legal or compliance functions as well.

Even with the growing adoption of DLT, many companies are still doubtful that blockchain-based systems will fully replace traditional trade and custody infrastructure.

Almost half of the respondents instead believe that hybrid decentralized and traditional finance operations will become mainstream within five years. This is much higher than the 11% of the respondents that made similar predictions a year ago.

However, 14% of those surveyed said that it is unlikely that digital investment systems will ever fully replace current trading and custody systems. This is also a sharp increase from the 3% that shared the same view last year.

The report comes as multiple institutions explore blockchain technology and move in on stablecoin infrastructure. JP Morgan, for instance, has launched its own stablecoin-like token called JPM.

Coinbase is leading a $2.5 billion race with Mastercard to acquire stablecoin infrastructure provider BVNK, in which Citigroup has recently acquired a stake.

Excited to announce a strategic investment from @Citi Ventures.

“Stablecoins are seeing increased interest in use for settlement of on-chain and crypto asset transactions. We were impressed by BVNK’s enterprise-grade infrastructure and their proven track record.” — Arvind… pic.twitter.com/xUKlw8IetT

— BVNK (@BVNKFinance) October 9, 2025

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage