Federal Reserve Governor Michael S. Barr used a keynote at DC Fintech Week to praise Congress for finally drawing lines around stablecoins—then immediately warned that the new law’s drafting could open channels for risk and regulatory arbitrage, including a pathway for Bitcoin-linked instruments to sit inside stablecoin reserves with only indirect Federal Reserve visibility.

Bitcoin May Exploit Loophole In GENIUS Act

Speaking in Washington on October 16, Barr said “payments innovation is accelerating,” and acknowledged that the newly enacted GENIUS Act “provides some clarity to issuers of stablecoins about how they can fit into the regulatory and supervisory framework,” potentially speeding development of new payment products. But he stressed that “success in accomplishing these goals will depend on the details of regulatory implementation,” adding bluntly: “Regulators have a lot of work to do to implement the act.”

The most pointed warning came in Barr’s discussion of what the statute now counts as permissible reserve assets for payment stablecoins. The GENIUS Act’s core safety mechanism is to restrict reserves to a list of high-quality, liquid instruments. Yet the text also allows reserves formed via overnight repurchase agreements backed by “any medium of exchange authorized or adopted by a foreign government.”

Barr highlighted the practical consequence with a concrete example: “For example, until quite recently, El Salvador treated Bitcoin as legal tender, and it still specifically permits Bitcoin to be used for transactions on a voluntary basis. As a result, an issuer could argue that Bitcoin repo could qualify as an eligible reserve asset for a stablecoin.”

He cautioned that if Bitcoin prices “were to drop sharply in value, a stablecoin issuer could be stuck holding the Bitcoin that had declined in value, potentially compromising the one-to-one backing of the stablecoin liabilities,” concluding that “to the extent possible, regulations should be put in place to eliminate or minimize such risks.”

Barr’s Bitcoin example ties directly to his broader concern: the GENIUS Act creates a mosaic of overseers—four federal agencies plus every state and territorial regulator can serve as primary supervisor of permitted stablecoin issuers.

Not Only Bitcoin: More Crypto Risks

In his view, that multiplicity risks creating uneven interpretations of the law’s guardrails and incentives for “charter choice” that could blunt federal prudential intent. “There might be a great deal of heterogeneity in the regulatory frameworks that apply to permitted issuers… The resulting array of charter choice options, unless carefully managed, may provide incentives for regulatory arbitrage,” he said.

Beyond the foreign-authorized medium-of-exchange clause, Barr flagged other reserve-design openings that could transmit stress. He noted that the GENIUS Act allows uninsured deposits to count as permissible reserves and recalled their role as a “key risk factor during the March 2023 banking stress.” The law empowers regulators to limit concentrations in such deposits, he said, but “it will matter how these rules are written.”

His critique extended to scope and structure. The statute empowers federal and state regulators to authorize a wide range of activities for stablecoin issuers—“digital asset service provider” and “incidental” businesses beyond pure issuance. Barr warned that issuers “are likely to seek to stretch these activities limitations,” even to the point of arguing they could “perform the full range of activities conducted by FTX,” provided they make certain representations and maintain appropriate accounting. That breadth, he suggested, could leave some issuers operating with risk profiles far afield from narrow payments functions while escaping consolidated capital regimes if housed in trust-chartered entities—an echo of historical vulnerabilities.

On capital, Barr argued the law’s issuer-level requirements could prove “too narrow” once firms branch into these additional lines, particularly when the act carves bank-affiliated issuers out of consolidated capital coverage. “Appropriate capital requirements are another area where coordination among federal and state regulators is key,” he said, adding that the statute’s standard for judging whether state rules are “substantially similar” to federal requirements will matter in practice.

He also pressed on consumer-protection gaps. The act does not sweep in all instruments commonly marketed as “stablecoins,” allowing certain dollar-denominated tokenized products to remain outside the new regime. That omission, Barr warned, risks confusing users into believing they are protected when “there are no prudential protections of any kind.” He urged federal and state enforcers to use unfair-and-deceptive-practices authorities to police misrepresentations and noted the law lacks the fraud and unauthorized-transfer protections that apply to traditional payment rails.

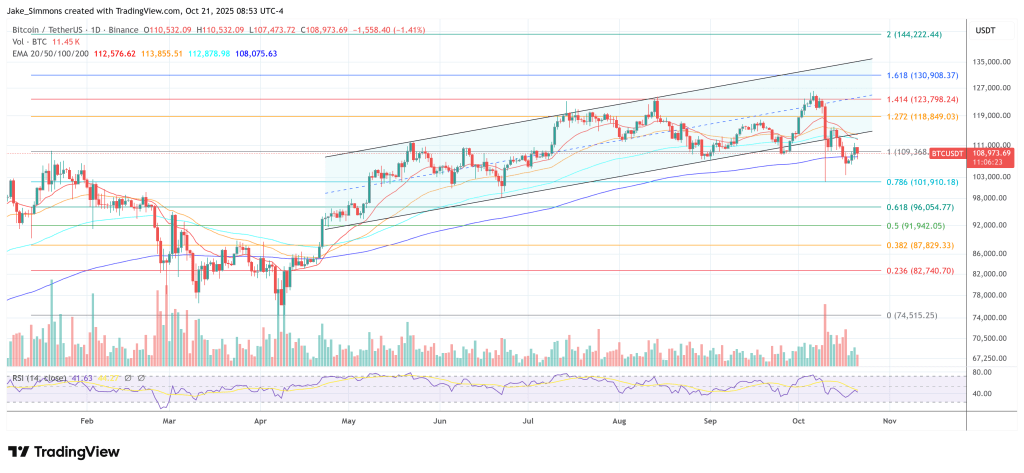

At press time, Bitcoin traded at $108,973.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.