Analyst Weekly, October 27, 2025

Earnings Season, So Far

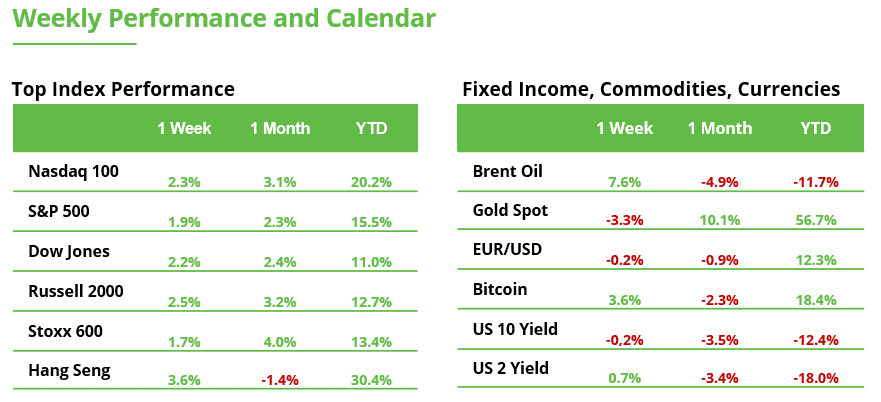

Early Q3 results have generally come in better than expected, with top-line growth improving across most sectors. Roughly 85% of S&P 500 companies have beaten expectations so far, the best pace in four years. Estimated sales growth rose between July and October in 10 of the S&P 500’s 11 sectors, signaling healthy demand. Financials, tech, and discretionary names are leading the charge, while utilities remain the lone soft spot.

That said, the margin picture is more mixed. Rising costs and wage pressures could weigh on profits, even as companies continue to beat on revenue. So far, EPS estimates haven’t moved much higher, suggesting investors are waiting for stronger confirmation before repricing expectations. After a big equity run-up this year, markets may need earnings to catch up to valuations. Overall, early signs are encouraging, but sustaining this momentum will depend on.

This week could decide whether the bull market keeps charging or pauses for breath. Five giants, Microsoft, Alphabet, Meta, Amazon, and Apple, together make up a quarter of the S&P 500 and will report results mid-week. Overall, 44% of the S&P 500’s market capitalization will be reporting results this week. Investors are zeroed in on their AI strategies: the scale of spending and, crucially, when it starts to pay off. Big Tech’s combined capex could top $420 billion next year, much of it tied to AI infrastructure. So far, revenue growth in cloud and digital ads has justified optimism, but profit growth across the “Magnificent Seven” is slowing from 27% last quarter to about 14%. With valuations stretched, any cracks in the AI or earnings story could test the market’s rally.

Fed to End QT and Extend Rate Cuts

The Federal Reserve appears ready to shift from tightening to support mode. With the labor market softening and inflation easing toward target, we expect policymakers to signal additional rate cuts by year-end and a formal end to QT. Bank reserves as a share of GDP have fallen sharply, tightening liquidity and forcing short-term rates higher than the Fed’s target. Ending QT would help stabilize funding markets and ease pressure on credit.

Markets have already begun pricing in a rate-cutting cycle, with swap rates trending lower through autumn. The policy pivot could provide relief for small- and mid-cap stocks, which have lagged during QT, and support broader market sentiment heading into 2026, especially if trade tensions continue to cool.

Markets Bet on a US-China Trade Truce Amid Policy Crosscurrents

Markets are positioning for a constructive outcome from next week’s US-China summit, as both sides signal progress toward easing trade tensions.Negotiators have reached preliminary consensus on issues including export controls, fentanyl, and shipping levies, while the US has dropped threats of 100% tariffs.

Initial market reaction reflects optimism that neither leader wants to destabilize the global economy. Still, investors remain alert to risks: China may press Washington to clarify its Taiwan stance, while rare-earth supply and tech policy remain leverage points. The broader backdrop is supportive: we expect the upcoming Fed rate cuts and an end to quantitative tightening to boost risk appetite. If talks yield a tariff truce and soybean deal, cyclical and China-sensitive sectors could extend gains, reinforcing the market’s “soft-landing” narrative.

No One Can Ignore Big Tech

We’re heading into one of the most eventful weeks of the year. Five US tech giants are set to report their quarterly results: Alphabet, Meta, and Microsoft on Wednesday, followed by Amazon and Apple on Thursday. Together, they represent around a quarter of the S&P 500, a striking example of how highly concentrated the US market has become.

So far, the US earnings season has been running positively, and the seasonal pattern also argues against any major negative surprises. Nevertheless, investors should expect increased volatility during this phase. Volatility, however, should not always be viewed as a warning sign, it is often a natural companion of an intact uptrend.

Can Microsoft Break Its July High?

The Microsoft stock gained 2.1% last week, closing at $523.61. While the all-time high from July 31 at over $560 has not yet been reached, the gap has narrowed noticeably. After the record high, the stock temporarily fell to $492, a decline of about 12%. Thanks to the recent recovery, the loss has now been reduced to around 7%.

The long-term uptrend remains intact, and from a technical perspective, much points to a continuation of the rally. Another push toward the record high seems possible. However, if the stock experiences a short-term pullback, the correction could initially extend toward the support zones between $482–488 or $461–466. These areas are considered technically relevant levels (Fair Value Gaps).

Microsoft, weekly chart. Source: eToro

US Sanctions Push Brent Prices Higher – Technical Resistance Remains

Brent crude recovered 6.5% last week to $65.16. The trigger was the US sanctions against Russia’s largest oil producers, which have heightened concerns about potential supply disruptions.

However, a look at the weekly chart shows that oil prices still face several technical resistance levels. The mere avoidance of a lower low is not enough to end the long-standing downtrend.

About five weeks ago, after reaching a high of $69.89, a new wave of selling began. This high now represents the key hurdle for the bulls. Buyers have also failed several times at the $70 mark back in July.

Only a sustained breakout above these levels, ideally confirmed by a weekly close, would significantly brighten the technical picture. Until then, the oil market remains vulnerable to renewed sell-offs.

Oil (Brent), weekly chart. Source: eToro

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.