Bitcoin’s recent decline is being driven by mid-cycle holders, not long-term whales, according to new on-chain research from VanEck analysts.

The firm noted in a recent report that long-term holders continue to accumulate while short-term futures markets show deeply oversold conditions following tariff-driven liquidations.

Despite widespread speculation that early Bitcoin whales triggered the selloff, on-chain data shows that coins held for five years or more continue to rise.

These older cohorts increased their holdings by roughly 278,000 BTC over the past two years, signaling limited turnover among wallets with the longest histories.

In contrast, supply among wallets that last moved their coins three to five years ago has dropped for every measurement window. Over the past two years, this tranche fell by 32% as coins were transferred to new addresses.

The VanEck analysts view these sellers as cycle-driven traders rather than long-term investors.

“Weak hands” set early pressure: VanEck

The past month delivered a −13% drawdown, driven in part by outflows from bitcoin ETPs. Since October 10, bitcoin ETP balances have fallen by 49,300 BTC — about 2% of total AUM — as recent buyers exited positions during rate-cut uncertainty and shifting AI-market sentiment.

Sentiment indicators also show rising fear among retail participants. Bitcoin’s fear-and-greed index fell to its lowest reading since March, aligning with the onset of tariff-related volatility.

Whale holdings are shifting in a more nuanced pattern than outright distribution, VanEck noted. Large holders with 10,000–100,000 BTC have reduced supply over the longer term — down 6% over six months and 11% over 12 months — while mid-sized holders in the 100–1,000 BTC range absorbed this supply and increased their balances by 9% and 23% over the same periods.

More recently, some large cohorts have turned into net buyers. The 10,000–100,000 BTC group increased holdings over the past 30, 60, and 90 days, coinciding with a sharp drop in futures market open interest during tariff-driven liquidations.

While the analysts stop short of making directional predictions, the data shows that the longest-term bitcoin holders remain largely in place, mid-cycle traders are driving selling, and futures markets have undergone a significant reset.

After a month of pronounced liquidations, the analysts characterize current conditions as aligned with prior periods of tactical re-entry for some investors.

Mid-cycle Bitcoin holders show the most selling

When analyzing coins by age rather than wallet size, selling pressure is most concentrated among holders who last moved their bitcoin within the past six months to five years. These groups saw significant outflows over the past month.

Holders in the 6-month to 2-year band have rotated into the market as sellers, while the 3- to 5-year cohort continues to shrink across all periods reviewed. Analysts connect this behavior to traders who entered during prior down cycles and are now exiting on price weakness.

By comparison, coins that last moved more than five years ago show minimal churn, reinforcing the idea that long-term holders are not driving the selloff.

Bitcoin’s futures markets reset as funding and open interest collapse

The futures market saw a rapid unwinding of speculative positioning. Open interest in bitcoin perpetual futures dropped roughly 19% in 12 hours during the selloff and is down 20% in BTC terms since October.

Funding rates — a key measure of futures optimism — also fell to their lowest levels since late 2023.

VanEck analysts noted that large basis-trading operations, including structured products and funds using long-spot/short-perp strategies, may be suppressing funding signals.

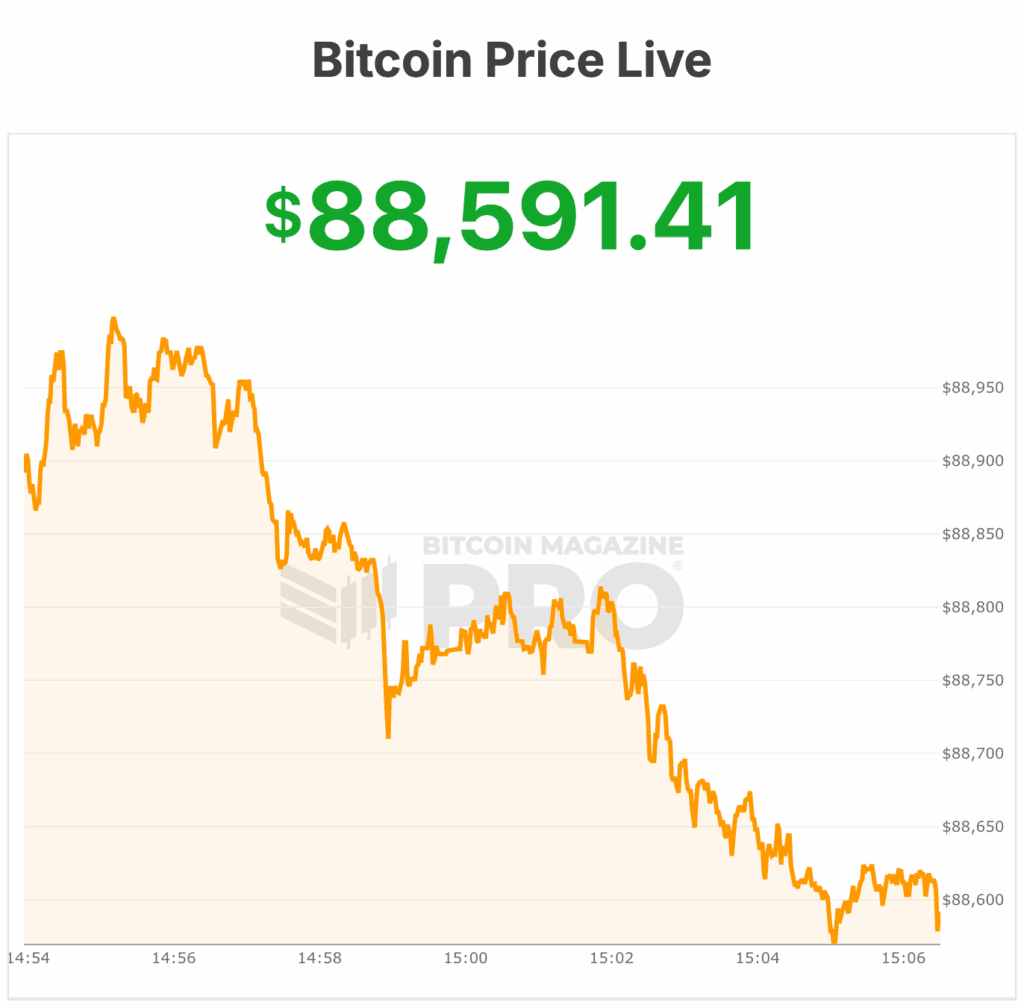

At the time of writing, Bitcoin is near $88,500 — its lowest level in seven months — as crypto markets extend their retreat and major crypto stocks sell off sharply. Bitcoin is down 4% in 24 hours, trading near the bottom of its weekly range with a $71 billion daily volume and a $1.78 trillion market cap.