JPMorgan Chase has launched a $100 million tokenized money-market fund on Ethereum (ETH), adding fresh Wall Street backing to the world’s second-largest blockchain. Ethereum is trading around $2,926, down -1% in the past 24 hours, with a market cap of $353 billion, while Bitcoin (BTC) changes hands at $86,782 (-0.5% on the day). The move lands just as high-profile strategist Tom Lee reiterates a bold call for ETH to reach $20,000 within a year, sparking a debate over how fast institutional tokenization can really move prices.

What Is JPMorgan Actually Putting on Ethereum, and Why Now?

JPMorgan’s asset-management arm is reportedly rolling out the OnChain Net Yield Fund, a private tokenized money-market fund issued on the Ethereum blockchain, wrote Vicky Ge Huang in The Wall Street Journal. The bank has seeded the fund with $100 million of its own capital and is now opening it to outside investors who meet strict thresholds: at least $5 million in investable assets for individuals and $25 million for institutions.

A tokenized money-market fund takes a traditional low-risk cash product, think short-term US Treasuries and high-grade paper. and wraps it in blockchain-based tokens. Those tokens can, in theory, settle faster, move 24/7 and plug into on-chain finance infrastructure.

JPMorgan executives told WSJ that client demand for tokenization has ramped up as regulatory clarity improves and more large asset managers experiment with similar structures.

This is clearly a reference to the impact of the GENIUS Act, which came into force earlier this Year, paving direct inroads for institutional money to move forward with USDC on-chain settlement.

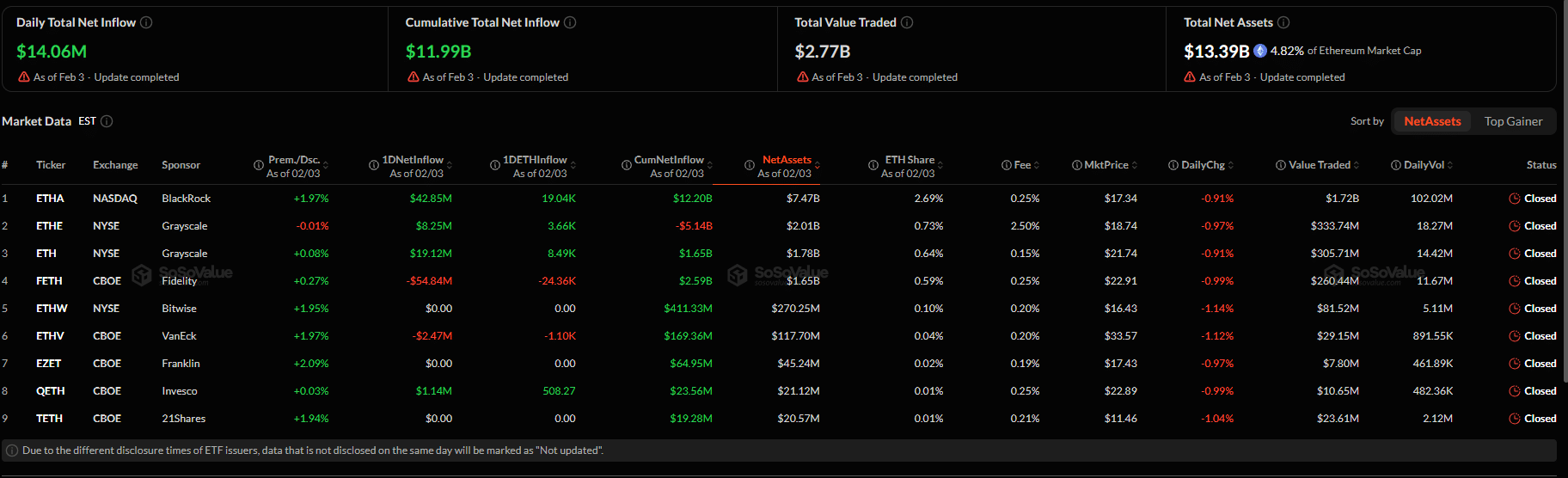

The Wall Street giant is not alone. BlackRock’s BUIDL tokenized fund has already amassed roughly $1.7–$2 billion across multiple blockchains, while Franklin Templeton’s BENJI/FOBXX suite has surpassed $410 million, according to CoinDesk’s Francisco Rodrigues. Other players like Ondo’s USDY, Hashnote’s USYC and Realize’s T‑BILLS-style products have helped push the tokenized Treasuries market to roughly $5–$9 billion in value over the past year.

(Source – Assets, RWA.XYZ)

Most of this institutional tokenization either lives directly on Ethereum or on private networks modeled on Ethereum’s stack, and JP Morgan is clearly doubling down on Ethereum, operating exclusively on ETH, while competitor BlackRock explores 8 different blockchains.

Data from RWA.xyz, cited by Lee, suggests Ethereum and its layer-2s host more than 70% of tokenized real-world asset value today.

How Could JPMorgan’s Move Shape Ethereum’s Long-Term Price Story?

Fundstrat co-founder Tom Lee argues that the kind of product JPMorgan is launching is exactly what could supercharge Ethereum’s upside.

Speaking at Binance’s blockchain conference in Dubai, Lee said the bulk of institutional tokenization activity is happening on Ethereum, making it the primary settlement layer for real-world assets entering crypto rails.

In his view, as this base grows, ETH is set up for a “bigger breakout” that could send prices beyond $20,000 within a year.

However,Sam Cooling of 99Bitcoins says the ETH/BTC ratio suggests that for ETH to reach that level, it would require a total crypto market cap exceeding $15 trillion, a feat that institutional tokenization alone cannot carry without a massive retail ‘burn’ or an orchestrated supply squeeze.

Lee also expects Bitcoin price to track a strong S&P 500 performance, potentially reaching $300,000 and making new highs in early 2026. If that plays out, he argues, Ethereum could outperform even that rally as tokenized assets and DeFi primitives converge.

This is the same broad institutional-adoption narrative behind other large players’ moves into Ethereum-based products, from BlackRock’s BUIDL to Franklin Templeton’s expanding tokenized fund lineup.

For traders, this raises an obvious question: is this just another bullish story, or does it mark a structural shift in demand? Prior coverage on institutional flows into ETH, such as our look at institutional demand for Ethereum and BlackRock’s Ethereum ETF ambitions, suggests this is becoming a multi-cycle theme rather than a single headline.

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

Does a $100M Fund Really Justify a $20K ETH USD Price Target?

Not everyone is buying the timeline on Lee’s explosive forecast. CCN technical analyst Valdrin Tahiri recently noted that while Ethereum may outperform Bitcoin on a relative basis, the charts do not currently support the kind of parabolic move implied by $20,000 ETH or a scenario where ETH trades at 0.25 BTC. “Neither asset is showing signs of the explosive move Lee projects,” he said, arguing that ETH needs BTC to regain clear bullish momentum before such levels come into play.

In the short term, crypto markets remain extremely sensitive to macro conditions, regulation, and liquidity cycles. Tokenized money funds are growing rapidly but remain relatively small compared to the multi-trillion-dollar traditional money-market universe. Even a $5–$9 billion tokenized Treasuries sector, as estimated by CoinDesk, is not, by itself, enough to dictate ETH’s price when derivatives, leverage, and speculative flows dominate day-to-day trading.

There is also a competitive risk. JPMorgan has explored other chains and technologies, as discussed in our piece on its blockchain strategy, and BlackRock has already migrated to Solana. If major institutions diversify across multiple base layers, Ethereum may remain the leader yet still see its tokenization moat slowly erode.

DISCOVER: Top 20 Crypto to Buy in 2025

What Should Crypto Investors Take Away from JPMorgan’s Ethereum Bet?

For long-term Ethereum holders, JPMorgan’s move is another data point supporting the thesis that real-world assets and money-market products are migrating on-chain, with Ethereum as a primary venue. It reinforces the idea that yield-bearing, regulated instruments can coexist with DeFi and potentially deepen on-chain liquidity over time.

However, the immediate effect on ETH USD price is likely to be modest compared with broader market sentiment and Bitcoin’s trajectory.

For traders and newer investors, the key is separating structural adoption from speculative time frames. The growth of tokenized funds from players like BlackRock, Franklin Templeton, and now JPMorgan strengthens the long-run case for Ethereum’s role in institutional finance, but it doesn’t guarantee Tom Lee’s $20K target, or any specific price, on a fixed schedule.

As always, position sizing, risk management, and an understanding of Ethereum’s volatility profile matter more than any single bullish sound bite.

If you want to compare this thesis with other Ethereum outlooks, you can revisit our recent Ethereum price prediction coverage and our report on ETH’s recent break below $3,000. The through-line across all of them: tokenization is real and growing, but price paths will remain messy.

EXPLORE: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post JPMorgan’s New Ethereum Fund Tests Tom Lee’s $20K ETH Dream appeared first on 99Bitcoins.