The bitcoin price continued to swing around the $90,000 level during thin holiday trading, rising and falling in sharp moves that lacked any volume needed for a sustained breakout.

The world’s largest cryptocurrency rose about 2.6% during low-liquidity sessions and held above $86,000 over the week, but was unable to sustain its $90,000 level in Monday’s Asian trading hours, according to market data.

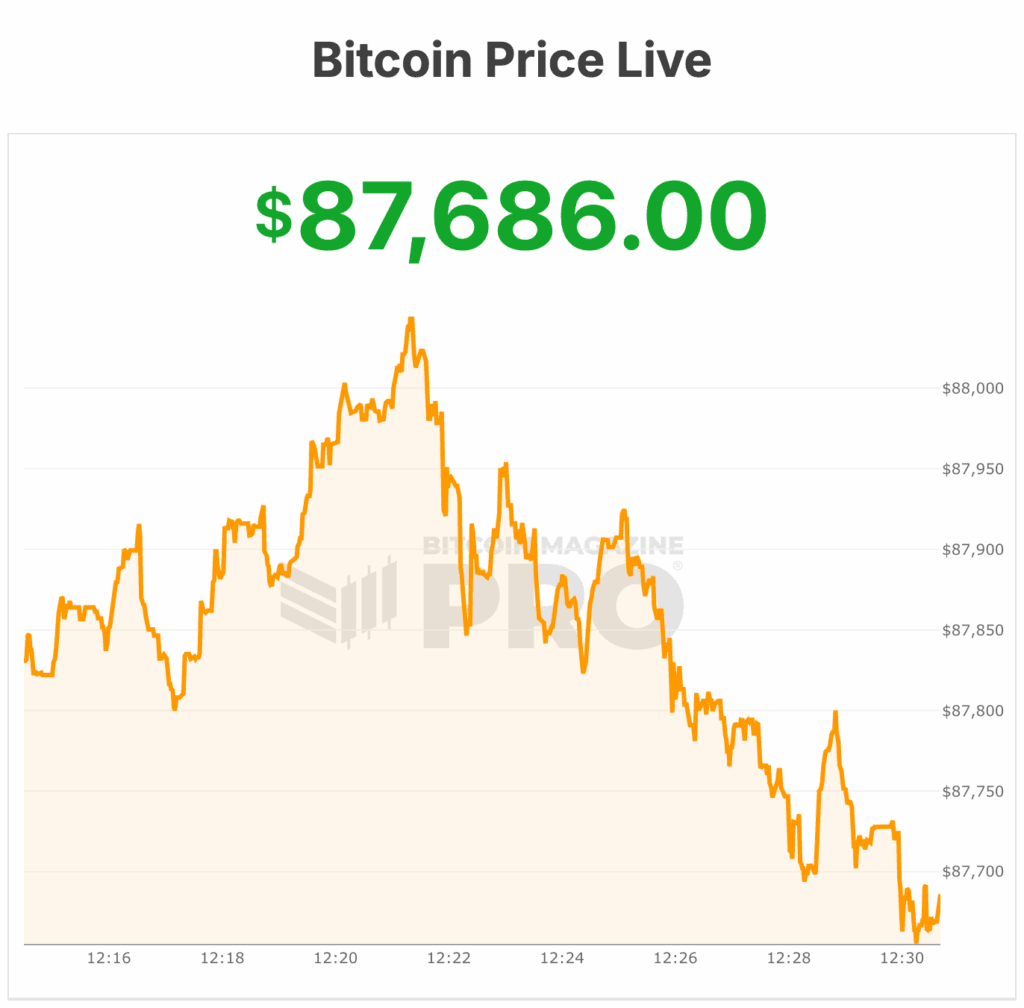

At time of writing, the bitcoin price was trading at $87,465 on Tuesday, with a 24-hour volume of about $52 billion and little change over the past day.

The cryptocurrency sits roughly 3% below its recent day high of $90,230, with a market capitalization of about $1.75 trillion based on a circulating supply of nearly 20 million BTC, according to Bitcoin Magazine Pro data.

QCP Capital said the move lacks the participation required to push prices decisively higher. In a note, the firm pointed to a sharp drop in open interest following last Friday’s record options expiry. Open interest fell by nearly 50%, signaling that many traders stepped to the sidelines.

Options are affecting market positioning

The record options expiry marked a turning point in market structure. Dealers who were long gamma ahead of the event are now short gamma to the upside, QCP said. In this setup, rising prices force dealers to hedge by buying spot bitcoin or short-dated call options.

That dynamic can amplify price moves and create a feedback loop during bitcoin price rallies.

QCP said a similar pattern emerged earlier this month when the bitcoin price briefly traded near $90,000. Funding rates rose quickly as dealers adjusted positions, contributing to short-term upward pressure.

Deribit’s perpetual funding rate climbed to more than 30% following the expiry, up from near flat levels earlier. Elevated funding rates increase the cost of maintaining long positions and often reflect crowded bullish trades.

Heavy activity was seen in the BTC-2JAN26-94K call option during the latest rally attempt. QCP said a move above $94,000 could extend the gamma-driven buying, but stressed that a breakout would require sustained spot demand.

The firm said that without any real volume, upside moves risk fading.

The macro backdrop is adding market volatility

Bitcoin’s recent push toward $90,000 earlier coincided with rising oil prices after renewed attacks on energy infrastructure in Russia and Ukraine dampened hopes for a near-term peace deal. Higher energy prices added to inflation concerns across global markets.

The bitcoin price traded higher in Asian hours as geopolitical uncertainty grew but gave back all gains in early U.S. hours.

Longer term, supporters continue to frame bitcoin as a hedge against fiscal imbalances. U.S. national debt has climbed to about $37.65 trillion, according to official data.

Bitcoin price has critical support at $84,000

According to Bitcoin Magazine analysts, the broader bitcoin market continues to reject lower levels within a broadening wedge pattern, suggesting downside momentum is weakening. Bulls now need to build on this defense by breaking resistance at $91,400 and, more importantly, $94,000 to regain control.

A weekly close above $94,000 could open the door to a move toward $101,000 and potentially $108,000, though heavy resistance is expected along the way.

On the downside, $84,000 remains critical support. A breakdown there would likely send the bitcoin price toward the $72,000–$68,000 range, with deeper losses possible below $68,000.

Short-term liquidity may remain thin during the current holiday period, but large options expiries near $100,000 could influence price action.

Overall sentiment remains cautious, per the analysts, with bulls showing resilience but still needing confirmation.

At the time of writing, the bitcoin price is near $87,000. Over the Christmas holiday sessions, bitcoin bounced between $86,000 and $90,000.