Join Our Telegram channel to stay up to date on breaking news coverage

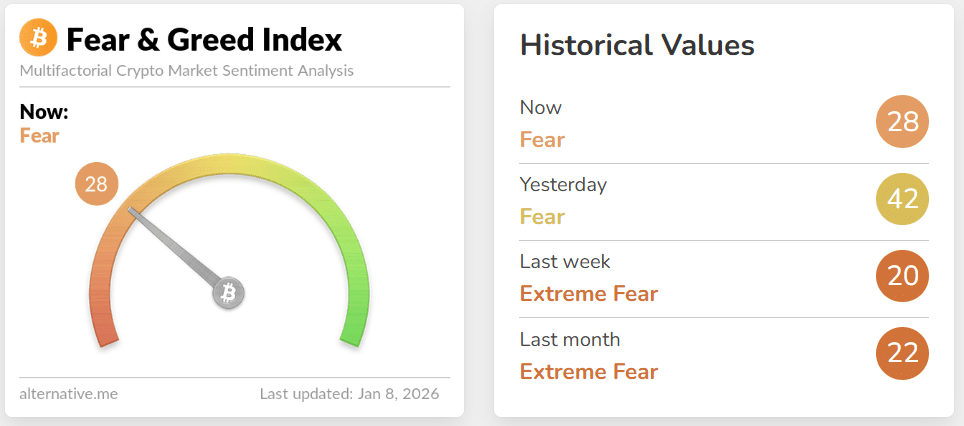

Bitcoin price pulled back over the last 24 hours to trade at $90,430 as of 1:15 a.m. EST, as the crypto market took a massive hit, dropping 2.5% to a market capitalization of $3.18 trillion, as the fear and greed index dropped back to fear.

Technical analysis shows Bitcoin’s price dropping back, albeit from a sustained surge at the beginning of the year that saw the asset rise above $93,500.

Greed And Fear Index Drops To Fear As Bitcoin Sees Strong Selling Pressure

According to CoinMarketCap data, the cryptocurrency market has dropped by 2.5% over the past 24 hours, with Bitcoin still unable to sustain its surge above $93,000.

The Crypto Fear and Greed Index briefly moved toward neutral on Wednesday, but it has since slipped back into the “fear” zone, signaling weakening investor confidence and reduced risk appetite.

As a result of the drop, over 111k traders were liquidated, with total liquidations totaling $364.56 million, according to CoinGlass data.

Meanwhile, according to analyst Maartunn, Bitcoin’s Net Taker Volume has hit -$19 million on the 25-hour MA, which indicates the strongest selling pressure since December 23.

Net Taker Volume (25H MA) just hit -$19M — the strongest selling pressure since Dec 23 🔻

Aggressive sellers are back in control. pic.twitter.com/4XWX1bTm5P

— Maartunn (@JA_Maartun) January 7, 2026

This signals that sellers are back in control of the short-term market. Net Take Volume calculates the gap between market order buy and sell volumes. Therefore, a negative reading reflects aggressive selling activity.

Meanwhile, data from Blockchain.com shows that the 200-week moving average remains below the BTC price, which supports a positive market narrative.

Bitcoin Price Risks Drop Below $89,000

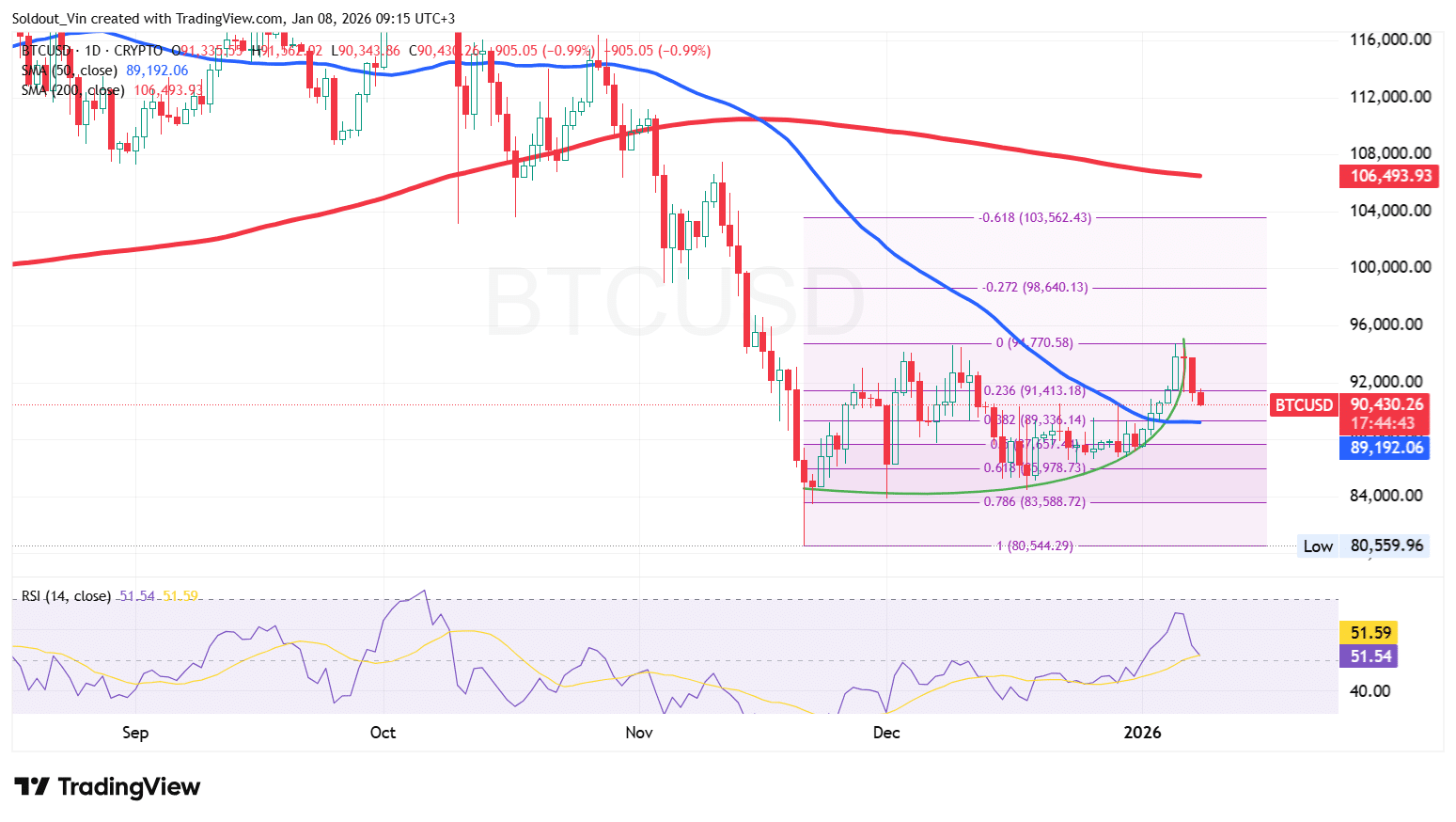

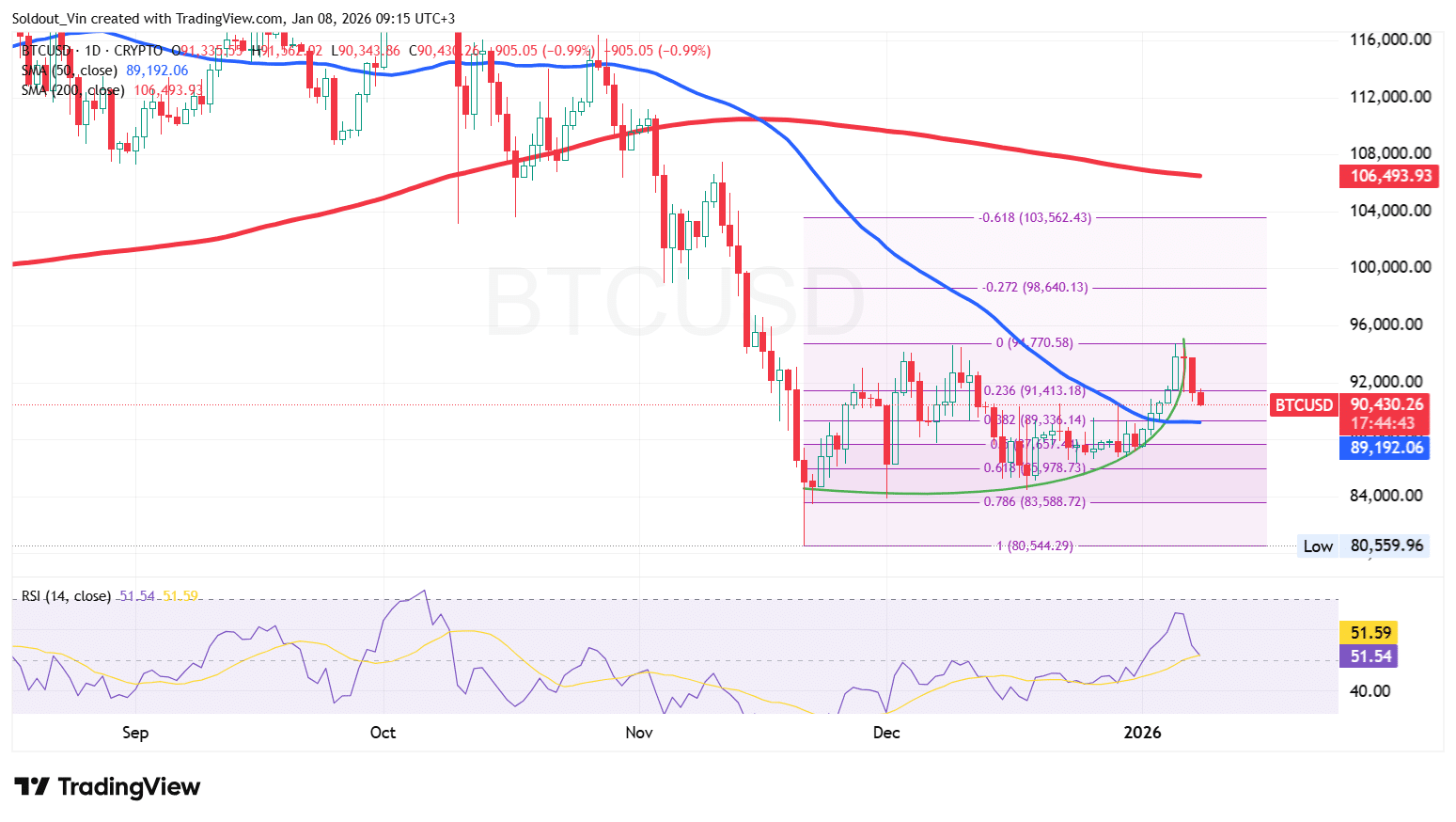

Bitcoin price is down 2% over the last 24 hours, as the crypto pulls back from the $93,500 area on the daily chart over the last 2 days.

As seen on the BTC/USD chart, the last two candles indicate the BTC price is currently in a correction after a sustained surge.

Bitcoin still trades well above the 50-day Simple Moving Average (SMA), indicating the price remains bullish in the short term.

Meanwhile, the Bitcoin price is being supported by the key Fibonacci Retracement levels at 0.382 ($89,336) and 0.5 ($87,657).

Meanwhile, the Relative Strength Index (RSI) is dropping from 66 to 51.54, indicating that sellers are stepping in or taking profits after the new-year surge.

Based on the BTC/USD chart analysis on the daily timeframe, the BTC price could still drop back to the $89,192 (50-day SMA), but the level is acting as a strong support. This scenario shows that investors are being cautious with any slight move.

As traders face indecision, Ali Martinez, a prominent crypto analyst on X, says that any price direction depends on whether BTC closes below $88,000 or $94,000.

Bitcoin $BTC needs a daily close outside $88,000–$94,000 to confirm trend direction. pic.twitter.com/T8ayEUCS8d

— Ali Charts (@alicharts) January 8, 2026

If the bearish pressure continues, Bitcoin is at risk of falling below the $89,000 level, with the 0.5 and 0.618 Fib levels acting as immediate support at $87,657 and $85,978, respectively.

However, if the 50-day SMA holds Bitcoin’s price, the asset could still surge in the long term, with $94,000 and $98,640 as the next target areas on the Fibonacci chart.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage