Arthur Hayes says Bitcoin’s next leg higher is less about crypto-specific catalysts and more about whether US policymakers are forced to respond to mounting stress in Japan’s currency and government bond markets. stress he argues will ultimately translate into fresh dollar liquidity.

In his latest essay, “Woomph,” published Wednesday, Hayes frames the recent yen weakness and a selloff in long-dated Japanese government bonds (JGBs) as the kind of systemic “alarm sound” that precedes official intervention.

“The financial markets went woomph as the yen weakened and JGB prices collapsed,” he wrote. “Therefore, analyzing the fragility that the yen and JGB injects into global markets at this juncture is extremely important. Will a meltdown of the yen and JGB markets cause some sort of money printing by the BOJ or the Fed? The answer is yes, and this essay will explain the mechanics of the said intervention that was foreshadowed last Friday.”

Related Reading

Hayes lays out a step-by-step scenario in which the New York Fed expands bank reserves, sells dollars for yen, and then deploys that yen into JGB purchases, effectively stabilizing both USD/JPY and Japan’s long-end yields while warehousing FX and duration risk on the Fed’s balance sheet.

In his telling, the signature will be visible in a specific line item: “Foreign Currency Denominated Assets” on the Fed’s weekly H.4.1 balance sheet release. If that figure grows rapidly, Hayes argues it would suggest the Fed has begun accumulating foreign-currency assets, potentially JGBs, consistent with the intervention pathway he describes.

The policy motive, he adds, is not charity. Hayes points to Japan’s large stock of foreign assets and its role as a major holder of US Treasuries, arguing that rising JGB yields could pull Japanese capital home and pressure US borrowing costs. Japanese policy debates over yen weakness and the BOJ’s tightening path, and the BOJ itself held its policy rate at 0.75% on January 23.

Hayes centers on what he calls a deliberately telegraphed signal: market chatter that US officials had “checked prices” with Wall Street dealers, language traders often interpret as a precursor to FX intervention. The Financial Times reported that a US “rate check” helped drive a sharp yen move and stoked speculation about coordinated action.

Related Reading

He also suggests the BOJ’s decision to stand pat, despite what he characterizes as a market demanding a stronger defense of the yen and the bond market, increased the odds of US help. Japan’s political backdrop matters here too: Sanae Takaichi dissolved parliament and set a snap election for February 8, a move widely covered in international media in recent days.

Why Hayes Ties It Back To Bitcoin

For Hayes, the Japan stress story is ultimately a liquidity story and he argues Bitcoin remains tethered to the direction of the Fed’s balance sheet. “This discussion of Japanese financial markets is important because for Bitcoin to exit its sideways funk it needs a healthy dose of money printing,” he wrote.

“What I will present is a theory which the actual flow of money through the corroded veins of the global monetary system doesn’t support yet. As time progresses, I will monitor the changes in certain line items on the Fed’s balance sheet in order to validate my hypothesis.”

In the essay, he also flags a shorter-term complication: a rapidly strengthening yen has historically aligned with risk-off positioning as leveraged investors unwind yen-funded trades, dynamics he says can drag on Bitcoin before any liquidity impulse arrives.

Hayes’ tactical conclusion is to stay patient until the balance-sheet evidence arrives. He says he exited levered Bitcoin proxies, including Strategy (MSTR) and Japan-listed Metaplanet, ahead of the yen move, and would consider re-entering if the “Foreign Currency Denominated Assets” line item starts rising sharply.

Moreover, he writes that his fund Maelstrom is continuing to add to Zcash (ZEC), while keeping other “quality DeFi” positions unchanged and only adding further if intervention-driven balance sheet growth becomes visible.

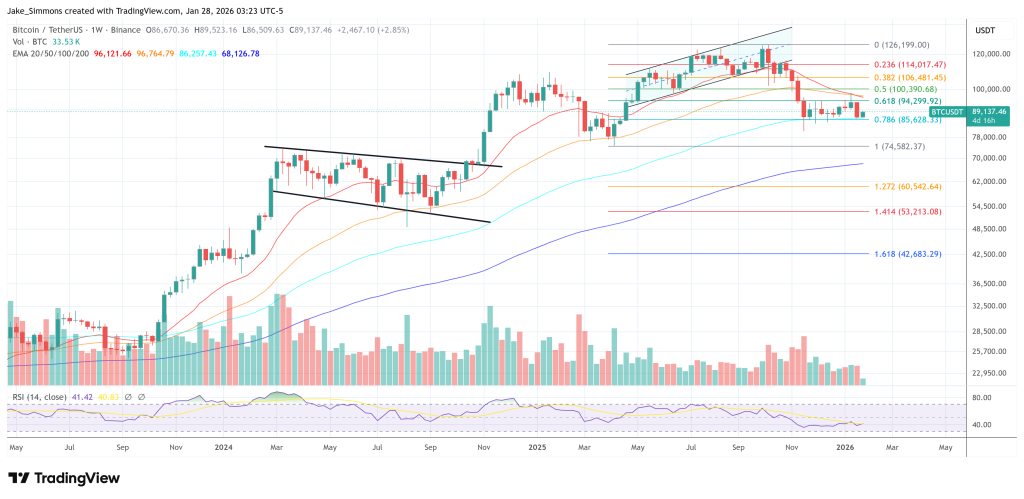

At press time, Bitcoin traded at $89,137.

Featured image created with DALL.E, chart from TradingView.com