Crypto prices can crash fast. One bad trade can wipe out weeks of your gains in minutes. It’s only natural to wonder: Can my crypto go negative, and can I actually owe money in the crypto space?

The answers depend on how you trade, not just what you buy. So before placing another order, you need to understand where crypto losses stop—and where they don’t.

Can Cryptocurrency Go Negative?

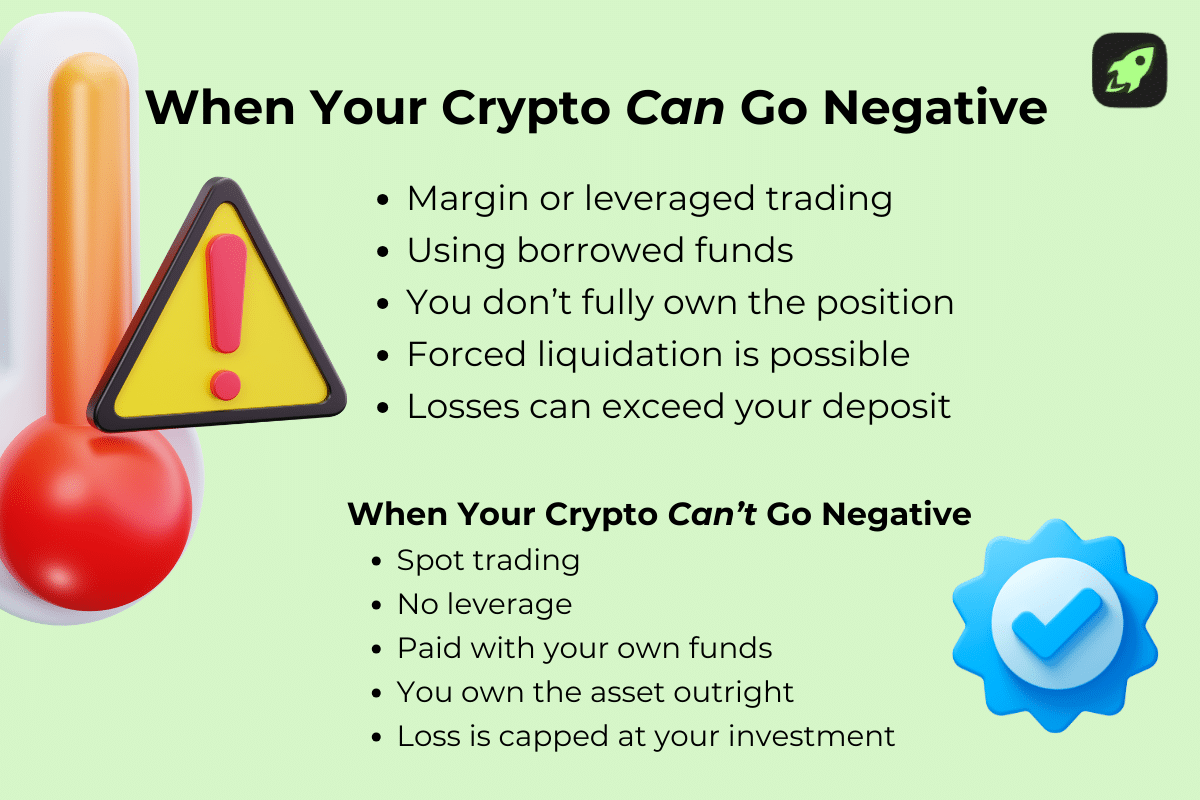

Cryptocurrency prices can never drop below zero, even though coins like Bitcoin and Ethereum can fluctuate wildly. Once a cryptocurrency reaches zero, it has no market value left. It can’t drop below that point, and you don’t owe any money just because the price of a coin collapsed. This is a basic rule of how prices work in all financial markets, not something unique to crypto.

So then why do people keep talking about “negative crypto”? The truth is, even though a coin can’t go negative, individual trading accounts can, depending on how you trade.

What Does “Going Negative” Really Mean in Cryptocurrency?

When people talk about crypto going negative, they usually mean one of two things:

- Your account balance has become negative because a leveraged trade lost more money than your collateral.

- You owe money to an exchange or lender because your losses exceeded your account equity.

Importantly, this isn’t going to happen in normal day-to-day spot trading. But in leveraged markets, such as margin trading or futures, your obligations can exceed your margin deposit.

Is It Possible To Lose All My Crypto Investment?

Yes, you can lose all the money you invested in a particular cryptocurrency.

Just to name one example: In 2022, Terra’s LUNA token collapsed almost completely in a matter of weeks. LUNA’s price fell from over $119 to nearly zero, all in in May 2022. Tens of billions in value were wiped out, leaving many investors with coins that had no meaningful market value anymore.

If a project fails, loses utility, suffers a major security breach, or simply loses its market demand, its price can fall to zero. When that happens, your crypto balance will still exist, but it will have no value. In other words, you’ll still have the coins, but they won’t be worth anything. In this case, your investment is effectively wiped out.

This happens more often than many investors expect, especially with smaller or newer digital assets. Crypto is extremely volatile, and not every project survives long-term.

Can You Lose More than You Invest in Crypto?

You can, but only in specific cases.

You may lose more than your initial investment if you use leverage or margin trading. In these cases, you’re trading with borrowed funds, not just your own money.

Leverage magnifies position size. That means profits grow faster, but losses do too. When prices move sharply against you, losses are calculated on the full position size, not just your initial margin. And if the market moves far enough and fast enough, your losses can exceed your deposited funds. At that point, your account balance becomes negative, and you owe money to the exchange or broker (unless the platform offers negative balance protection, which limits losses to your account balance).

This only happens when borrowing is involved, not normal crypto spot trading.

Spot Trading: Where You Can’t Go Negative

Spot trading is the simplest and safest way to trade digital currencies: You buy a digital asset using your own money, so you own it outright. If the price goes up, your portfolio’s value increases. If the price drops, your portfolio’s value decreases.

The hard limit is: you can only lose what you’ve invested. Nothing more.

There are no margin calls (requests to add more funds to keep a position open). No borrowed funds or liquidation events (forced position closures by an exchange), and most importantly, no negative balances. Even if the price drops to zero, your loss stops there.

For beginners, spot trading provides a critical advantage: risk is contained and predictable. You always know the maximum possible loss before entering a trade. That’s why most experienced traders recommend sticking to spot trading until you fully understand how leverage works, and if you even want to use it.

Get started with spot trading by reading our guide.

How to Get Free Crypto

Simple tricks to build a profitable portfolio at zero cost

Margin Trading: Where Negative Balances Become Possible

Margin trading lets you borrow funds from an exchange to open leveraged positions. A small initial investment (your margin) can control a much larger position. That’s the appeal—bigger potential gains. But the downside is bigger potential losses, too.

Here’s how it can go negative:

- You open a leveraged position with borrowed funds.

- The market moves the opposite direction.

- Your losses exceed your deposited margin.

- Your account balance turns negative and you may owe money to the exchange or lender.

In practice, margin trading is extremely risky. During large market swings, liquidation rates can reach as high as 40–60% of all open leveraged positions. The reality is that the majority of retail margin traders lose money over time, often wiping out their initial margin entirely, with this type of trading.

When crypto exchanges liquidate your positions to cover losses, extreme volatility and slippage may mean they still can’t recoup everything. In most cases, that leaves a deficit you have to pay.

Long vs. Short Positions: Both Can Go Negative

Both long and short positions can lead to negative balances when leverage is involved. But what exactly are they?

- A long position profits when prices rise and loses when prices fall. A sharp drop can wipe out your margin faster than expected.

- A short position profits when prices fall and loses when prices rise. Because prices can theoretically rise without limit, short positions carry especially high risk if not carefully managed.

In both cases, leverage increases exposure. Losses are not capped by your initial margin unless strong risk controls are in place. The direction of the trade doesn’t matter, since borrowed funds are the risk multiplier, not whether you’re bullish or bearish.

Learn more: What Are Long and Short Positions in Crypto?

Extreme Volatility: When You Can Actually Go Negative

Crypto markets are extremely volatile. Prices can drop or spike within minutes, leading to panic selling. This is especially dangerous during crashes, major news, or sudden shifts in investor sentiment.

Still, volatility can’t push your balance below zero all on its own. No matter how violent the storm, if you’re spot trading, your losses stop when your position hits zero, and you don’t owe any money.

The risk appears when you trade with leverage. In highly volatile conditions, prices can move faster than liquidation systems can react. Slippage increases, order books thin out, and liquidation may happen at worse prices than expected.

When that happens, a leveraged position can close below your remaining margin, leaving a negative balance.

Negative Balance Protection (NBP): Your Primary Safeguard

Negative balance protection (NBP) exists for one reason: to prevent traders from owing money after a liquidation.

When an exchange offers NBP, it guarantees that, in most cases, your losses will not exceed your account balance. If a position collapses too quickly, the platform absorbs the remaining loss instead of passing it on to you. Not all exchanges provide this protection, though, and even those that do might limit it to certain markets or account types. Others exclude extreme conditions.

That’s why checking the platform’s risk policy matters as much as understanding leverage itself. NBP doesn’t make margin trading completely safe, but it does protect you against the worst possible outcome.

Stop-Loss Orders: Your Emergency Exit

Stop-loss orders are one of the simplest and most effective risk-management tools available. They automatically close a position when price reaches a predefined level. This limits losses without requiring constant monitoring.

In leveraged trading, stop-losses serve an even more important role. They help you exit before liquidation thresholds are reached, reducing the chance of slippage and forced closures.

However, stop-losses aren’t perfect. In extreme volatility, they may execute at worse prices than expected. But using them consistently dramatically reduces the probability of catastrophic loss.

Read more: What Is a Stop-Loss Order?

The Golden Rules to Avoid Going Negative

- Rule #1: Stick to Spot Trading (Especially as a Beginner)

If you’re new to crypto investing, avoid leverage. Spot trading keeps your losses capped at what you’ve invested, and prevents margin calls or negative balance situations. It’s a safe way to participate in crypto markets without borrowing money. - Rule #2: If Using Margin, Never Exceed 3x Leverage

Higher leverage magnifies both gains and losses. A 3x leverage limit is a safer threshold for relatively inexperienced traders. Going beyond that increases the chance that small price swings will wipe out your margin. - Rule #3: Only Use Isolated Margin

Isolated margin confines your risk to a specific position. Unlike cross margin, which pools all your funds together, isolated margin ensures a single bad trade doesn’t drag your entire account into the negative. This simple boundary can be a lifesaver when the market moves too quickly to follow. - Rule #4: Set Stop-Losses on Every Position

Treat stop-losses as mandatory, not optional. Even if you’re confident, the market can turn in seconds. A stop-loss order gives your trade a safety net and drastically reduces unplanned losses. This rule applies to both spot and leveraged trading. - Rule #5: Start Small, Scale Slow

Don’t put all your capital into one trade or strategy. Start with small positions and grow gradually when you have a track record of sound decisions and strong risk control. Slow scaling lets you learn without burning through your balance on one big mistake. - Rule #6: Avoid Trading During Extreme Volatility

Major news, macro events, or sudden market swings can widen spreads and cause slippage. When the market is turbulent, reduce exposure or sit out until conditions stabilize. Volatility can destroy leveraged positions faster than you can react.

Final Thoughts

Your crypto portfolio’s value is tied to market prices, so it can go down sharply, even to zero—but the asset itself can’t go negative if you’re spot trading. Losses that leave you owing money only happen when you participate in margin trading, leverage, or derivatives with borrowed funds.

Safe trading begins with understanding risk. Stick with the basics first. Use spot trading to build confidence before you experiment with margin. If you do use leverage, keep it low, use negative balance protection, and always set thoughtful stop-losses to limit downside.

In volatile markets, protection is absolutely essential. Following these rules won’t guarantee profits, but they will keep you out of situations where you owe more than you’ve invested.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.