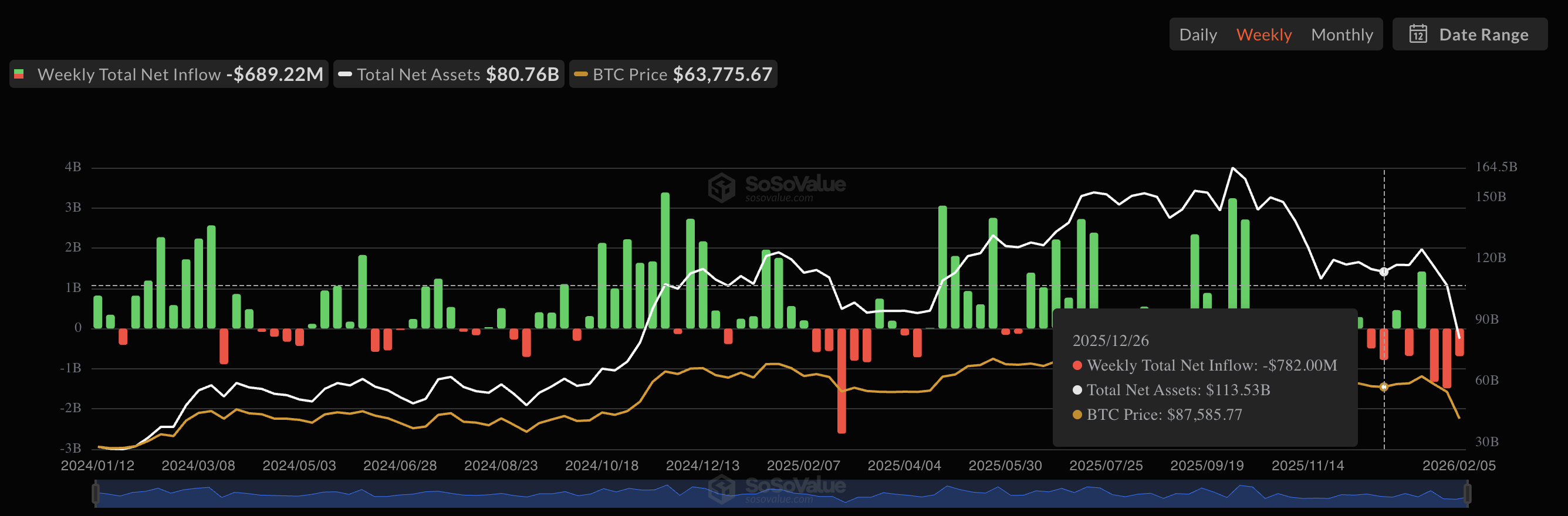

After a chaotic week for the cryptocurrency market, the US-based Bitcoin ETFs (exchange-traded funds) saw significant capital inflows on Friday, February 6. As the flagship cryptocurrency and the rest of the market suffered huge declines, the BTC-linked exchange-traded products also posted substantial withdrawals during the week.

With the bear market confirmed by the latest steep price decline, it would be interesting to see how the US Bitcoin ETFs would perform during their first extended period of downward price action. To give perspective, the BTC exchange-traded funds have had 11 days of capital inflows so far in 2026.

US Bitcoin ETFs Post $330M Net Inflows

According to the latest market data, the US Bitcoin ETFs saw a total net inflow of $330 million on Friday. This round of capital influx comes after three days of heavy withdrawals from the BTC exchange-traded funds over the past week.

While the market data for Friday’s activity remains incomplete, it comes as little surprise that BlackRock’s iShares Bitcoin Trust (with the IBIT ticker) led this round of capital inflows. According to SoSoValue’s data, the exchange-traded fund added $231.62 million in value to close the week.

Furthermore, Ark & 21Shares’ (ARKB) followed in second place, with a total net inflow of $43.25 million on the day. Meanwhile, Bitwise’s Bitcoin ETF (BITB) and Grayscale’s Bitcoin Mini Trust (BTC) registered $28.7 million and $20.13 million in total net inflows, respectively, on Friday.

Invesco Galaxy Bitcoin ETF (BTCO) was the only other Bitcoin ETF that registered activity on the day, posting a total net inflow of $6.97 million. As inferred earlier, these figures come in stark contrast to the performances seen earlier in the week.

It is worth mentioning that this capital influx seen by the Bitcoin ETFs coincided with the price of Bitcoin reclaiming the $70,000 level on Friday. Meanwhile, it is no coincidence that the Coinbase Premium, an indicator of demand from United States investors, flipped positive going into the weekend.

Source: SoSoValue

According to data from SoSoValue, this $330 million performance also brought the weekly record to around $350 million in negative outflows. Notably, the $561 million capital inflow recorded on Monday, February 2, also played a part in the final weekly figure.

Bitcoin Price At A Glance

After briefly reclaiming the $70,000 mark on Friday, the premier cryptocurrency has cooled off over the weekend. As of this writing, the price of BTC stands at around $68,900, reflecting an over 1% decline in the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.