Whereas the crypto economic system shed billions this week, the overall worth locked (TVL) in decentralized finance protocols slipped underneath the $200 billion vary to $196.6 billion. The TVL in defi misplaced roughly 3.16% over the past day, and the $592 billion in good contract protocol tokens dropped in worth by 3.5% during the last 24 hours.

Defi TVL Slips Under $200 Billion, Quite a few Protocols Shed Billions, Dex Commerce Quantity Dives

The worth locked in defi has slipped underneath the $200 billion mark for the primary time since March 16, 2022. On the time of writing the overall worth locked (TVL) is roughly $196.6 billion, down 3.16% over the past 24 hours.

All ten of the highest defi protocols, aside from Anchor, have seen important 30-day TVL proportion declines. Curve Finance is down 11.74%, Lido has misplaced 13.73%, Makerdao shed 16.81%, and Convex Finance has misplaced 10.59% since final month.

The largest loser over the past 30 days is the Aave Protocol which misplaced 21.98% since final month. Curve Finance is the main defi protocol because it dominates by 9.56% with right now’s TVL of round $18.8 billion.

The TVL held on Ethereum-based defi protocols nonetheless guidelines the roost right now with 55.55% dominance or $109.21 billion right now. Terra blockchain is the second largest when it comes to defi TVL with 14.36% of the $196.6 billion. Terra’s TVL right now equates to $28.23 billion and $16.48 billion resides in Anchor.

Behind Ethereum and Terra, when it comes to defi TVL measurement, contains blockchains comparable to BSC ($12.04B), Avalanche ($9.38B), and Solana ($6.09B).

The highest 5 defi protocols, when it comes to defi TVL measurement, contains Curve, Lido, Anchor, Makerdao, and Convex Finance. Terra’s Anchor Protocol noticed a 30 day TVL enhance of round 4.15% final month.

Aave model three (v3) noticed a major enhance over the past 30 days regardless of the unique shedding 21.98%. Aave v3 has a TVL right now of round $1.38 billion, up 2,711% since final month.

Statistics present that on Saturday, Could 1, 2022, there’s 428 decentralized trade (dex) platforms with a mixed TVL of round $61.44 billion. There’s additionally 142 defi lending protocols with $48.87 billion complete worth locked.

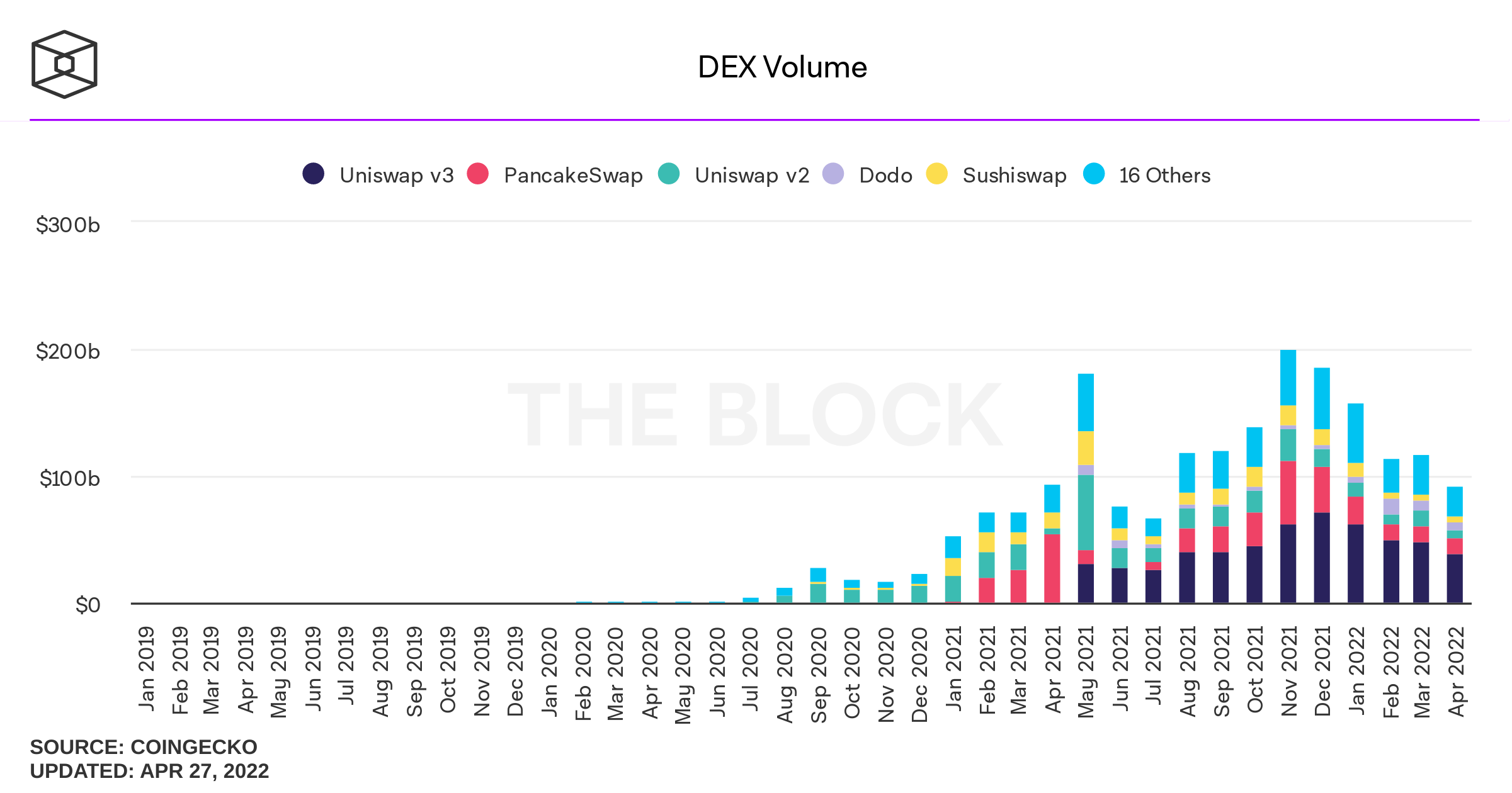

Information additional exhibits that dex commerce quantity dropped throughout the month of April. In March dex quantity was round $117 billion and statistics present that April’s dex commerce quantity was solely round $92.18 billion.

What do you consider the worth locked in defi slipping under the $200 billion vary this week? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any harm or loss brought about or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.