Analyst Weekly, June 23, 2025

Oil’s Risk Premium Has Arrived

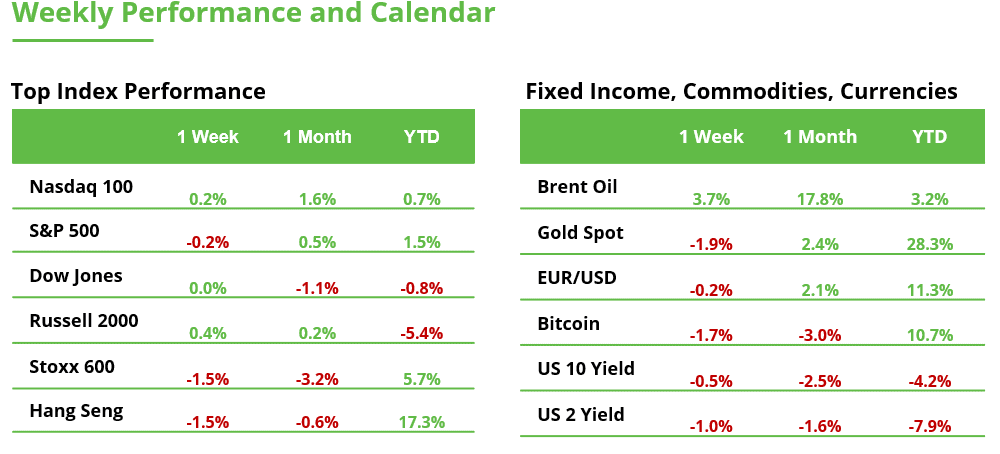

Picking up from last week’s commentary on potential oil market disruption, this week investors are turning their focus to the broader macroeconomic implications of rising geopolitical tensions in the Middle East. By June 22, Brent crude had climbed nearly 18% from early-month levels, reaching a five-month high near $79. The move reflects rising concern over the potential disruption of key trade routes, particularly the Strait of Hormuz, which handles nearly 30% of global seaborne oil flows. Betting markets now put the odds of a closure at around 60% over the next 12 months.

While much of the early market reaction has centered on Western energy security and central bank policy, China may be one of the most strategically exposed economies in this scenario. As the world’s largest energy consumer in 2024, China remains heavily reliant on imported fossil fuels, particularly from the Middle East. Official data show that six of its top 10 oil suppliers are based in or near the Persian Gulf, with additional volumes flowing, often at discounted rates, via transshipment hubs like Malaysia. This leaves a large share of China’s energy supply vulnerable to disruption. The result could be a resurgence of cost-push inflation across China’s manufacturing sector, introducing new macro headwinds for both domestic growth and global supply chains.

Investment Takeaway: Investors are now positioning for a more volatile macro environment. Expect heightened demand for inflation hedges, such as energy equities, real assets, and gold, and a growing focus on resilience in global supply chains. Regions and sectors more exposed to energy costs and trade flows in Asia and Europe may face near-term headwinds, while commodity exporters and defensive sectors could benefit.

Fed Chair Jerome Powell has emphasized that temporary oil price spikes alone are not enough to shift policy- they must be sustained and feed into broader inflation expectations to alter the path of cuts. This nuance reinforces investor demand for quality, liquidity, and flexibility, and may push portfolio construction toward more balanced, all-weather strategies.

Dollar Drifts, Gold Gains: A Reserve Shift in Motion

The US dollar is under pressure- DXY has touched below its post-Liberation Day low, before recent geopolitical tensions have generated sporadic safe-haven demand. Several short-term catalysts have been driving the downward trend: 1. over $500 billion in liquidity has entered the market since late April (as the US is paying its short-term obligations post-reaching the debt limit), 2. new tariff risks are clouding the trade outlook, 3. economic data has softened, 4. Section 899 of the US tax bill has raised concerns about foreign capital flows, 5. the deficit continues to widen, and, 6. markets are increasingly pricing in Fed rate cuts.

But beyond the usual macro noise, a more structural shift may be brewing. Historically, when the dollar weakens, foreign central banks step in to buy Treasuries as a way to stabilize their own currencies. That pattern appears to be breaking. Despite the dollar’s slide, foreign central banks have continued selling Treasuries, raising the possibility they are gradually diversifying away from US-denominated assets.

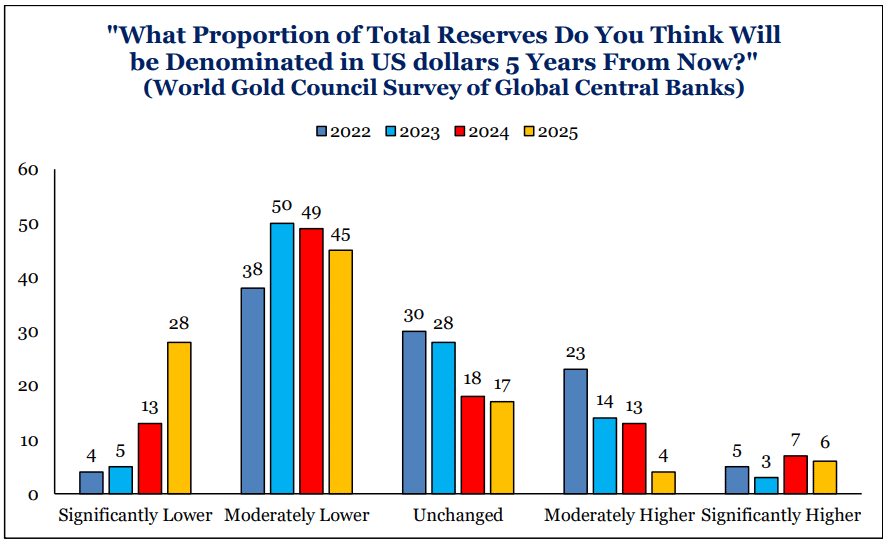

We’ve noted subtle signs of diversification away from the dollar in recent quarters, but now it’s becoming more explicit. A recent World Gold Council survey found that 73% of central banks expect dollar reserves to decline over the next five years, while 95% expect to increase their gold holdings. Geopolitical risks, sanctions exposure, and rising trade tensions are increasingly shaping reserve management decisions.

If this shift persists, it would mark a structural change in global capital flows, a move away from dollar dominance that could raise long-term US borrowing costs, weaken Treasury demand, and reshape how the world manages financial risk. What looks like a short-term dollar selloff may, in fact, be the opening act of a broader reserve realignment.

Source: World Gold Council, June 2025.

FedEx earnings on Tuesday: How much is global trade really suffering?

FedEx is delivering more than just a standard quarterly update this week. After months of trade conflicts, geopolitical tensions and economic uncertainty, these numbers could finally provide concrete insights into how significantly all these factors have impacted global trade.

Stress test for logistics stocks

The US has enacted a series of tariff increases and threats. Tariffs announced on April 2 in particular sent shockwaves through the financial markets, from which many stocks have yet to fully recover, including names in the logistics sector.

Reality check

FedEx will report its earnings for March through May on Tuesday after U.S. market close. This period coincides with increased pressure on global goods flows due to U.S. trade policy. Earnings per share are expected to rise 9.8% to $5.94, while revenue is forecast to decline 1.9% to $21.7 billion.

This suggests improved efficiency or consistent cost control despite declining revenues. However, such a pattern, rising profits on falling sales, is not sustainable long-term. Management will provide guidance during the earnings call. Investors should pay close attention to any signals regarding supply chains, demand, and trade risks.

Technical analysis and outlook

Since breaking its uptrend line in February, FedEx stock has been in a broader downtrend. The 17% increase from the April low to $226 is to be seen as a technical rebound within the ongoing trend. A sustained breakout above resistance at $245 could be the first sign of a trend reversal. Until that happens, the recovery remains a counter-trend move.

FedEx in the weekly chart. Source: eToro

More than just FedEx

FedEx is a key economic indicator, but not the only one. In times of geopolitical tension, tariff uncertainty, supply chain disruptions, and shifting trade agreements, a broad view of transportation and logistics data is essential.

Other key metrics include container throughput indices (e.g., RWI/ISL), air cargo data, the Baltic Dry Index, and trade figures from major economies. Results from other logistics companies like UPS, Maersk, and DHL also complete the picture.

Bottomline

Investors should focus on where global trade is actually organized and executed. Changes to tariffs or trade restrictions impact transport demand almost immediately, often within weeks. Highly globalized companies with flexible logistics are especially affected. Tuesday’s results will test investor confidence not just in FedEx, but in the broader resilience of global trade.

Technical Analysis: Oracle

Oracle has broken to new all-time-highs this week after smashing through the previous high from December last year. It will be important for the bulls to defend any retest of the $200 handle and that in theory should act as a floor now to a continued move higher. After breaking the uptrend back in March, investors would have rightly been worried, but since finding a bottom it has now rallied over 80%.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.