Ripple has been consolidating its outstanding Q4 gains for months now. The Daily Breakdown takes a closer look at the charts.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Wednesday’s TLDR

- Rotation sends stock leaders lower

- …and boosts the laggards

- Ripple continues to consolidate

What’s Happening?

Yesterday was a rotation day, as we saw market leaders take a dip, while market laggards caught a bid.

That was notable on a sector-by-sector basis, with notable rallies in materials, healthcare, and staples, while leaders like tech, semiconductors, and communications took a pause.

It was also notable on an individual stock basis, with notable rallies in General Motors, Target, PepsiCo, UnitedHealth, and even Apple. However, recent market leaders took a break, with Advanced Micro Devices, Broadcom, Nvidia, Netflix, and General Electric falling multiple percent.

The Dow rallied nearly 1%, the S&P 500 was about flat on the day, and the Nasdaq 100 tumbled 0.8%. That says a lot about the rotation.

Now bulls will look to see if Tuesday’s rotation turns into something bigger — meaning more selling pressure in the leaders and larger rebounds in the laggards — or if it’s just some of the day-to-day noise we sometimes see in the markets.

Looking Ahead: Volumes could very well start to dry up as investors head out early for the long holiday weekend. Keep tomorrow’s monthly jobs report on your radar, as that has the potential to move markets.

Want to receive these insights straight to your inbox?

Sign up here

The Setup — Ripple

Yesterday’s discussion hinged on Bitcoin — which is trading higher this morning — and today I want to take a closer look at Ripple. With a market cap of $129 billion, it’s much smaller than BTC’s market cap of $2.1 trillion (both on a non-fully-diluted basis).

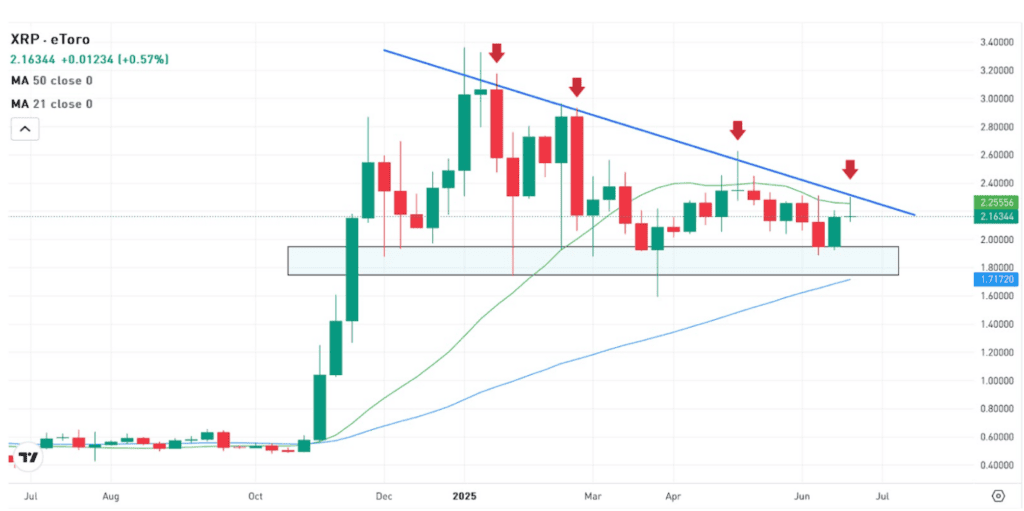

However, XRP has been trading really well since November. Ultimately, it climbed almost 600% from early November to its highs in mid-January. Since then, it’s been consolidating the gains from this giant rally.

This reminds me of the pattern we saw with BTC last year, as it consolidated for several quarters before eventually breaking out. There’s no guarantee that will be the case for XRP, but it is healthy price action when we see some much-needed consolidation after a huge rally took place.

Bulls will want to see the $1.70 to $1.95 area continue to act as support. On the upside, they’re looking for an eventual breakout over downtrend resistance (blue line). In that scenario, bulls would be looking for a potential rally back to the highs up toward $3.00.

On the downside, a break of support could usher in more selling pressure.

What Wall Street Is Watching

IWM

Interestingly, small caps were a top performer in US stocks yesterday, with the Russell 2000 outperforming the Dow, Nasdaq, and S&P 500. It’s another “rotation” development, as this group quietly hit its highest level since February. Can small caps maintain momentum? Consensus analyst price targets are calling for about 20% upside from current levels.

XLF

The financial sector ETF — the XLF — hit a new all-time high on Tuesday, as JPMorgan, Wells Fargo, and Bank of America helped lead the way. Financials make up roughly 14% of the S&P 500 and have been the best-performing sector over the past year. Check out the chart for XLK.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.