1. The Rise of the DAT: A Symptom of Shallow Understanding

As Bitcoin adoption by public companies accelerates, imitators are inevitable. The latest trend? DATs — “Digital Asset Treasuries” — which seek to replicate the success of Bitcoin treasury companies by allocating reserves to altcoins like Ethereum or Dogecoin.

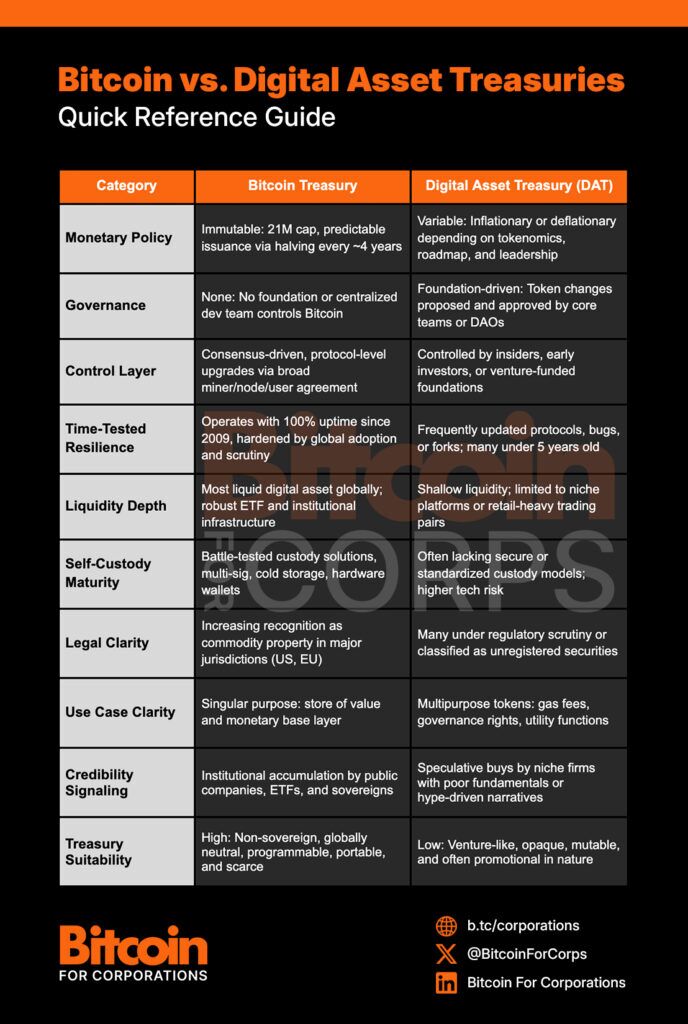

From the outside, the surface-level pitch might seem similar: acquire a digital asset, move early, build a treasury strategy, issue equity or dehttps://bitcoinmagazine.com/bitcoin-for-corporations/how-bitcoin-reduces-counterparty-risk-in-corporate-treasury-strategybt, and attempt to capture long-term upside and reflexive flows. But beneath the surface, the comparison collapses.

In recent months, several companies have made headlines for pivoting to DAT models:

- CleanCore Solutions plunged 60% after unveiling a $175M Dogecoin treasury plan.

- Bit Digital (BTBT) wound down its Bitcoin mining operations to become an Ethereum-only staking and treasury company.

- Spirit Blockchain Capital and Dogecoin Cash Inc. launched DOGE-centric treasury strategies and lost over 70% YTD.

These moves aren’t just risky — they reveal a fundamental misunderstanding of what makes Bitcoin uniquely suited to serve as a treasury reserve asset.

2. Bitcoin Is Money. Tokens Are Venture Bets.

Bitcoin is not a tech platform or a product roadmap. It is money — purpose-built, neutral, leaderless, and maximally conservative in its evolution. Its rules are set in stone, its issuance schedule immutably locked, and its design fiercely resistant to change.

Altcoins like Ethereum or Dogecoin, by contrast, are better understood as venture-stage software projects masquerading as money. They are:

- Governed by foundations or small groups of core developers

- Subject to frequent, sometimes radical, protocol changes

- Actively managed to optimize for new feature adoption, not monetary stability

- Closely tied to charismatic founders and foundation capital structures

From a capital stewardship perspective, this is the difference between:

- Allocating reserves to a sovereign, apolitical monetary instrument

- Speculating on the long-term success of a VC-style technology platform

One is purpose-built for value preservation. The other is a proxy for early-stage risk.

3. Time Horizon Inversion: Bitcoin Aligns, Altcoins Mismatch

A corporate treasury’s role is not to chase yield — it is to preserve and grow shareholder value over long durations. Public companies are rewarded for resilience, discipline, and clear capital frameworks that hold up across cycles.

Bitcoin’s design aligns with this. Its properties reward conviction over time:

- Supply is fixed: 21 million, with issuance halving every four years

- Market access is global and constant: no exchange hours or gatekeepers

- Liquidity deepens over time as adoption grows

- Volatility compresses over longer horizons

Altcoins invert this logic. They:

- Inflate supply through unlock schedules and protocol changes

- Routinely shift consensus models (e.g. ETH’s move to proof-of-stake)

- Depend on speculative growth narratives to maintain interest

- Lack predictable issuance and upgrade paths

This mismatch creates tension for treasuries. The longer you hold a token, the more governance, execution, and regulatory risk you accrue. It becomes harder — not easier — to defend the allocation.

Bitcoin, by contrast, becomes easier to justify over time. It’s the only digital asset where deeper holding reduces—not increases—tail risk.

4. What Could Go Wrong: Risks of Building on Altcoin Treasuries

For public companies, capital strategy must prioritize durability, auditability, and market trust. Allocating to altcoins introduces risks that are antithetical to those goals.

- Protocol Uncertainty: Tokens like Ethereum undergo frequent technical upgrades that can introduce bugs, change economics, or expose validators to new forms of slashing or MEV risk. Corporate treasuries require stability — not ongoing protocol experimentation.

- Governance and Capture Risk: Many altcoins are governed by foundations or small teams. Key protocol decisions may reflect the interests of insiders or early investors, not long-term holders. Companies risk being exposed to governance forks, roadmap pivots, or consensus drama.

- Regulatory Uncertainty: Bitcoin has been widely acknowledged by U.S. regulators as a commodity. Most altcoins occupy a murkier legal territory — and many are actively under investigation or pending litigation. A sudden classification as a security could trigger forced divestment, legal penalties, or reputational damage.

- Custody and Infrastructure Limitations: While Bitcoin benefits from mature institutional custody solutions, many altcoins do not. Staking contracts, wrapped tokens, and DeFi-based custodial layers add smart contract risk and reduce auditability. This weakens the balance sheet rather than strengthening it.

- Narrative Fragility: When price appreciation slows or reverses, the underlying thesis of an altcoin treasury often collapses. Without monetary fundamentals to fall back on, the “strategic” story devolves into a speculative one — and boards, auditors, and shareholders begin asking hard questions.

Building a corporate treasury on top of tokens with malleable rules, weak settlement assurances, and governance opacity is not bold — it’s reckless. Bitcoin is the exception not just because it came first, but because its architecture is the only one built to last.

5. Bitcoin Is the Bedrock

Public companies that adopt Bitcoin are not making a bet on crypto. They’re upgrading the foundation of their capital structure with an asset that is:

- Non-sovereign: Immune to political interference or monetary debasement

- Finite: Capped at 21 million, with no centralized authority to inflate supply

- Verifiable: Every unit auditable, every transaction immutable

- Accessible: Liquid and tradable in every major jurisdiction

- Battle-tested: Operating flawlessly for over 15 years with no bailouts or downtime

Bitcoin’s uniqueness isn’t ideological — it’s structural. And that structure is what enables it to serve as a modern balance sheet anchor in a time of currency volatility, debt saturation, and institutional distrust.

Disclaimer: This content was written on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be interpreted as an invitation or solicitation to acquire, purchase or subscribe for securities.