The Daily Breakdown takes a deep dive into Ferrari, uncovering its margins, guidance out to 2030, and the valuation for RACE stock.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Deep Dive

Ferrari is best known for its luxury supercars and Formula 1 legacy. While it’s been building cars for more than 75 years, the stock — trading under the ticker symbol “RACE” — will mark its 10-year anniversary as a public company on October 21. Since its debut, shares have climbed more than 600%, easily outpacing the S&P 500’s ~230% gain over the same period.

Despite its long-term success, Ferrari hit a speed bump recently. From its October 2 high to its October 14 low, shares dropped over 25%. The decline followed its Capital Markets Day, where management issued new long-term guidance. The headline takeaway? Slower growth, but stronger profitability.

Management now expects 2030 revenue of roughly €9 billion — below analysts’ estimates and implying 5% annual growth versus the 9% forecast from its 2022 to 2026 plan. However, margins impressed: Ferrari anticipates EBITDA margins of at least 40% and EBIT margins of at least 30%, both above prior guidance. Further, industrial free cash flow is expected to nearly double to €8 billion between 2026 and 2030 (up from the €4.6 billion to €4.9 billion expected in 2022 to 2026).

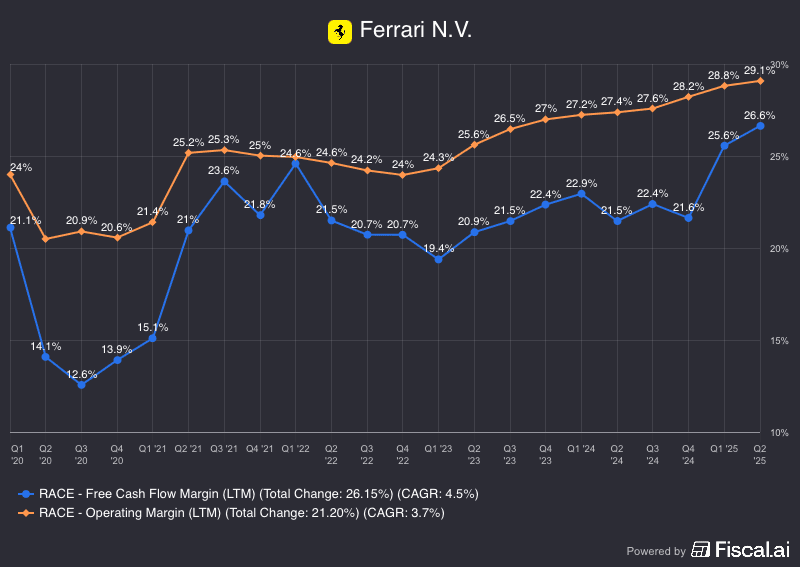

Above is a chart of the company’s operating margin and free cash flow margin — the latter meaning how much of every dollar in revenue falls down to the company’s free cash flow. Notice how strong of margins Ferrari generates (vs. the single-digit percentages we often see in the auto space).

The TLDR for investors: Ferrari is steering toward slower sales growth, but higher profitability and cash flow.

Want to receive these insights straight to your inbox?

Sign up here

Diving Deeper — Valuation

When it comes to Ferrari, it may be difficult to differentiate the business from other low-margin automakers. Management carefully builds an order book — one that is now stretching into 2027, per management’s remarks on the most recent conference call — and then focuses on execution and delivery.

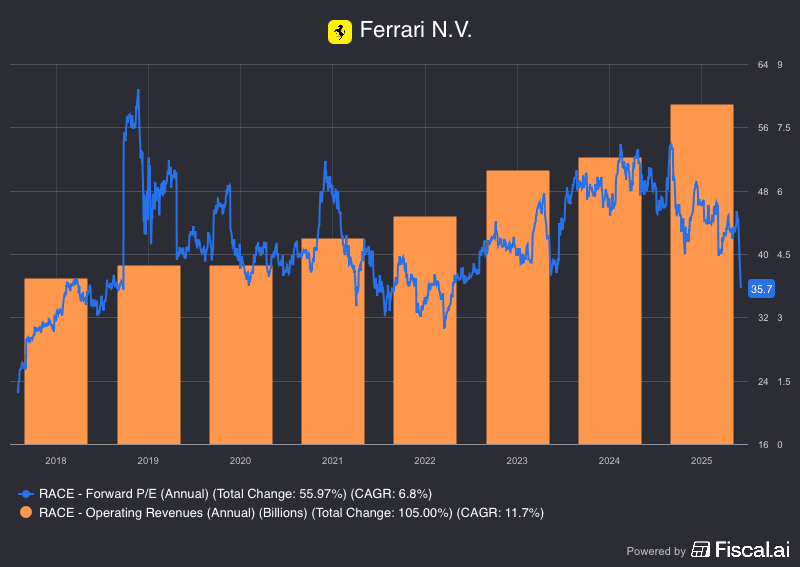

We can see that steadiness in the chart below too, which highlights revenue (in orange) and the forward P/E ratio (in blue).

Notice two key points: first, Ferrari’s revenue held steady through the pandemic-related logistical challenges of 2020 and continued climbing despite the 2022 bear market, which was marred by soaring inflation and rising interest rates. Second, notice how the valuation is approaching its lowest multiple since mid-2022, when the stock bottomed amid the broader market correction.

Risks and the Bottom Line

Remember, because Ferrari has far better margins than other automakers, it’s going to command a higher valuation. However, it still faces the risk of valuation compression, as the market may decide the stock no longer deserves as much of a premium given slower revenue growth expectations. Tariff-related headlines could also spook investors, while a global slowdown or pandemic-like shock would threaten demand and operations. Lastly, the stock is out of favor right now and it’s not clear when that will change. Investors should take that into consideration when assessing this stock for their desired timeframe.

The Bottom Line: Some investors may feel Ferrari is too exposed or too expensive to warrant a position. Others may feel that the recent ~26% correction was an overreaction and may find its valuation cheap when compared to the last several years.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.