Catching the coveted Bitcoin backside requires analyzing extra than simply its worth. One of the dependable indicators of market bottoms has traditionally been miner knowledge. Usually thought of to be some of the resilient gamers within the crypto ecosystem, miners capitulate solely when Bitcoin turns into too costly to mine.

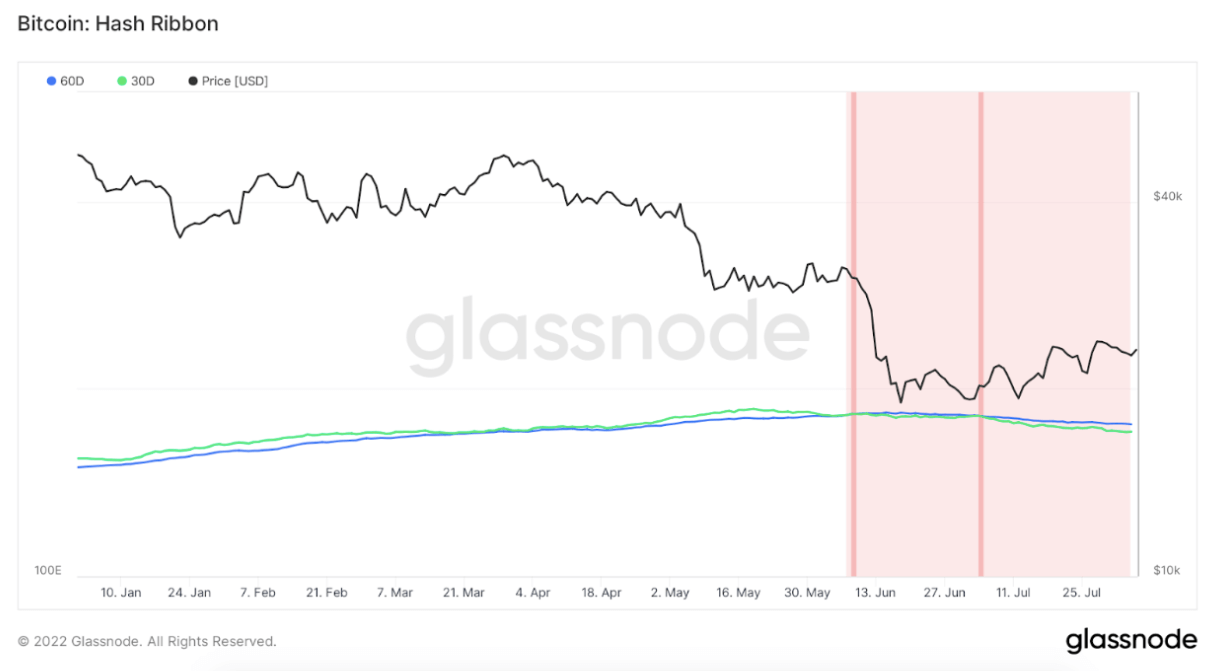

Hash ribbons are a singular metric used to find out whether or not the market is at the moment in its bear or bull section. The indicator incorporates the 30-day and the 60-day easy transferring common (SMA) of Bitcoin’s hash fee. The 30-day SMA dropping under the 60-day one reveals the start of a bear market and reveals miners have begun to capitulate.

Information reveals that the market has been in a miner capitulation mode for nearly 60 days straight. The more serious of miner capitulation can be over as soon as the 30-day SMA crosses above the 60-day SMA. Nevertheless, the distinction between transferring averages standing nonetheless for days on finish makes it laborious to find out after we may see a pattern reversal.

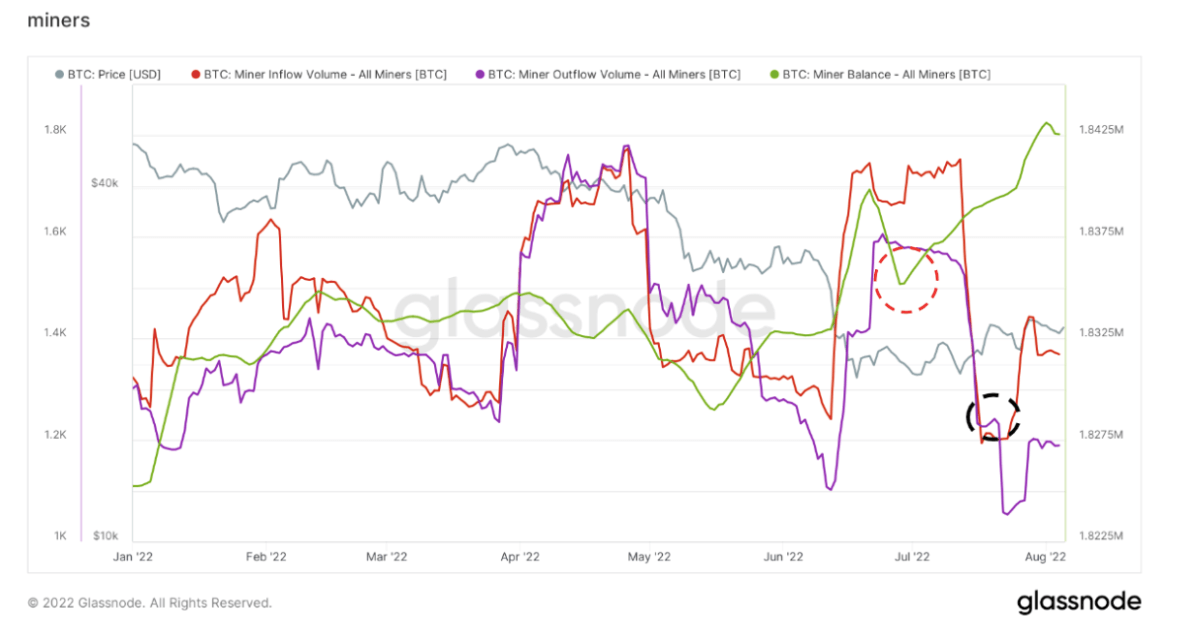

Nevertheless, analyzing miner balances reveals that the worst has handed, and miners have begun to get better. Miner balances have a look at the entire provide held in addresses that belong to miners to find out whether or not they’ve been promoting off their belongings. In response to knowledge from Glassnode, miner balances recovered from the lows they reached in June and are the best they’ve been since October 2017 (highlighted in purple).

Alongside balances recovering, we’ve additionally seen miner outflows from exchanges briefly surpass inflows to trade addresses (highlighted in black). This reveals that extra miners have been withdrawing their BTC from exchanges than they’ve been depositing it to promote in the marketplace.

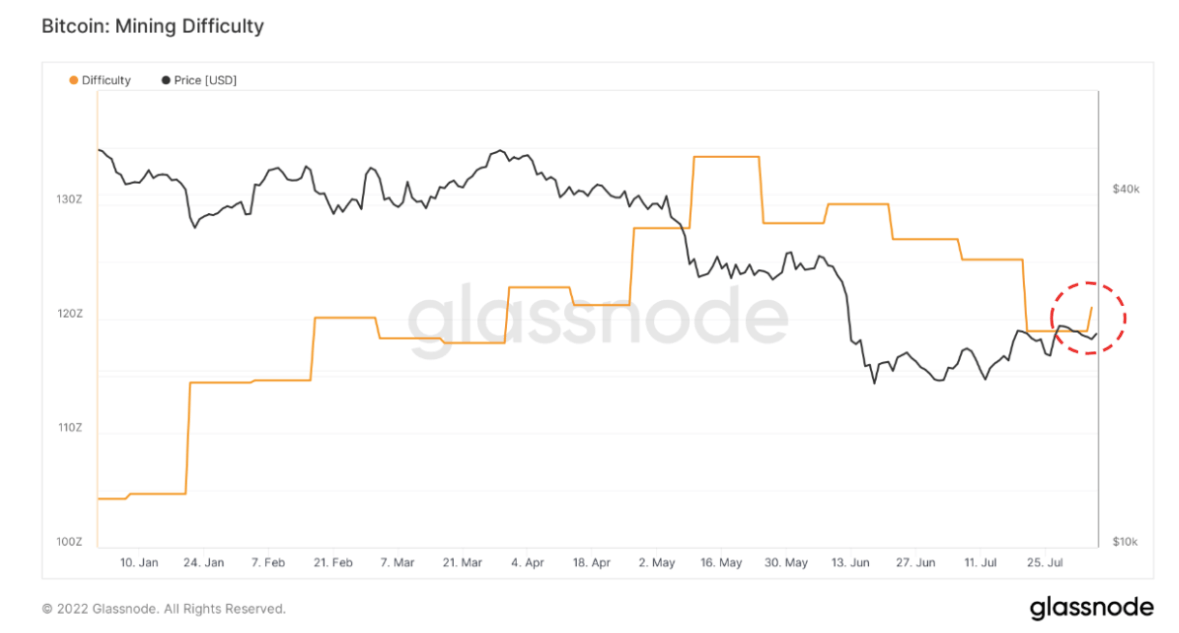

The issue adjustment additionally reveals that Bitcoin may have reached its backside. Outlined as the present estimated variety of hashes required to mine a block, the problem adjustment elevated for the primary time since June, rising by 1.7%. The rise reveals that the Bitcoin mining problem may have bottomed firstly of August. If Bitcoin can proceed holding its worth alongside the $23,000 resistance, we’d not revisit these mining problem lows any time quickly.

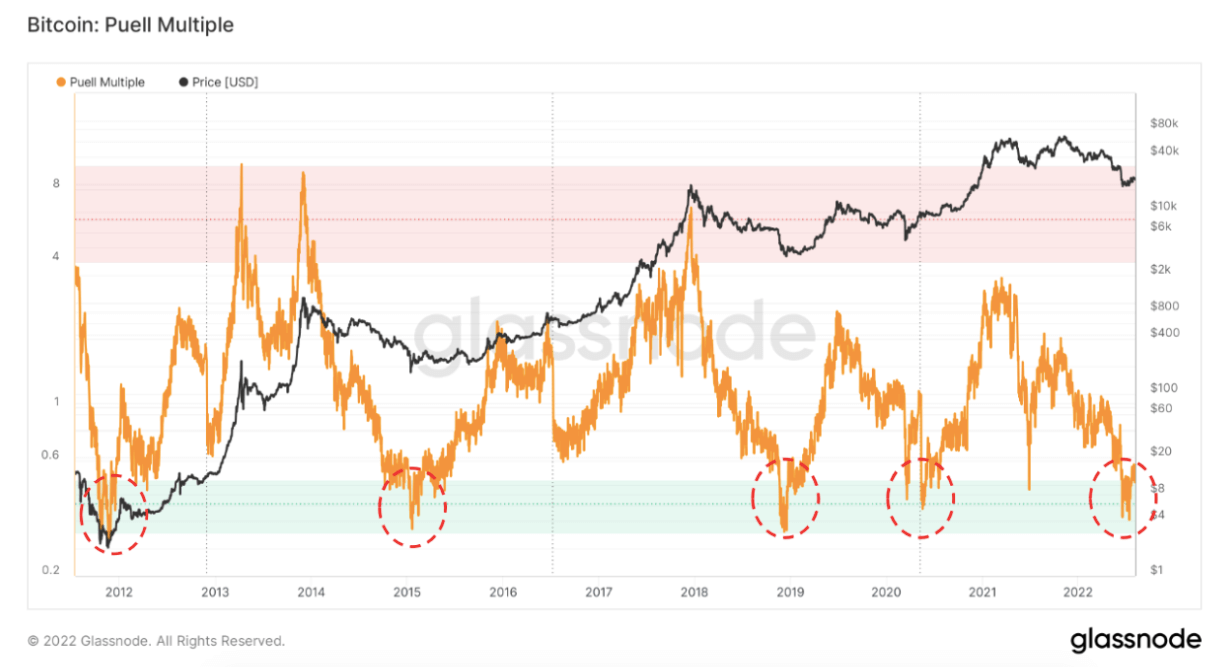

Lastly, one other dependable indicator of market bottoms additionally appears to be flashing purple. The Puell A number of is an indicator used to find out mining likelihood by calculating the ratio of day by day coin issuance in USD and the 365-day transferring common of day by day coin issuance worth. When the Puell A number of is low, it reveals that miner profitability is low in comparison with the yearly common. When the indicator is excessive, miner profitability is excessive, and it incentivizes miners to liquidate their treasuries.

The Puell A number of has marked earlier cycle bottoms with an excellent diploma of accuracy — it flashed backside alerts in November 2011, January 2015, November 2018, and Might 2020. Information has proven that the Puell A number of has left the inexperienced zone for the primary time since June and is climbing slowly and steadily. And whereas the indicator has gone out and in of the inexperienced zone in earlier market cycles, the outlook stays optimistic.