According to Itaú Asset Management, Brazil’s largest private bank, investors should consider holding 1%–3% of their portfolios in Bitcoin starting in 2026. The recommendation came in a research outlook released this week and frames Bitcoin as a small, complementary holding rather than a main bet.

Itaú Backs Small Bitcoin Positions

The bank’s note points to Bitcoin’s low correlation with many traditional assets and to currency risks that hit local investors hard this year. Itaú also moved to build the infrastructure behind that view: in September 2025 it created a dedicated crypto division and named former Hashdex executive João Marco Braga da Cunha to lead the team. That new unit sits alongside the bank’s existing products and is meant to help clients access regulated crypto tools.

Access Through Local Products

Brazilian savers can already reach Bitcoin via products tied to Itaú. The bank is part of the team that launched the IT Now Bloomberg Galaxy Bitcoin ETF, known by its ticker BITI11, which began trading on November 10, 2022. The ETF gives investors a spot-like route to Bitcoin inside the local market, and it sits alongside unit trusts and pension products that offer crypto exposure.

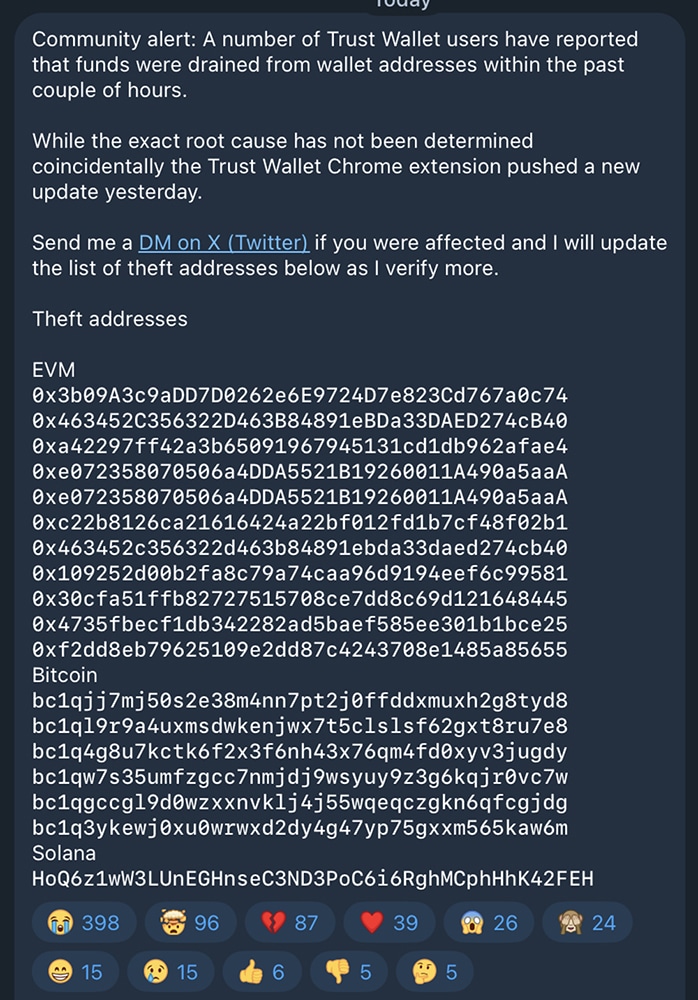

A correlation matrix showing how BITI11, a Bitcoin ETF, moves in relation to major Brazilian and global market indices, according to data from Itaú.

Small But Existing Crypto Footprint

Itaú says its regulated crypto suite manages roughly R$850 million across several funds and ETFs, a modest amount compared with its wider business but still a clear signal of product readiness. The bank’s asset arm is large: it manages more than 1 trillion reais for clients, which helps explain why its guidance on allocations draws wide attention.

Market Context And Timing

Itaú’s move arrives after a year in which currency swings amplified losses for some Brazilian holders of foreign assets. That reality appears to be part of the math behind recommending a 1%–3% position — a small buffer for those worried about local-currency shocks, not a bet meant to replace stocks or bonds. The bank frames the position as a disciplined, long-term allocation, not a short-term trade.

What This Means For Investors

For ordinary investors the guidance is simple to read: keep exposure small and controlled. A 1% position will hardly change a diversified portfolio on its own, while 3% is still within what many institutions have called a “satellite” slot. Based on reports, Itaú expects to offer more choices — from low-volatility wrappers to riskier strategies — through the new unit as demand grows.

Featured image from La Nación, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.