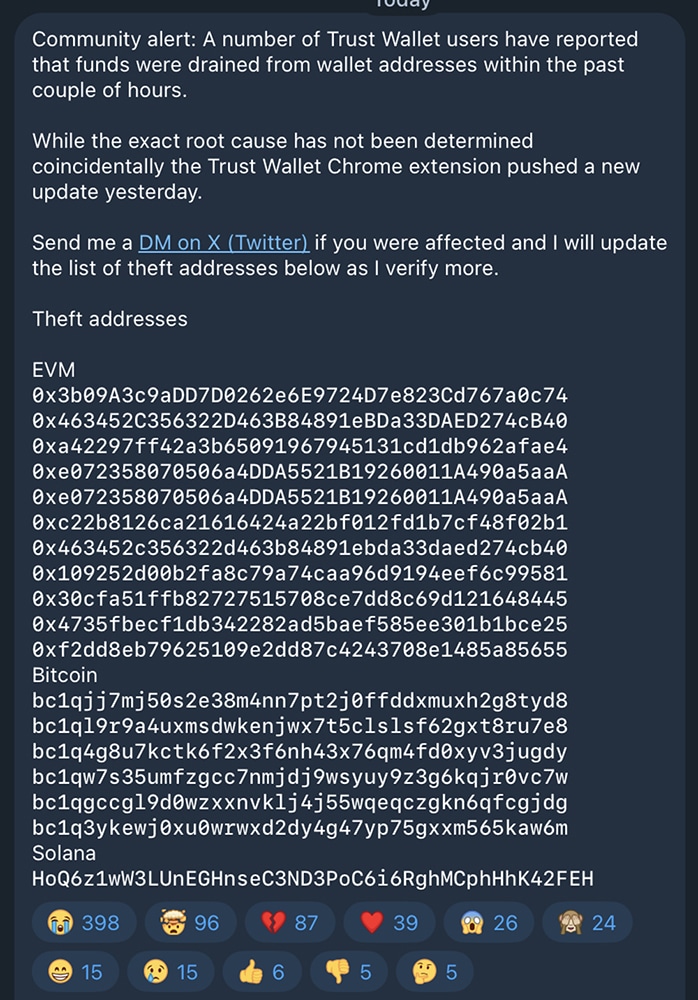

Bitcoin price dynamics heading into the next market cycle are being reframed by Michael Saylor, who argues that the forces capable of pushing Bitcoin to new all-time highs have little to do with speculation, retail enthusiasm, or ETF-driven flows. Instead, Saylor’s outlook positions Bitcoin price appreciation as the outcome of a deeper structural transition that is unfolding quietly within the banking system.

Michael Saylor On Bitcoin Price’s Structural Shift

As the market looks toward 2026, Michael Saylor’s thesis on Bitcoin price action focuses on a structural shift away from trader-driven dynamics toward regulated financial institutions, a transition that could fundamentally reshape how capital engages with Bitcoin at scale. For most of its history, Bitcoin price discovery has been dominated by cyclical trading behavior, leverage, and sentiment-driven momentum.

Related Reading

Even milestones such as spot Bitcoin ETFs, while broadening access, largely remain confined to traditional capital markets. Saylor’s view departs from this model by highlighting Bitcoin’s gradual integration into bank balance sheets, where valuation is driven by utility, collateralization, and long-term capital allocation rather than short-term market cycles.

Recent developments underscore this shift. A growing number of major US banks have begun offering Bitcoin-collateralized loans, a move that signals a reclassification of Bitcoin from a high-volatility trading asset to a recognized form of financial collateral. Lending against Bitcoin reflects institutional confidence in its liquidity, custody standards, and long-term value stability. In practical terms, this positions Bitcoin alongside assets that are suitable for credit creation rather than short-term speculation.

Once Bitcoin is integrated into lending structures, treasury operations, and institutional risk models, demand characteristics change materially. Capital deployed through these channels is not reactive to short-term price fluctuations. It is strategic, compliance-driven, and designed for multi-year horizons. This type of demand absorbs supply consistently, reinforcing scarcity dynamics already embedded in Bitcoin’s fixed issuance model. As a result, Bitcoin price appreciation becomes a function of sustained capital allocation rather than episodic market rallies.

Banking Infrastructure And The New Ceiling For Bitcoin Price

Saylor identifies 2026 as the period when the impact of banking adoption becomes fully visible. Major financial institutions such as Charles Schwab and Citigroup, planning to roll out Bitcoin custody and related services, point to a broader alignment between Bitcoin and regulated financial infrastructure.

Related Reading

Custody plays a pivotal role in this process. When banks custody Bitcoin, they unlock the ability to embed it across wealth management platforms, corporate treasury strategies, and secured lending products. This dramatically expands Bitcoin’s addressable capital base by enabling participation from institutions previously constrained by regulatory, operational, or fiduciary limitations.

As banking participation deepens, Bitcoin price behavior is likely to evolve. Volatility driven by leveraged trading and speculative positioning diminishes in relative importance, while long-term balance-sheet accumulation becomes a dominant force. In this environment, according to Saylor, Bitcoin’s new all-time highs will not be the product of sudden euphoria but the result of sustained absorption by institutions operating at scale.

Featured image created with Dall.E, chart from Tradingview.com